Trending

Supreme Court Issues Nationwide Directions To Expand And Reform Open Prisons

The Supreme Court today issued comprehensive directions to ensure the effective utilisation and expansion of Open Correctional Institutions (OCIs) across the country, holding that they must function as meaningful institutions of reform and rehabilitation.A bench of Justice Vikram Nath and Justice Sandeep Mehta observed that the directions are issued to ensure that the constitutional...

Recognition Of Menstrual Health As A Fundamental Right Under Article 21

“A period should end a sentence, not a girl's education.” When the Supreme Court uttered those lines on January 30, 2026, it wasn't just grand rhetoric, it marked an earthquake moment in Indian law. That ruling,Dr. Jaya Thakur v. Union of India, didn't simply nudge policy; it redrew the map entirely. In clear terms, the Court folded menstrual health and meaningful access to menstrual hygiene management (MHM) inside educational settings right into Article 21 itself, the very backbone of life and...

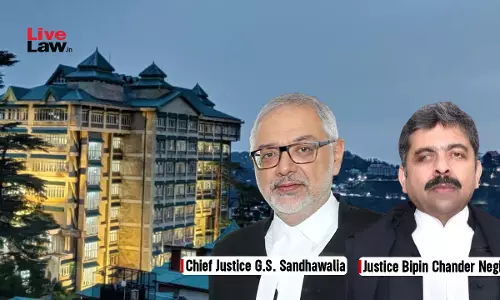

Habeas Corpus Plea Cannot Be Maintained For Minor's Custody Between Parents: Himachal Pradesh High Court

The Himachal Pradesh High Court has declined to entertain a habeas corpus petition filed by a father seeking production and custody of his minor daughter, holding that in custody disputes between parents, the appropriate remedy lies before the competent Guardian Court.While dismissing a habeas corpus petition filed by a father seeking production and custody of his minor daughter, Chief...

Madhya Pradesh High Court Upholds Termination Of Scindia School Employee For Selling Tobacco, Cigarettes On School Premises

The Madhya Pradesh High Court has upheld the termination of a peon working with the renowned Scindia School at Gwalior, for selling tobacco cigarettes, bidi and gutka on the school premises.The bench of Justice Anand Singh Bahrawat observed, "The services of petitioner were terminated on account of serious charges of selling tobacco, cigarettes, bidi, gutka and other such items within the...

[Specific Relief Act] Opportunity To Amend Must Be Given Before Dismissing Suit U/S 34 Proviso: Karnataka High Court

The Karnataka High Court has held that before dismissing a suit under the proviso to Section 34 of the Specific Relief Act, 1963 for want of appropriate consequential relief, the Court must afford the plaintiff an opportunity to amend the plaint or, in deserving cases, mould the relief. The Court observed that the proviso is intended to avoid multiplicity of litigation and not to...

Medical Education Admission Rules | PG Aspirant Approaches MP High Court Seeking Extension Of NRI Quota To Stray Vacancy Round

A post-graduate medical aspirant seeking admission under the NRI quota has approached the Madhya Pradesh High Court challenging the validity of Rule 14(2) of the MP Medical Education Admission Rules, 2018. The challenge is limited to the provision permitting the conversion of unfilled NRI quota seats after the third round of counselling. The petitioner contended that such seats should...

'Potential To Disturb Communal Harmony': Kerala High Court Stays Release Of 'The Kerala Story 2', Asks CBFC To Re-Examine

The Kerala High Court on Thursday (February 26) stayed release of the movie Kerala Story 2: Goes Beyond, following pleas challenging its censor certification. The film was slated to hit the theatres tomorrow.Justice Bechu Kurian Thomas in his order said, "...the very content in the teaser itself, which is conceded to be part of the movie, has the prima facie potential to distort the...

'State Can't Chase Foreign Investment While Ignoring Local Industries': Madras High Court Allows Fireworks Units Near Srivilliputhur Sanctuary

The Madras High Court recently criticised the State government for focusing on foreign investments while disregarding the local industries in the State. The bench of Justice G Jayachandran and Justice KK Ramakrishnan noted that the Government was having a lackadaisical approach to local industries, but at the same time, extending subsidies and tax exemptions for the foreign investors....

Supreme Court Asks Isha Foundation To Explore Settlement In Coimbatore Crematorium Land Dispute

The Supreme Court today asked the Isha Foundation to explore the possibility of amicably settling a land dispute in relation to the Foundation's Kayantha Sthanam (Crematorium) created on the outskirts of Coimbatore.The bench CJI Surya Kant and Justices Joymalya Bagchi, Vipul Pancholi was hearing a plea filed by a resident of Coimbatore who is aggrieved by the creation of a crematorium next to...

'Lapses By Advocate, Defendant's Illness': Calcutta High Court Sets Aside Eviction Decree, Condones 496-Day Delay In Filing Appeal

The Calcutta High Court has held that the illness of a litigant coupled with laches on the part of the conducting advocate can constitute “sufficient cause” for condonation of delay under Section 5 of the Limitation Act, and that such applications need only be decided on the touchstone of preponderance of probabilities.Justice Biswaroop Chowdhury allowed a second appeal (SA 34 of 2019)...

Kerala High Court Grants Bail To NDPS Accused, Says Relative Was Only Informed Grounds Of Arrest Over Phone, Not In Writing

The Kerala High Court recently granted bail to a person accused of an offence under the Narcotic Drugs and Psychotropic Substances Act (NDPS Act) after noting that the grounds of his arrest was not intimated in writing to his relative and it was done only over phone.Dr. Justice Kauser Edappagath noted that there are prima facie material to connect the accused with the crime but since the...

Actress Assault Case: Kerala High Court Orders Completion Of Probe In FIRs Registered On Dileep's Plea Against Media Trial Within Two Months

The Kerala High Court has recently (20 February) directed the State to complete the investigation in the FIRs registered pursuant to its order in Malayalam cine actor Dileep's plea against media trial, within two months.Justice C Pratheep Kumar issued the direction. The petition was filed alleging that the directive that prohibited the publication, broadcast and telecast of trial proceedings...

![[Specific Relief Act] Opportunity To Amend Must Be Given Before Dismissing Suit U/S 34 Proviso: Karnataka High Court [Specific Relief Act] Opportunity To Amend Must Be Given Before Dismissing Suit U/S 34 Proviso: Karnataka High Court](https://www.livelaw.in/h-upload/2026/01/22/500x300_648570-karnataka-hc-dharwad-bench-justice-anant-ramanath-hegde.webp)