Corporate

Arbitrator Can't Pierce Corporate Veil To Fasten Liability On Non-Signatory: Madras High Court Partially Sets Aside Award

The Madras High Court partially set aside an arbitral award holding that arbitrator cannot pierce a corporate veil or treat a non-signatory as an alter ego to fasten liability, while modifying the award to direct repayment of a loan of Rs. 2.5 crore with interest. Justice N. Anand Venkatesh held that the arbitrator exceeded its jurisdiction by treating a third party as...

IBC Does Not Override Statutory First Charge Under Gujarat VAT Act, Both Laws Operate In Harmony: NCLAT

The National Company Law Appellate Tribunal at Delhi recently held that the Insolvency and Bankruptcy Code (IBC) does not override a statutory first charge created under the Gujarat VAT Act, and that both laws operate in harmony when such a charge qualifies as a security interest under the Code. A Bench of Judicial Member Justice Yogesh Khanna and Technical Member Indevar Pandey observed...

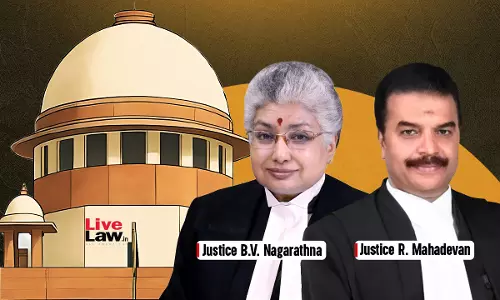

'Frivolous Cases Waste Judicial Time' : Supreme Court Raps Income Tax Dept For Filing SLP On Settled Issue

The Supreme Court on Friday pulled up the Income Tax Department for filing yet another Special Leave Petition (SLP) in a matter already settled by the Court, calling it a frivolous exercise that contributes to mounting pendency.A Bench of Justice BV Nagarathna and Justice R Mahadevan was hearing an SLP challenging a Karnataka High Court order on tax deduction at source (TDS) liability, an...

Even Though Evidence Act Is Not Applicable To Arbitration, Tribunal Must Follow Its Core Principles: Madras High Court

The Madras High Court has recently observed that although arbitral tribunals are not bound by the Evidence Act, they must still follow its foundational principles when assessing evidence to avoid judicial scrutiny. A single bench of Justice N Anand Venkatesh stated that “the fundamental principles of the Evidence Act which provides the basis for dealing with the case must be satisfied...

Tax Authorities Cannot Resurrect Repealed VAT Powers After GST Regime, Nor Retain Deposits Without Statutory Backing: Tripura High Court

The Tripura High Court has held that where show-cause notices imposing penalty under Section 77 of the Tripura Value Added Tax Act, 2004 (TVAT Act) were issued after delay of 9 years, long after the repeal of the TVAT Act after GST Regime, are arbitrary, illegal and vitiated by malafides. The Court further held that the State cannot retain the security deposit taken for VAT registration...

Post-Award Claim For Reimbursement Of Municipal Tax Is Not Maintainable U/S 9 Arbitration Act: Calcutta High Court

The Calcutta High Court held that a partner cannot claim reimbursement of municipal tax payments through a post award petition filed under section 9 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) as such issue constitutes substantive monetary dispute requiring adjudication under section 34 of the Arbitration Act. Justice Gaurang Kanth dismissed the petition filed...

LiveLawBiz: Business Law Daily Round-Up: November 27, 2025

IPR Delhi High Court Grants Relief To Tesla Inc, Extends Bar on Indian Company's Use of 'Tesla' Marks In EV MarketDelhi High Court Rejects Philips' Plea For Perjury Action Against Ex-Employee In Software Piracy CaseMadras High Court Quashes Order Allowing Pfizer To Seek Documents From Indian Drug Manufacturer For US SuitDelhi High Court Declines To Return Plaint In Sun Pharma's Trademark...

Supreme Court Dismisses Byju Raveendran's Appeal Against NCLAT Order Mandating CoC Nod For BCCI's Plea To Withdraw CIRP

The Supreme Court on Friday dismissed an appeal filed by Byju Raveendran, suspended director and promoter of Think and Learn Private Ltd (which ran the Ed-Tech firm Byju's), challenging an order of the National Company Law Appellate Tribunal which held that the approval of the Committee of Creditors is necessary for the application filed by the BCCI to withdraw the insolvency proceedings...

Investment On Profit-Sharing Basis Does Not Qualify As Financial Debt : NCLT Delhi Reaffirms

The National Company Law Tribunal at New Delhi has recently reaffirmed that an investment made on a profit-sharing basis does not constitute a financial debt under Section 5(8) of the Insolvency and Bankruptcy Code and therefore cannot be used to initiate insolvency proceedings under Section 7. The ruling came in a case where Modern Solar Private Limited sought to treat Rs 20 lakh advanced...

Chandigarh Consumer Commission Orders BMW India To Refund ₹1.32 Crore For Defective BMW X7

The State Consumer Disputes Redressal Commission, UT Chandigarh, comprising Justice Raj Shekhar Attri (President) and Rajesh Kumar Arya (Member), has held BMW India Pvt. Ltd. and its senior management liable for selling a defective luxury vehicle (BMW X7 xDrive40d M Sport) and for deficiency in service. The Commission has directed the manufacturer to refund ₹1,32,90,000 (the cost of...

Delhi High Court Cancels 'BLUE SPOT' Mark Of Local Spirits Company After Finding It Unused For Five Years

The Delhi High Court has ordered the removal of the trademark “BLUE SPOT” registered to Stardford Spirits Pvt. Ltd.,a local spirits company after finding that the alcohol brand had not been used for more than five years. In an order dated November 19, 2025, Justice Manmeet Pritam Singh Arora allowed a rectification petition filed by Irish Distillers International Limited, part of the...

Delhi High Court Declines To Return Plaint In Sun Pharma's Trademark Suit Against Artura, Says Cause Of Action Partly Arose In Delhi

The Delhi High Court has refused to return the plaint in a trademark infringement and passing off suit filed by Sun Pharmaceutical Industries Ltd., holding on a prima facie basis that part of the cause of action arose in Delhi through the defendant-Artura Pharmaceuticals' online presence. A single bench of Justice Tejas Karia, in an order dated November 24, 2025, held that the question...