High Courts

Madras High Court Weekly Round-Up: October 20 - October 26, 2025

Citations: 2025 LiveLaw (Mad) 364 To 2025 LiveLaw (Mad) 373 NOMINAL INDEX N Venkatesan v. The State of Tamil Nadu, 2025 LiveLaw (Mad) 364 K Heerajohn v. The District Registrar and Another, 2025 LiveLaw (Mad) 365 Joe Micheal Praveen v. Apsara Reddy and Another, 2025 LiveLaw (Mad) 366 X v. Union of India, 2025 LiveLaw (Mad) 367 Ramasamy v State of Tamil Nadu and Others,...

Delhi High Court Discharges Lawyer In Contempt Case For Intimidating Woman Judge, Using Derogatory Language

The Delhi High Court has discharged a lawyer in a criminal contempt case for misbehaving with a woman judge and intimidating her by using derogatory and threatening language. A division bench comprising Justice Vivek Chaudhary and Justice Manoj Jain accepted the unconditional apology tendered by the lawyer and discharged him from the contempt proceedings.A complaint was received by the...

Delhi High Court Weekly Round-Up: October 20 To October 26, 2025

Citations 2025 LiveLaw (Del) 1327 to 2025 LiveLaw (Del) 1365NOMINAL INDEXEarthz Urban Spaces Pvt. Ltd. v. Ravinder Munshi & Ors. 2025 LiveLaw (Del) 1327 RAHUL @ BHUPINDER VERMA v. STATE (NCT OF DELHI) 2025 LiveLaw (Del) 1328 X v. STATE OF NCT & ANR 2025 LiveLaw (Del) 1329 NATIONAL HIGHWAYS AUTHORITY OF INDIA. versus HINDUSTAN CONSTRUCTION CO. LTD 2025 LiveLaw (Del) 1330 M/S H...

GST | Assessee Entitled To Copy Of Seized Electronic Data Unless Prejudicial To Investigation: Delhi High Court

The Delhi High Court has made it clear that an assessee is entitled to copies of the data stored on its electronic devices which are seized by the GST Department, unless the same is prejudicial to the probe.A division bench of Justices Prathiba M. Singh and Shail Jain observed,“A perusal of Section 67(5) of the CGST Act clearly shows that copies of the seized data cannot be denied to...

Delhi High Court Directs Customs To Ensure Strict Implementation Of Minimum Import Price On Soda Ash

The Delhi High Court has directed the Customs authorities to ensure strict implementation of the Minimum Import Price (MIP) imposed by DGFT on Soda Ash, warning of stringent action in case of any violations.A division bench of Justices Prathiba M. Singh and Shail Jain gave “clear directions to all the Customs Authorities…to ensure that the Notification No. 46 of 2024-25 along...

S.107 GST Act | Taxpayer Can't Ignore Order Merely Because Copy Was Illegible: Delhi High Court

The Delhi High Court has made it clear that a taxpayer cannot ignore an order passed against it and uploaded on the GST portal, merely because copy of the order was allegedly illegible.A division bench of Justices Prathiba M. Singh and Shail Jain thus refused to condone the taxpayer's delay in filing appeal against a GST demand order merely on the ground that the order supplied to it...

'Don't Blindly Trust AI'; Bombay High Court Quashes Income Tax Assessment Passed On Unverified AI-Generated Case Laws

The Bombay High Court has quashed an income tax assessment after noting that the Assessing Officer had relied upon non-existent, AI-generated case laws while passing the assessment order. The Court stated that in the era of Artificial Intelligence, the tax authorities cannot blindly rely on such AI-generated results. AI-generated case laws must be cross-verified before using them...

Unsigned GST Demand Order Valid If Accompanied By DRC-07 Bearing Officer's Details: Delhi High Court

The Delhi High Court has held that an unsigned GST demand order is valid, if the same is accompanied by DRC-07 which contains the details of the official who passed the order.DRC 07 is a summary of the demand order issued by the proper officer, to be uploaded on GST Portal, specifying the amount of tax, interest or penalty payable.A division bench of Justices Prathiba M. Singh and Shail Jain...

FERA | ED Can Seize Indian Currency Intended For Illegal Purchase Of Foreign Exchange: Delhi High Court

The Delhi High Court has made it clear that Indian currency can be seized by the Enforcement Directorate under provisions of the erstwhile Foreign Exchange Regulation Act, 1973, if the same is intended to be used for illegal purchase of foreign exchange.FERA, 1973 was enacted to regulate the inflow and outflow of foreign exchange in India, and to prevent hoarding of foreign currency. The...

Delhi High Court Restrains Entity From Infringing Tata's Vivanta Trademark

The Delhi High Court has restrained an entity from infringing the trademark of Tata Group's Indian Hotels Company Limited which runs and operates hotel brand 'Vivanta'.Justice Manmeet Pritam Singh Arora passed an ad-interim injunction restraining the use of 'Vivanta Stays' or any other mark deceptively similar to Vivanta.The development comes in a trademark infringement suit preferred...

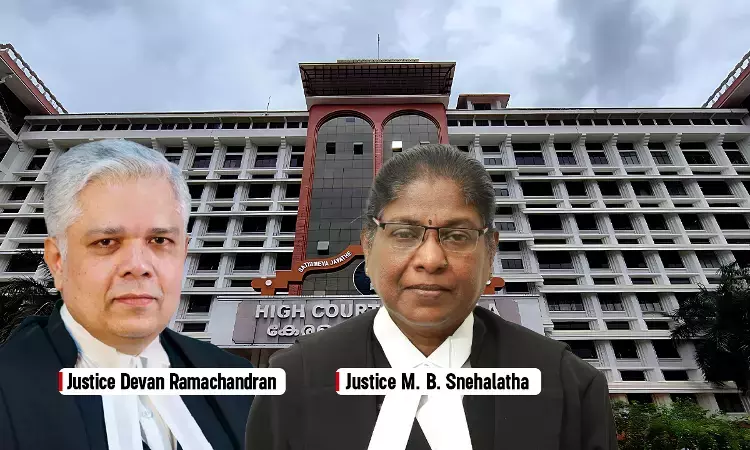

NHAI Concessionaires Holding Work Orders Prior To March 2024 Don't Need Environmental Clearance For Earth Extraction: Kerala High Court

The Kerala High Court held that the National Highway Authority of India (NHAI) concessionaires holding valid work orders issued prior to March 21, 2024, do not need to obtain separate Environmental Clearance (EC) for extraction, sourcing, or borrowing of ordinary earth for linear projects such as roads and pipelines.The division bench comprising Justice Devan Ramachandran and Justice M...

Employees Can Only Be Reverted To Immediate Lower Post From Which They Were Promoted, Not To Lowest Post: Chhattisgarh HC

A Division bench of the Chhattisgarh High Court comprising Justice Sanjay K. Agrawal and Justice Radhakishan Agrawal held that an employee can only be reverted to the immediate lower post from which they were promoted and reverting them to a post lower than that is unsustainable and bad in law. Background Facts The petitioner was initially appointed as a Technician Grade–III in...