High Courts

Claimant Can Pursue Alternate Remedy For Severed Part Of Award Without Limitation Bar: Bombay High Court

The Bombay High Court has held that time spent in earlier arbitral proceedings can be excluded while computing limitation, even if only part of an arbitral award is set aside and fresh proceedings arise from a different agreement. A single bench of Justice Sandeep V Marne, in an order dated December 17, 2025, said Section 43(4) of the Arbitration and Conciliation Act allows exclusion of...

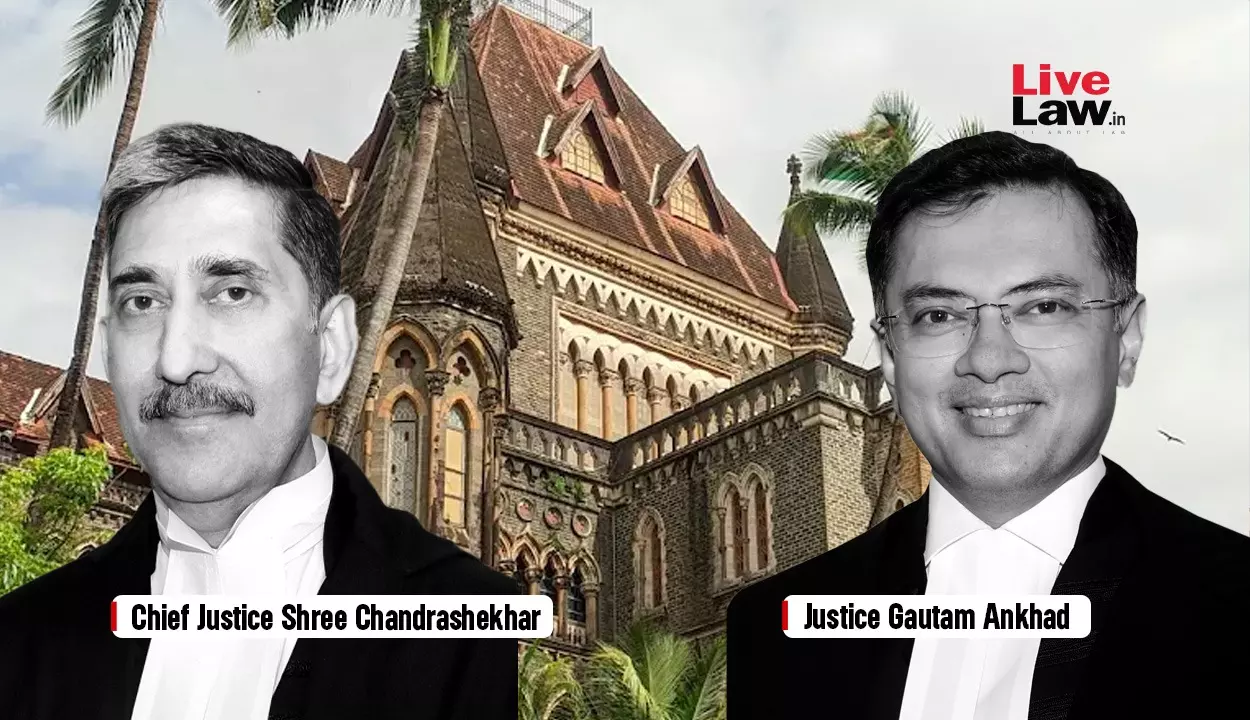

Liquor Licence Cannot Be Granted Like This: Bombay High Court To Maha Govt Over Permitting Open Sale Of Liquor At Sunburn Festival

In a Public Interest Litigation (PIL) raising concerns over the sale of liquor in the first ever Sunburn Festival, which is being held in Mumbai from December 19 till December 21, the Bombay High Court on Friday questioned the Maharashtra Government's decision to allow liquor at the event, especially when it is going to be held in an open-air venue.A division bench of Chief Justice...

Himachal Pradesh High Court Weekly Round-Up: December 8, 2025 To December 14, 2025

Citations: 2025 LiveLaw (HP) 250 to 2025 LiveLaw (HP) 255 Nominal Index: Nanak Chand v/s Madan Lal., 2025 LiveLaw (HP) 250 Sapna Devi v/s State of H.P. and others., 2025 LiveLaw (HP) 251 Atul Sharma v/s Union of India and others., 2025 LiveLaw (HP) 252 Controller of Stores, Northern Railway v/s M/s CBM Industries Pvt. Ltd. and Anr., 2025 LiveLaw...

