High Courts

Gujarat High Court Orders Release Of Imported Distillate Oil Seized For Not Meeting Criteria, Says Test Didn't Clearly Say If It Was Diesel

The Gujarat High Court recently directed release of imported distillate oil which was earlier seized on the ground that it did not meet the parameters of distillate oil, holding that the test report did not definitively conclude that the Distillate Oil was Diesel, to an extent that it would change the nature of classification from Distillate Oil to Diesel. Distillate oil is a form of liquid...

Delhi High Court To Examine Whether Delhi Jal Board Qualifies As 'Local Authority' & Works Contract Services Would Attract 12% GST

In yet another writ petition, concerning works contract services provided to Delhi Jal Board, where its status as a 'Local Authority' was called-into-question, the Delhi High Court has stayed the summary Show Cause Notice under Section 73 of the CGST Act, 2017. A Division Bench comprising, Justice Prathiba M. Singh and Justice Shail Jain noted that few similar disputes relating...

GST Act | Orissa High Court Quashes Recovery Proceedings Premised On 'Mistaken Identity' After Verifying Payment Receipt From Bank

The Orissa High Court in a matter involving 'mistaken identity' where one individual was assessed despite having a cancelled registration number (GSTIN), has quashed Show Cause Notice under Section 73 of the CGST Act, 2017. A Division Bench comprising Chief Justice Harish Tandon and Justice Murahari Sri Raman noted the 'mistaken fact' in Section 73 adjudication proceedings....

Farmer's Land Need Not Be In His Own Name To Claim Relief Under CM's Krishak Durghatna Scheme: Allahabad High Court

The Allahabad High Court has held that for grant of benefits under the Mukhyamantri Krishak Durghatna Kalyan Yojana, the primary source of income/ livelihood of the deceased farmer needs to be seen rather than seeing the revenue records to ascertain whether the agricultural land was in the name of the deceased or not.The “Mukhyamantri Krishak Durghatna Kalyan Yojana” has been brought in...

Masala Bonds Case: Kerala High Court Stays Interim Order By Single Bench On ED's Appeal Against Stay Of Show Cause Notice To KIIFB

The Kerala High Court on Friday (19 December) admitted the appeal preferred by the Enforcement Directorate against a Single judge's interim order staying the show cause notice issued against Kerala Infrastructure Investment Fund Board (KIIFB) under the Foreign Exchange Management Act, 1999 (FEMA), relating to the utilisation of funds raised through masala bond. The bench has stayed the...

Writ Petition Not Maintainable After GSTAT Becomes Functional; Assessees Must Avail Remedy U/S 112 GST Act: Orissa High Court

The Orissa High Court has dismissed two writ petitions filed under the Goods and Services Tax (GST) regime, holding that the availability and operationalisation of the statutory appellate remedy before the Goods and Services Tax Appellate Tribunal (GSTAT) bars the exercise of writ jurisdiction under Article 226 of the Constitution. In Amit Kumar Das v. Joint Commissioner of State...

Preliminary Enquiry Can't Be Sole Basis For Dismissal Once Regular Enquiry Fails: Rajasthan High Court Reinstates Constable

Rajasthan High Court set aside the dismissal of a police constable imposed by senior police authority while exercising suo-motu review powers under Rule 32 of the Rajasthan Civil Services (Classification, Control and Appeal) Rules, opining that preliminary enquiry could not be made sole basis of punishment when such material did not come on record during the regular enquiry.The bench of...

J&K&L High Court Flags Borrowers' Misuse Of Courts To Stall Loan Recovery; Says Conduct Defeats SARFAESI Act's Purpose

Deploring the growing tendency of defaulting borrowers to misuse judicial remedies to stall recovery of public money, the High Court of Jammu & Kashmir and Ladakh has held that such conduct strikes at the very purpose of the SARFAESI Act.A Division Bench comprising Justice Sindhu Sharma and Shahzad Azeem observed, “... It is highly disturbing that a small but recalcitrant class...

SVLDR Scheme Can't Be Invoked For Fresh SCN Issued After Deadline Even If Arising From Same Dispute: Delhi High Court

The Delhi High Court dismissed a retail business' plea seeking benefit of government's tax amnesty scheme for a second show cause notice issued to it post the cut-off date, in pursuance of the first SCN.A division bench of Justices Prathiba M. Singh and Shail Jain clarified that mere reference to earlier SCN doesn't make subsequent SCN eligible under Sabka Vikas Legacy Dispute Resolution...

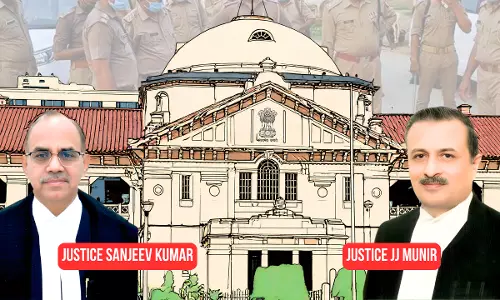

'Downright Impertinence': Allahabad High Court Slams SSP For Deputing Sub-Inspector To Reply To CJM, Seeks Explanation

The Allahabad High Court on Thursday reprimanded the Senior Superintendent of Police (SSP), Badaun, for delegating the task of communicating with t Chief Judicial Magistrate (CJM) to a Police Sub-Inspector. A bench of Justice J.J. Munir and Justice Sanjiv Kumar, termed the act "downright impertinence" and further directed the SSP to file a personal affidavit explaining why separate...

Madras High Court Rejects Jaipur Restaurant's Co-Ownership Claim To 'Dasaprakash' Trademark

The Madras High Court has refused to recognise a Jaipur-based company as a co-owner of the “Dasaprakash” trademark, holding that the brand is a jointly owned family mark that could not have been transferred by a single family member.The original mark is commonly associated with a South Indian restaurant chain. A single bench of Justice N Anand Venkatesh, in a judgment dated December 16,...

Rajasthan High Court Issues Notice On Challenge To Advocates Welfare Fund Amendment Enhancing Vakalatnama Stamp, Membership Fees

Rajasthan High Court issued notice on a petition challenging the validity of Rajasthan Advocates Welfare Fund (Amendment) Act, 2020 (“2020 Act”), that enhanced the stamp fee on Vakalatnama by 4 times, along with enhancement in the membership fee for the Rajasthan Advocates Welfare fund established under the Rajasthan Advocates Welfare Fund Act, 1987 (“Act”).The petition submitted that...