Trending

Information Technology Act Provisions Regarding Service Of Notice Inapplicable To Service Under GST Act: Allahabad High Court

In a landmark judgment, the Allahabad High Court has held that the provisions of Information Technology Act regarding dispatch and receipt of service are not applicable to service made under Section 169 of the Goods and Service Tax Act, 2017. The six modes of service provided under Section 169(1) of the State/Central GST Act are: (a) tendering directly or by messenger; (b) dispatch...

Delhi Air Pollution | GST Council Meeting Can't Be Conducted On VC, PIL To Abolish 18% Tax On Air Purifiers 'Loaded': Centre To High Court

Union of India informed the Delhi High Court on Friday (December 26) that the meeting of the GST Council to decide the issue of lowering or abolition of GST on air-purifiers can only be conducted physically and not virtually and sought to time to respond to a PIL to declare air-purifiers as “medical devices”.The PIL moved by lawyer Kapil Madan further seeks removal of imposition of 18%...

Service Tax | Sale Of Popcorn & Beverages At Cinema Counters Is Not Service, No Service Tax Payable: CESTAT Delhi

The Delhi Bench of the Customs, Excise and Service Tax Appellate Tribunal has set aside a service tax demand of over ₹18.84 crore against assessee, holding that the sale of food and beverages such as popcorn, snacks and soft drinks at cinema counters amounts to sale of goods and does not involve any element of “service” under the Finance Act, 1994. A Bench...

Centre Imposes Anti-Dumping Duty On 2-Ethyl Hexanol Imports From EU, US, Korea, Others Till June 2026

The Ministry of Finance, Department of Revenue has imposed Anti-Dumping Duty on imports of “2-Ethyl Hexanol” from European Union, Indonesia, Korea RP, Malaysia, Taiwan and United States of America till June 26, 2026. 2-Ethyl Hexanol. 2-Ethyl Hexanol is a basic organic chemical. It is produced on a massive scale for use in numerous applications such as solvents, flavours, and...

'Strong Prima Facie Case': Calcutta High Court Flags Unfair Exclusion Of IndiaMART By ChatGPT, Defers Interim Relief Pending OpenAI Hearing

The Calcutta High Court has held that IndiaMART has made out a strong prima facie case of selective discrimination after being allegedly excluded from ChatGPT-generated search results, but declined to grant ad-interim relief on the ground that such an order would virtually amount to granting final relief without hearing OpenAI and the other respondents.Justice Ravi Krishan Kapur, sitting in...

Revenue Cannot Reclassify Input Services Or Deny CENVAT Credit While Sanctioning Refund: CESTAT Chandigarh

The Chandigarh Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) held that revenue cannot reclassify input services or deny CENVAT credit at the stage of sanctioning a refund, without first challenging the assessment or invoking Rule 14 of the CENVAT (Central Value Added Tax) Credit Rules, 2004. S.S. Garg (Judicial Member) and P. Anjani Kumar...

Thrissur Consumer Commission Holds FCA India Automobiles And Its Dealer Liable For Selling Defective Car

The Thrissur Consumer Disputes Redressal Commission bench comprising C.T Sabu, President, Sreeja S, Member and Ram Mohan R, Member has held FCA India Automobiles Pvt. Ltd, its dealer and its service provider liable for selling a defective FIAT Linea T-Jet car to the complainant. Brief facts: On 30.09.2013, the complainant purchased a FIAT Linea T-Jet car from Hyson...

GST Registration Can Be Restored If Returns And Dues Are Cleared: Gauhati High Court

The Gauhati High Court has allowed a writ petition seeking restoration of Goods and Services Tax (GST) registration which had been cancelled due to non-filing of returns for a continuous period of six months. A single judge bench of Justice Kardak Ete was hearing the petition filed by a proprietor engaged in execution of works contracts, whose GST registration was cancelled by the...

MP High Court Orders Status Quo In Plea For Exclusive Burial Ground For Muslim Community

The Madhya Pradesh High Court has directed the State authorities to maintain status quo over a graveyard located in district Katni's Sleemnabad while hearing a plea seeking to protect the burial rights of the Muslim community and to declare the graveyard as exclusive burial ground. The division bench of Chief Justice Sanjeev Sachdeva and Justice Vinay Saraf directed; "Issue notice. Notice...

Criminal Courts Must Proactively Filter Factually Fractured Prosecutions At Challan Stage To Arrest 'Snail-Paced Justice': J&K High Court

Holding that criminal courts are not meant to function as passive recipients of police reports, the Jammu and Kashmir and Ladakh High Court has underscored that from the very presentation of a final police report (challan), courts must proactively apply judicial acumen to examine whether a case discloses a complete and coherent factual foundation warranting trial, or whether it is a...

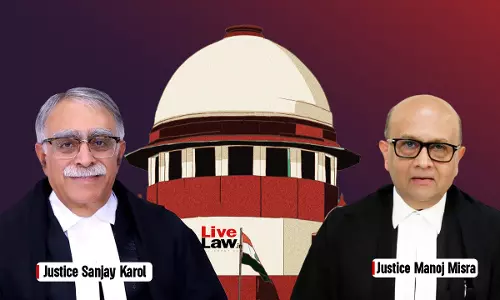

Medical Negligence | 'Commission Under WB Clinical Establishments Act Can Decide Deficiency In Patient Service': Supreme Court

The Supreme Court recently held that the Commission established under West Bengal Clinical Establishments Act, 2017 is entitled to adjudicate upon 'deficiency in patient care service' as well as to award compensation."Section 38 categorically provides that medical negligence complaints would be dealt with by the State Medical Councils. The Division Bench held that the Commission was not...