High Courts

'Merely Changing Words Won't Help': Delhi High Court Raps Litigant For Repeatedly Filing Pleas To Strike Down BNS Sections

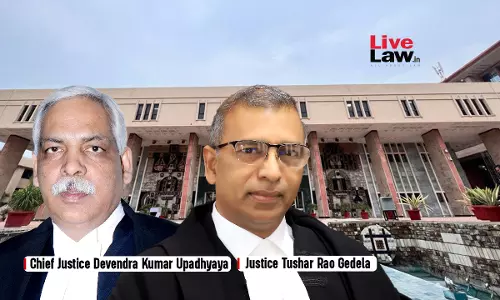

The Delhi High Court on Wednesday rapped a litigant for repeatedly filing petitions challenging certain provisions of the Bharatiya Nyaya Sanhita (BNS) 2023, despite dismissal of his earlier pleas seeking similar reliefs.A division bench comprising Chief Justice DK Upadhyaya and Justice Tushar Rao Gedela pulled up Upendra Nath Dalai, who filed a writ to declare the offences of waging war...

Bengaluru Stampede: Relief For RCB's Nikhil Sosale, Karnataka High Court Allows Him To Leave City With Prior Intimation To Police

The Karnataka High Court on Wednesday relaxed the bail condition imposed on Nikhil Sosale, Marketing Head of IPL cricket team RCB (Royal Challengers Bengaluru) which stands embroiled in the deadly Bengaluru stampede,.Sosale was arrested on June 6 in connection with the case and was granted bail after 6 days, subject to condition of not leaving Bengaluru.He now sought relaxation of this...

2021 Sub-Inspector Recruitment In Limbo: Rajasthan High Court Asks State To Consider Their Candidature For 2025 Vacancies, Relax Age Limit

The Rajasthan High Court has asked the State to consider granting age relaxation of 4 years, instead of 3 years, as notified in the advertisement, to candidates who appeared in the 2021 Sub-Inspector Recruitments process, and had re-applied for the 2025 process.The bench of Justice Ashok Kumar Jain opined that the matter related to legitimate expectation of the youth and such candidates shall...

Appearance Of Workman Through Advocate Amounts To Deemed Consent For Employer's Legal Representation: Jharkhand High Court

In Alembic Pharmaceuticals Limited v. Jay Prakash Singh, a single-judge bench of the Jharkhand High Court comprising Justice Deepak Roshan held that 'consent' under Section 36(4) of the Industrial Disputes Act (IDA) need not be explicit and that implicit consent of the other parties is sufficient.In this case, the Labour Court had ruled in favour of the respondent-workman and debarred...

Kerala High Court Refuses To Relax Ban On Sale Of Chemical Kumkum At Sabarimala, Says Health & Ecology Over Commerce

The Kerala High Court on Wednesday (November 12) refused to modify its order banning the sale of chemical kumkum and shampoo sachets in Sabarimala.The Division Bench comprising Justice Raja Vijayaraghavan V. and Justice K.V. Jayakumar remarked that it is concerned about the devotees and ecology of Sabarimala, and not the commercial aspects of kuthaka holders (stall owners), who may be affected...

Karnataka High Court Directs State Bar Council To Refund Excess Enrolment Fee Collected From Advocate; Says It Cannot Collect Fee Contrary To Law

The Karnataka High Court recently directed the Karnataka State Bar Council to refund the excess enrollment fee collected contrary to the statutory enrollment fee prescribed under Section 24(1)(f) of the Advocates Act, 1961.For Context: The prescribed statutory fee is ₹750; the Karnataka State Bar Council has been collecting optional fees of ₹6800. The petitioner Advocate Ravichandragouda...

'It Has Hurt Everyone': Delhi High Court Strongly Condemns Shoe Attack On CJI Gavai, Says Appropriate Measures Must

The Delhi High Court today remarked that incidents like the one where a lawyer hurled a shoe at Chief Justice of India BR Gavai in open court must "not only be deprecated but appropriate measures need to be taken".A division bench comprising Chief Justice DK Upadhyaya and Justice Tushar Rao Gedela made the remark while hearing a PIL seeking guidelines to take down videos of the...

High Court Issues Notice To Karnataka Govt On State Election Commission's Plea Seeking Final Reservation List In Gram Panchayats

The Karnataka High Court on Wednesday (November 12) issued notice to State Government on a petition filed by the State Election Commission seeking a direction to take immediate action and issue the final notifications of reservation of seats under section 5(5) of the Karnataka Gram Swaraj and Panchayath Raj Act, 1993 in respect of 5,950 Gram Panchayats whose terms will expire by January...

Post-Dated Cheques Given As Security Can Attract Section 138 NI Act Once Liability Crystallizes: Delhi High Court

The Delhi High Court has held that Post-Dated Cheques (PDCs), issued as security for financial liability, can mature into an actual outstanding liability, thus attracting provisions under Section 138 of the Negotiable Instruments Act 1881, if dishonoured.Justice Neena Bansal Krishna reasoned that security cheques are given to be utilised if certain liabilities arise during business...

Delhi High Court Refuses To Stay Order Restraining Ravi Mohan Studios From Using 'BRO CODE' For Tamil Film

The Delhi High Court on Wednesday refused to stay the operation of a single-judge order that had restrained actor Ravi Mohan's production house from using the title 'BRO CODE' for its upcoming Tamil film, following a trademark dispute with Indospirit Beverages Private Limited, the maker of the alcoholic beverage 'BROCODE'.A division bench comprising Justice C Hari Shankar and Justice Om...

Long-Term Posting Of Same Police Officer At Sabarimala Can Undermine Transparency, Efficiency: Kerala High Court

The Kerala High Court has directed the Chief Police Co-ordinator to submit details of all police officers currently holding critical positions in Sannidhanam and Pamba, along with the duration of their posting.The division bench comprising Justice Raja Vijayaraghavan V and Justice K V Jayakumar issued the direction while considering a Special Commissioner report pertaining to change of...

SC's Jospeh Shine Judgment Which Decriminalized Adultery Not Prospective, Nullified Pending Prosecutions Also: Rajasthan High Court

The Rajasthan High Court held that the decriminalization of adultery by the Supreme Court in Joseph Shine v Union of India shall not just apply prospectively but, it will apply retrospectively to all pending and ongoing cases, which is necessary to uphold the constitutional guarantees of equality, dignity and privacy.The bench of Justice Anand Sharma held that when Section 497 IPC (Adultery)...