Trending

Bengaluru Court Grants Bail To Congress MLA K.C. Veerendra In Online Betting Case

On 30 December, a Bengaluru court granted bail to Congress MLA K.C. Veerendra, who had been arrested by the Enforcement Directorate (ED) in connection with alleged online betting, gambling, and casino-related offences.The order was passed by the Special Court for People's Representatives in Bengaluru, presided over by Additional City Civil and Sessions Judge Santhosh Gajanan Bhatt. Veerendra,...

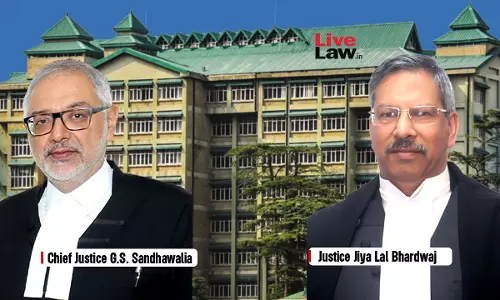

HP High Court Questions Shifting Of RERA Office From Shimla To Dharamshala; Interim Order Restraining Shift To Continue

The Himachal Pradesh High Court admitted a petition challenging the decision of the State Government to shift the Real Estate Regulatory Authority office from Shimla to Dharamshala.The Court remarked that RERA was a small institution with limited manpower and that the State ought to consider relocating larger offices instead of burdening a statutory authority with minimal staff.A Division...

Foreign Trade Policy | Natural Honey Exports Capped At USD 1,400 Per Metric Ton Till March 2026, Notifies DGFT

The Directorate General of Foreign Trade (DGFT) has notified that Minimum Export Price (MEP) for Natural Honey will be USD 1,400 per metric ton and exports below this price would not be permitted. In a Notification dated December 31, 2025, DGFT has notified extension by revising the Export Policy condition for Honey falling under tariff heading ITC HS 04090000 till March 31 2026,...

Union Govt Notifies Trade Deals With New Zealand, Switzerland, Norway & Iceland; Eliminates Duty On 100% Of Indian Exports

The Ministry of Finance, Department of Revenue has notified 100% Duty-Free Exports under four major Free Trade Agreements with New Zealand, Switzerland, Norway and Iceland. Indian exports would be partially exempt from various Rates like Basic Customs Duty and fully exempt from Agriculture Infrastructure and Development Cess as well as Health Cess. India also concluded two more...

Delhi High Court Refuses To Cancel Bail In ₹72 Crore GST Evasion Case After 5 Years, Pulls Up Department For Lapse In Probe

The Delhi High Court has refused to cancel bail granted to an accused in Goods and Services Tax (GST) evasion case involving alleged tax fraud of Rs. 72 crore more than 5 years ago, while strongly criticising the investigating agency for lapses in the investigation.Justice Amit Mahajan said that the investigation was still not complete in the matter and even after a lapse of more than five...

A Doctrinal Shift In Judicial Response To Cyber Fraud

The Delhi High Court's judgment in Dabur India Limited v Ashok Kumar on fraudulent domain name registration is best understood as a judicial response to the changing anatomy of digital fraud. The Court was confronted with an ecosystem in which impersonation websites, fake investment portals, and cloned brand identities proliferate at scale, often vanishing and reappearing faster than traditional legal remedies can respond. Against this reality, the judgment, authored by Justice Prathiba M....

Delhi High Court Grants Dynamic Injunction Against Piracy Sites Streaming Warner Bros, Netflix Content

The Delhi High Court has granted an ex parte ad interim dynamic+ injunction restraining dozens of piracy websites from hosting or making available copyrighted films and television shows owned by Warner Bros. Entertainment Inc. and other global entertainment companies. The injunction will operate until April 20, 2026. The suit was filed by Warner Bros along with other major global...

MP High Court Protects Young Live-In Couple, Cautions Against Economic And Social Costs Of Early Life Choices

The Madhya Pradesh High Court, while granting protection to a couple, aged 20 years, observed that although the Constitution confers certain individual rights, such as the right to reside per one's own will, it is not always necessary to exercise or enforce them in every circumstance. The bench of Justice Gajendra Singh highlighted the practical difficulties, noting that if the young...

LiveLawBiz: Business Law Daily Round-Up: January 02, 2026

TAX New RSP Based Valuation Mechanism, 40% GST Rate On Pan Masala, Cigarettes, Cigars, Tobacco Products From February 01No GST On Liquidated Damages For Breach Of Contract: Karnataka High Court Quashes SCNER-1 Returns Don't Require Detailed CENVAT Disclosure; Extended Limitation Not Invocable: CESTAT DelhiIPRDelhi High Court Upholds Order Rejecting Ericsson's Data Security Invention...

CPC Provision For First-Stage Rejection Of Complaints Not Applicable To RERA If Actionable Claims Exist: HP RERA

The Himachal Pradesh Real Estate Regulatory Authority (HP RERA) has recently held that a complaint disclosing a prima facie cause of action under the Real Estate (Regulation and Development) Act, 2016 cannot be rejected at the threshold by invoking a Civil Procedure Code provision meant for rejection of complaints.A coram comprising Chairperson R D Dhiman and Members Amit Kashyap and Vidur...

Delhi High Court Upholds JEE Candidates' Dismissal Over Alleged Manipulation In Response Sheets, Asks Them To Do Community Service

The Delhi High Court has upheld dismissal of a petition filed by two students challenging the National Testing Agency's (NTA) findings regarding alleged manipulation of their JEE Mains, 2025, examination response sheets, while sparing them of costs but ordering them to do one-month community service instead. A division bench comprising Chief Justice DK Upadhyaya and Justice Tushar Rao Gedela ...

State Cannot Deny Work-Charged Benefits To Eligible Worker On Ground Of Cadre Abolition: HP High Court

The Himachal Pradesh High Court held that abolition of the work-charged establishment in 2005 could not nullify a right that had already accrued in favour of the employee in 2003. Justice Ranjan Sharma remarked that: “Once a right for work charge status had accrued to the petitioner on completion of 8 years of continuous service w.e.f. 01.01.2003… the abolition of work charge establishment...