Corporate

NCLAT Fines Prospective Resolution Applicant Rs 15 Lakh For Obstructing Insolvency Process, Turning It Into A “Tom & Jerry Show"

The National Company Law Appellate Tribunal (NCLAT) at New Delhi on Tuesday imposed a cost of Rs. 15 lakh on Astral Agro Ventures, a Prospective Resolution Applicant (PRA), for obstructing the Corporate Insolvency Resolution Process (CIRP) of Megi Agro Chem Ltd. The tribunal observed that the insolvency resolution process “cannot be reduced to a Tom & Jerry show” where a PRA, who...

NCLT Approves Rs 12.8 Crore Resolution Plan By Knowledge Marine Director For Sterling Healthcare

The National Company Law Tribunal at Mumbai has recently approved a resolution plan worth Rs 12.8 crore by a Mumbai individual for Sterling Healthcare Limited. In an order delivered on November 13, 2025 by a coram of Judicial Member Sushil Mahadeorao Kochey and Technical Member Prabhat Kumar approved a resolution plan by the whole time director of Knowledge Marine & Engineering Works...

NCLT Must Verify ED Attachment Before Refusing Property Release To Successful Resolution Applicant : NCLAT

The National Company Law Appellate Tribunal (NCLAT) on Tuesday held that the National Company Law Tribunal (NCLT), Mumbai, should have verified whether a Bangalore-based flat was provisionally attached by the Enforcement Directorate (ED) before refusing its release to the successful resolution applicant (SRA) of insolvent DSK Southern Projects Pvt. Ltd.A coram comprising of Judicial...

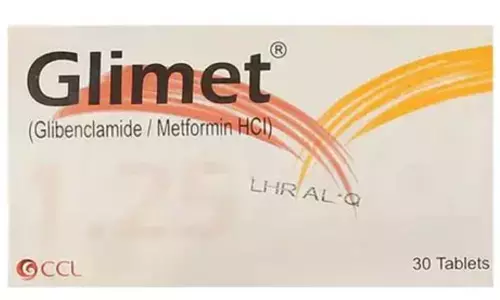

Bombay High Court Blocks Sale Of Diabetes Drug ELGIMET For Similarity To GLIMET's Mark

The Bombay High Court on Tuesday restrained the use of the diabetes drug mark ELGIMET, finding it deceptively similar to the registered mark GLIMET, and confirmed an interim injunction against its sale and manufacture. A single bench of Justice Sharmila U Deshmukh, observed that “GLIMET” and “ELGIMET” were phonetically and structurally similar and that an average consumer with...

Delhi High Court Restrains Jaipur Hotel From Using Logo Similar To Beverly Hills Polo Club

The Delhi High Court has recently restrained a Jaipur hotel from using marks featuring a polo player device that were found to be deceptively similar to the well-known Beverly Hills Polo Club (BHPC) logo. The ex-parte ad-interim injunction will remain in force until February 02, 2026. The order, issued on November 13 by Justice Manmeet Pritam Singh Arora, came in a suit filed by...

Refund Of Capital Advance From Karta To HUF Is Capital Receipt; Commercial Use Of Capital Does Not Convert It Into Income: ITAT Mumbai

On November 17th, 2025 the Bench of Shri Vikram Singh Yadav (Accountant Member) and Shri Sandeep Singh Karhail (Judicial Member) of the ITAT Mumbai partly allowed the appeal holding that the disallowance under Section 14A (Expenditure for exempt income) r/w Rule 8D cannot exceed the actual expenditure of ₹69,455 incurred by the assessee, and that the excess refund of...

Date Of default For MSMEs Refers to Original NPA Not Subsequent Defaults After Restructuring: NCLT Kolkata

The National Company Law Tribunal (NCLT) at Kolkata has recently clarified that when an MSME corporate debtor's account is restructured and subsequently defaults again, the date of default for an insolvency application must refer back to the original NPA date, in accordance with the RBI circular currently in force and not to the date of default following restructuring. A coram...

Punjab & Haryana High Court Quashes Negative Blocking of ITC Under Rule 86A; Holds Ledger Cannot Be Blocked Beyond Available Credit

The Punjab & Haryana High Court has quashed orders that disallowed debit from Electronic Credit Ledgers of taxpayers in excess of the Input Tax Credit (ITC) available at the time of passing of the said order. The Division Bench comprising, Justice Lisa Gill and Justice Meenakshi I. Mehta followed the principles judicial reasoning for blocking of Electronic Credit Ledger under Rule 86-A...

Rebate Under Rule 18 CER Cannot Be Denied Without Examining Duty On Exported Goods: Bombay High Court Remands Yamaha's Claim

The Bombay High Court has held that a rebate under Rule 18 Central Excise Rules, 2002, cannot be denied without determining the tax liability on exported goods, and has remanded Yamaha's rebate claim to the principal commissioner for fresh consideration. Justices M.S. Sonak and Advait M. Sethna were examining whether the India Yamaha Motor P. Limited was entitled to a rebate...

Arbitration | Dispute On Interest Rate Doesn't Fall Under Public Policy Ground To Set Aside Award Ordinarily: Supreme Court

The Supreme Court on Tuesday (November 18) upheld the charging of a 24% interest rate in an arbitral award, stating that an interest rate agreed upon in a commercial loan agreement did not violate the fundamental policy of Indian law. “It is well-settled that fundamental policy of Indian law does not refer to violation of any Statue but fundamental principles on which Indian law is...

Delhi High Court Dismisses Aqualite's Appeal; Upholds Interim Injunction Granted To Relaxo In Design Piracy Suit

The Delhi High Court has dismissed an appeal filed by Aqualite Industries Pvt. Ltd. and upheld the interim injunction granted by a Single Judge restraining Aqualite from manufacturing and selling slippers alleged to infringe Relaxo Footwears Ltd.'s registered designs. Delivering judgment on 18 November 2025, a Division Bench of Justice C. Hari Shankar and Justice Om Prakash Shukla...

Audit Assessment Under Orissa VAT Act Is Invalid If Audit Visit Report Is Time-Barred: High Court

The Orissa High Court has held that an audit assessment under Section 42 of the OVAT Act (Odisha Value Added Tax Rules, 2005) cannot be initiated when the AVR (Audit Visit Report) is beyond the limitation period. Chief Justice Harish Tandon and Murahari Sri Raman were examining whether the Assessing Authority has jurisdiction to proceed with Audit Assessment under Section 42 of the...