Amendment Made In Pleadings Claiming House Tax Arrears For Subsequent Period Not Barred By Res Judicata: Punjab & Haryana High Court

The Punjab & Haryana High Court has dismissed a civil revision petition filed by a tenant challenging an order of the Rent Controller, Ludhiana, which allowed the landlady to amend her pleadings to claim house tax arrears for a subsequent period, holding that such an amendment does not violate the principle of res judicata and is permissible in rent proceedings involving...

Bombay High Court Bars Chandigarh Firm From Using Bunge India's 'LOTUS' Mark For Edible Oils

The Bombay High Court has permanently restrained Chandigarh-based Lotus Refinery Pvt. Ltd. and its associate entities from using the mark “LOTUS” or any deceptively similar mark for edible oils. The court held that that the adoption of an identical mark for identical goods amounted to trademark infringement and passing off of Bunge India Pvt. Ltd.'s long-standing registered trademark. In...

Fraudulent CENVAT Credit Allegations Involving Complex Facts Not Fit For Writ Jurisdiction: Delhi High Court

The Delhi High Court has held that the precedents barring invocation of writ jurisdiction in cases involving complex GST/ ITC transactions equally apply to cases of fraudulent CENVAT Credit.A division bench of Justices Prathiba M. Singh and Renu Bhatnagar observed,“This Court has consistently taken the view that in cases involving fraudulent availment of ITC, ordinarily, the Court would not...

Customs | Attending Weddings Can't Justify Indian Origin Foreigner Bringing Half Kilogram Gold Jewellery: Delhi High Court

The Delhi High Court has made it clear that under the garb of attending weddings where wearing gold jewellery is a common affair, a foreigner of Indian origin cannot be permitted to bring half kg gold jewellery to India.A division bench of Justices Prathiba M. Singh and Renu Bhatnagar further added that there was no explanation for the Petitioner, a US citizen, to bring 17 high value...

Punjab & Haryana High Court Upholds Transfer Of Income Tax Assessment Jurisdiction From Chandigarh To Goa, Says It Is In Public Interest

The Punjab & Haryana High Court has dismissed a writ petition challenging the transfer of income tax assessment jurisdiction from Chandigarh to Panaji, Goa, holding that the Revenue authorities acted within their powers under Section 127(2) of the Income Tax Act, 1961 and that the transfer was justified in public interest to facilitate coordinated investigation.Justice Deepak Sibal...

Export Held Up Due To Conflicting Lab Reports: Delhi High Court Asks Customs To Decide Pan Masala Exporter's Plea

The Delhi High Court has asked the Customs authorities to consider releasing the bank guarantee of a city-based pan masala exporter, forfeited after conflicting lab reports about adulteration of its export products with tobacco.A division bench of Justices Prathiba M. Singh and Shail Jain observed that when no objections were found in the first lab test report (CRCL), “the circumstances...

Bombay High Court Refuses To Stay Conviction Of Sports Minister Manikrao Kokate In 1995 Cheating Case, Suspends Sentence

In a setback for senior Nationalist Congress Party (NCP) (Ajit Pawar Faction) leader Manikrao Kokate, the Bombay High Court on Friday refused to stay his conviction in the 1995 cheating case. However, the court suspended his sentence for the time being. Single-judge Justice Rajesh Laddha heard the revision application filed by Kokate through senior advocate Ravi Kadam and advocate Aniket...

Aiding Escape Of Prime Accused In Murder Of Social Media Influencer Shows Clear Complicity: P&H High Court Denies Anticipatory Bail

The Punjab & Haryana High Court has dismissed a petition seeking anticipatory bail filed by an accused alleged to have facilitated the escape of the prime suspect in the murder of a social media influencer Kanchan Kaur Bhabi, holding that such conduct shows clear complicity and disentitles the petitioner from discretionary relief at the pre-arrest stage.Justice Sumeet Goel noted,...

Delhi High Court Quashes Bank's Decision Declaring Account Of Jai Anmol Ambani's Firm As Fraudulent

The Delhi High Court on Friday reportedly quashed a decision by the Union Bank of India declaring bank account of Anil Ambani's son Jai Anmol Ambani's firm as fraudulent. As per a report by PTI, the court said that no show cause notice was served to Jai Anmol Ambani which was sent to an address from which the company had vacated in 2020. Justice Jyoti Singh said no show cause notice was...