High Courts

Writ Petition Can't Be Entertained Seeking Deletion Of Deceased's Name From Record Of Rights, Tahasildar Enquiry Needed: Orissa High Court

The Orissa High Court has held that a writ petition seeking deletion of deceased person's name from Record of Rights (RoR) cannot be entertained as an enquiry by the jurisdictional Tahasildar is a necessary precondition before replacing a deceased person with his legal representatives.Clarifying the jurisdictional issue, the Bench of Justice Ananda Chandra Behera held –“It is the...

Civil Judge Can't Authenticate Talaq, Grant Decree Dissolving Muslim Marriage; Family Court Is Competent Forum: Gauhati High Court

The Gauhati High Court has held that civil judge does not have the jurisdiction to authenticate dissolution of a Muslim marriage in the form of talaq and grant a declaratory decree of divorce and the competent court would be the Family Court or the District Court in the absence of family court.In doing so the high court upheld an order of Civil Judge (senior division) which had dismissed...

Banks Move Bombay High Court Challenging Stay Of 'Fraud' Classification Proceedings Against Anil Ambani

In what could spell trouble for industrialist Anil Ambani, three banks - Bank of Baroda, Indian Overseas Bank and the IDBI Bank have moved the Bombay High Court challenging the order of a single-judge, who had stayed fraud classification proceedings initiated by the three banks, against the founder and chairman of the Reliance Group, after prima facie finding 'serious defects' in the...

Advocate-Client Privilege | Court Can't Compel Lawyers To Reveal Source Of Documents Filed On Client's Instructions: Delhi High Court

The Delhi High Court has held that a lawyer cannot be compelled to disclose the source of document given by the client as it falls within privileged communication, without there being any prima facie judicial finding of fraud. Justice Neena Bansal Krishna said that when a client hands over a document to their lawyer for legal defense, such an act regarding origin of the document is part of...

Jammu & Kashmir And Ladakh High Court Weekly Roundup: January 5 - January 11, 2026

Nominal Index:Saleema & Ors Vs UT Of J&K 2026 LiveLaw (JKL) 1STATE OF J & K vs NAZIR AHMAD BHAT AND OTHERS 2026 LiveLaw (JKL) 2State of Jammu and Kashmir vs Ahsan-ul-Haq Khan 2026 LiveLaw (JKL) 3Lt. Col. Daljit Singh Dogra vs State of J&K 2026 LiveLaw (JKL) 4Bharat Oil Traders Vs Assistant Commissioner & anr 2026 LiveLaw (JKL) 5Rishi Kumar vs Chenab Valley Power Projects...

No Travel Restrictions In Bail Order : Allahabad HC Directs Trial Court To Grant Passport NOC To Dancer Sapna Choudhary

The Allahabad High Court (Lucknow Bench) last week set aside a lower court order that refused to grant a 'No Objection Certificate' (NOC) to popular Actor-Dancer and stage performer, Sapna Choudhary, for the renewal of her passport. Allowing her application filed under Section 482 CrPC, a bench of Justice Pankaj Bhatia directed the trial court to issue an NOC to her for renewal. The Court...

Misuse Of Court Live-Stream: Madhya Pradesh High Court Directs YouTube, Instagram To Block Offending URLs

While hearing a PIL alleging misuse of live-streamed court proceedings through reels, clips and memes, the Madhya Pradesh High Court, on Monday (January 12), directed the concerned platforms, YouTube and Instagram, to block access to the offending URLs within 48 hours. The division bench of Chief Justice Sanjeev Sachdeva and Justice Vinay Saraf directed; "By IA 24384/2025, the petitioner...

Delhi High Court Takes Suo Motu Cognisance Of Patients, Attendants Sleeping Outside Hospitals Amid Cold Wave

The Delhi High Court on Monday took suo motu cognisance of the “pitiable conditions” of patients, attendants and family members forced to sleep outside city hospitals in the biting winter cold due to lack of shelter.A division bench comprising Justice C Hari Shankar and Justice Om Prakash Shukla took cognizance of a newspaper report published in The Hindu on January 11. The report is...

Can Police Approve Gang Charts Without DM? Allahabad High Court Flags 'Unfettered' Discretion In Commissionerate System; Summons ACS

In a stinging rebuke to the UP Govt regarding the implementation of the Uttar Pradesh Gangsters and Anti-Social Activities (Prevention) Act, 1986, the Allahabad High Court recently issued a show-cause notice to the Additional Chief Secretary (Home).A bench of Justice Vinod Diwakar has directed the top bureaucrat to explain the repeated failure of the Home Department to provide justification...

SARFAESI | Borrower's Right Of Redemption Ends On Publication Of Sale Notice, Not On Completion Of Sale: J&K&L High Court

Emphasising the transformative impact of the 2016 amendment to the SARFAESI Act, the Jammu and Kashmir and Ladakh High Court has held that a borrower's right of redemption no longer survives till the completion of sale and instead stands extinguished on the date of valid publication of the notice of sale.A Division Bench of Justice Sanjeev Kumar and Justice Sanjay Parihar made it clear that...

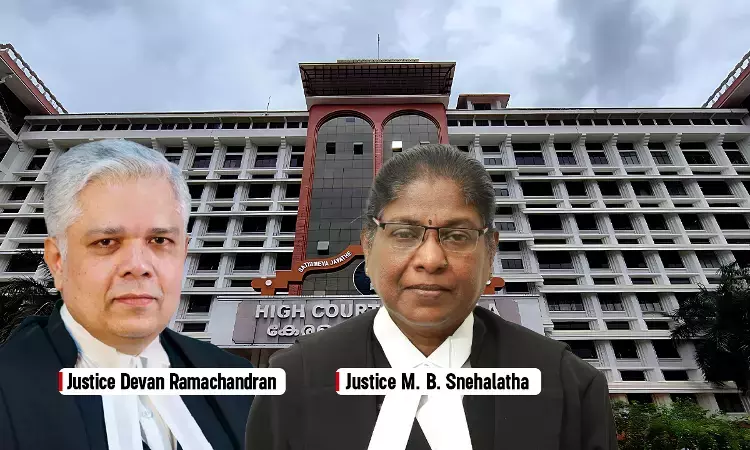

Suraj Lama Missing Case: Kerala High Court Expresses Displeasure Over Delay In Forensic Identification

The Kerala High Court on Monday (12 January) granted two weeks time to the Forensic laboratory, Thiruvananthapuram to examine the body recovered from Kalamassery, suspected to be that of Suraj Lama— an Indian citizen deported from Kuwait who allegedly went missing after landing at Kochi International Airport.A Division Bench comprising Justice Devan Ramachandran and Justice M B Snehalatha...

Madhya Pradesh High Court Weekly Roundup: January 05 - January 11, 2026

Citations: 2026 LiveLaw (MP) 3 to 2026 LiveLaw (MP) 8Nominal Index Rakesh Verma v State of Madhya Pradesh 2026 LiveLaw (MP) 3Vickramh Kkalmady v State of Madhya Pradesh 2026 LiveLaw (MP) 4Naresh Chandra Agrawal v. Income Tax Department & Ors. 2026 LiveLaw (MP) 5Anil Kumar Mishra v State of Madhya Pradesh 2026 LiveLaw (MP) 6SM v State 2026 LiveLaw (MP) 7Maharaj Singh Yadav v State of...