Corporate

“Gross Concealment”: Delhi High Court Imposes ₹5 Lakh Costs On Party In Poppy Seeds Smuggling Case

The Delhi High Court recently imposed exemplary costs of ₹5 lakh on the power of attorney holder of a company, purportedly involved in smuggling of prohibited items like poppy seeds.A division bench of Justices Prathiba M. Singh and Shail Jain noted that the Petitioner had failed to disclose that his challenge to the penalty order passed by the Customs authority was previously dismissed by...

Delhi High Court Grants Interim Relief To Aadhar India Over Non-Issuance Of Pre-Show Cause Notice Intimation In GST Case

The Delhi High Court, while examining whether pre-consultation prior to a GST Show Cause Notice was mandatory or discretionary, granted interim relief to Aadhar India by permitting the proceedings arising from the Show Cause Notice dated 29 November 2024 to continue, but directing that any final order passed pursuant thereto should not be given effect without further orders of...

Bombay High Court Sets Aside Patent Office Rejection, Orders Fresh Consideration of Medical Therapeutic Device Patent

The Bombay High Court has set aside the rejection of a patent application for a medical therapeutic device, directing the Patent Office to reconsider the matter afresh. The court found that the Patent Office had failed to follow mandatory statutory procedures under the Patents Act before refusing the application. A single bench of Justice Arif S Doctor passed the order on November 17,...

Delhi High Court Protects Realty Firm Signature Global Against Fake Websites

The Delhi High Court has granted ad-interim relief to real estate developer SignatureGlobal (India) Limited, restraining the operator of 'signatureglobal.com' from using the impugned domain or any online platform that impersonates the company. The injunction will remain in force until March 10, 2026.A single bench of Justice Tejas Karia passed the order on November 12, 2025, after finding...

Mere Obligation To Pay Under Compromise Deed Does Not Amount To Financial Debt: NCLT New Delhi

The National Company Law Tribunal (NCLT) at New Delhi has recently held that a mere breach of an agreement, resulting in an obligation to pay under a compromise deed, does not by itself qualify as a financial debt under the Insolvency and Bankruptcy Code (IBC), 2016. The order was passed by a bench comprising Judicial Member Manni Sankariah Shanmuga Sundaram and Technical Member Atul...

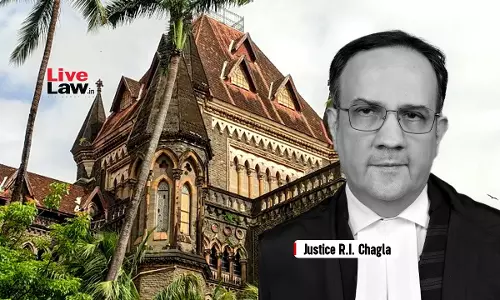

Arbitral Tribunal Cannot Rewrite Executed Contract Using Internal Notings: Bombay High Court Sets Aside Award Against Konkan Railway

The Bombay High Court set aside a majority arbitral award that had directed Konkan Railway to bear Royalty Charges for earth used in a Madhya Pradesh project holding that the arbitral tribunal acted in contravention of the contractual terms and committed patent illegality by relying on internal tender committee minutes to infer a different intention of the parties. Justice R.I....

Transfer Pricing Officer Cannot Cherry-Pick Transactions When Transactional Net Margin Method Is Accepted: ITAT Mumbai

The Income Tax Appellate Tribunal (ITAT) Mumbai has held that once the Transactional Net Margin Method (TNMM) is accepted for benchmarking all international transactions, the Transfer Pricing Officer (TPO) cannot cherry-pick only the management fee and assign an Arm's Length Price (ALP) at NIL. In the case in hand, the assessee had preferred an appeal before the ITAT seeking deletion...

Affidavit Of Cost Accountant In Personal Hearing Cannot Be Ignored When Facts Are Admitted By State Tax Officer: Kerala High Court

The Kerala High Court has held that an affidavit by professionals, such as a cost accountant, given during a personal hearing, cannot be ignored, especially when a state tax officer admits facts referred therein. Justice Ziyad Rahman A.A. stated that when a professional swears an affidavit before this Court, highlighting the matters that transpired during the course of the hearing,...

KVAT Act | Permission For Compounding Tax Cannot Be Cancelled For Suppression; Only Suppressed Turnover Can Be Taxed: Kerala High Court

The Kerala High Court has held that under the KVAT Act (Kerala Value Added Tax Act, 2003), the assessing authority cannot cancel permission to pay tax at compounding rates for suppression in the same year it was opted, and only the suppressed turnover can be taxed at normal rates. Justice M.A. Abdul Hakhim opined that cancellation proceedings are still pending, and the cancellation...

Applications Under Section 60(5) IBC Cannot Be Used To Modify Approved Resolution Plans: NCLT Delhi

The National Company Law Tribunal (NCLT) at Delhi has recently clarified that an application under Section 60(5) of the Insolvency and Bankruptcy Code (IBC), which empowers the NCLT to determine disputes affecting the resolution process, cannot be used to revisit or modify a resolution plan once it has been approved by the tribunal. The ruling came in a petition filed by the...

Two Days Delay In Paying Last Instalment Under VAT Amnesty Scheme Owing To Technical Glitch Is Condonable: Gujarat High Court

The Gujarat High Court has extended benefit of Amnesty Scheme under the Gujarat Value Added Tax (GVAT) Act, 2003 to dealer who was precluded from making full payment under the Scheme on account of 'automatic' re-adjustment of instalment amount. The Division Bench, comprising Justice Bhargav D. Karia and Justice Pranav Trivedi set aside rejection of application under the Scheme noting...

NCLAT Fines Prospective Resolution Applicant Rs 15 Lakh For Obstructing Insolvency Process, Turning It Into A “Tom & Jerry Show"

The National Company Law Appellate Tribunal (NCLAT) at New Delhi on Tuesday imposed a cost of Rs. 15 lakh on Astral Agro Ventures, a Prospective Resolution Applicant (PRA), for obstructing the Corporate Insolvency Resolution Process (CIRP) of Megi Agro Chem Ltd. The tribunal observed that the insolvency resolution process “cannot be reduced to a Tom & Jerry show” where a PRA, who...