Trending

Rubbing Penis Against Child's Private Part Not 'Penetrative Sexual Assault' Under POCSO Act: Delhi High Court Modifies Man's Conviction

The Delhi High Court has held that rubbing of a male genital against a child's genital, in the absence of proof of penetration, does not constitute “penetrative sexual assault” under Section 3 of the Protection of Children from Sexual Offences (POCSO) Act.Justice Chandrasekharan Sudha observed,“The rubbing of the penis of the accused against the private part of PW1 does not apparently...

“Symbols Of Rajput Pride Reduced To Picnic Spots”: Rajasthan High Court Flags Littering, Encroachments At Haldighati & Rakht Talai

“These sites, once symbols of Rajput pride and national heritage, are now marred by modern encroachments, environmental pollution, littering, and administrative indifference, resulting in irreversible damage to their cultural, historical, and ecological integrity,” court said.

Kerala High Court Directs RTA To Finalise Time Gap Norms For Stage Carriages Entering Kochi

The Kerala High Court has recently directed the Regional Transport Authority (RTA) to finalise the revision in timing in respect of the vehicles of the stage carriages entering Kochi city.Justice Viju Abraham gave the directions while considering a writ petition concerning bus timing in Kochi.The Court has previously urged the need to regulate bus timings in the State and directed the...

'High Time That No Mercy Is Shown': Jharkhand High Court Orders Demolition Of Illegal Structures In Jamshedpur Within One Month

In a significant order aimed at curbing rampant illegal constructions in Jamshedpur, the Jharkhand High Court has directed the Jharkhand Notified Area Committee (JNAC), Jamshedpur to demolish illegal structures raised by the private respondents within one month.A Division Bench comprising Chief Justice M.S. Sonak and Justice Sujit Narayan Prasad was hearing a PIL concerning...

Single Appeal Maintainable Against Common Judgment Rendered In Suit And Counter-Claim: Madras High Court

The Madras High Court recently observed that a single appeal is maintainable against a common order involving a claim and counter claim. Justice AD Maria Clete added that though a counterclaim is treated as a cross-suit under Order VII Rule A of CPC, a single judgment in the suit would not require multiplicity of appeal. “There could be no quarrel that a single appeal...

25% RTE Quota Applies To Pre-Primary Classes, Limiting It To Class I Disadvantageous To Children From Weaker Sections: Rajasthan High Court

Rajasthan High Court held that that the obligation to reserve 25% seats under the Right to Education Act, 2009 (“the Act”) was applicable not only to the Class I but also to all pre-primary levels wherever such education was offered.The division bench of Acting Chief Justice Sanjeev Prakash Sharma and Justice Baljinder Singh Sandhu opined that by restricting the applicability to Class I,...

Delhi Court Slams NGO For Retaining Man's Pet Dogs Over Alleged Cruelty Despite Judicial Order For Release

A Delhi Court on Friday slammed an NGO for its negligent attitude and defying a judicial order directing it to release 10 dogs to its owner. Additional Sessions Judge Surabhi Sharma Vats of Karkardooma Courts said that the NGO, Sanjay Gandhi Animal Care Centre, miserably failed to comply with the judicial orders despite repeated opportunities and a categorical clarification that there was...

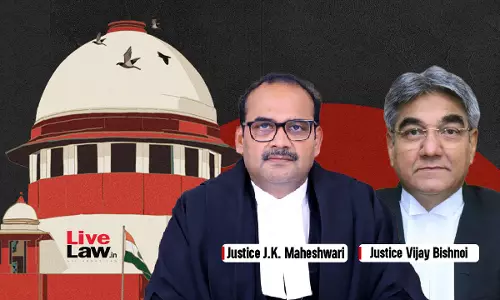

States Cannot Prescribe Qualifications Beyond Those Laid Down In Union Law: Supreme Court

When a field prescribing a qualification for a public post is occupied by the Union, then it is impermissible for the States to impose additional qualifications, observed the Supreme Court. A bench of Justices JK Maheshwari and Vijay Bishnoi heard the batch of appeals concerning the challenge to the power of the State Government to prescribe the essential qualifications for the position of...

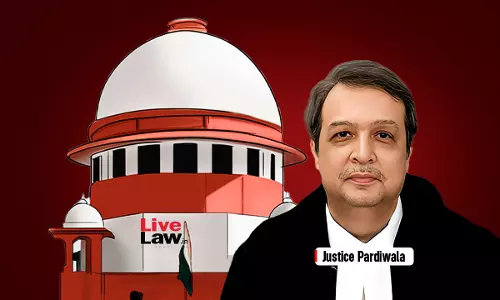

'Tax Sovereignty Must Not Be Compromised' : Supreme Court Suggests Safeguards While Entering Into International Tax Treaties

In his concurring opinion in the Tiger Global–Flipkart tax dispute, Justice JB Pardiwala stressed that tax sovereignty is an essential facet of India's economic independence and warned against ceding taxing rights through international treaties or external pressures.Justice Pardiwala fully agreed with the reasoning and conclusions reached by Justice R Mahadevan, who authored the main...