High Courts

Rajasthan HC Directs IDBI Bank To Refund ₹58 Lakh To Victim Of Cyber Crime, Directs Action Against Those Selling Customer's Data

Granting relief to a victim of digital fraud who lost Rs. 58 Lakh from his IDBI bank account due to unauthorized electronic transactions, the Rajasthan High Court directed the bank to refund the entire amount with interest in view of the “Zero Liability” direction by RBI in its July 6, 2017 circular.As per the Circular, in the event of any unauthorized transactions in anyone's bank...

Treadmills & Other Gym Equipment Qualify As 'Sports Goods' Under Entry 60 Of A.P. VAT Act: Andhra Pradesh High Court

The Andhra Pradesh High Court has held that while treadmills, dumbbells, rotators and fit-kit exercise kits, cannot be associated with one specific sport, these equipment are nonetheless used by sports persons to maintain physical fitness and thus fall in the description of “sports goods”.While allowing a writ petition of a dealer of gym equipment who contended that such equipment related...

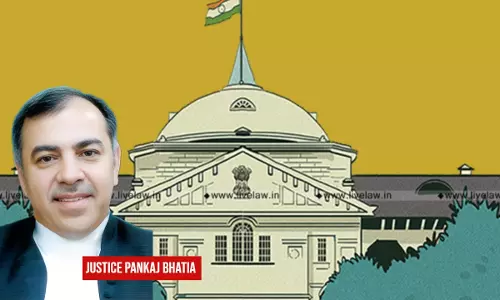

Under Trial Must Obtain Permission From Court To Travel Abroad Prior To Applying For Issue/ Re-Issue/ Renewal Of Passport: Allahabad HC

The Lucknow Bench of the Allahabad High Court has held that an under trail must obtain permission for travelling abroad from the Court concerned prior to applying for issue, re-issue or renewal of passport before the passport authority.The bench of Justice Rajan Roy and Justice Om Prakash Shukla held “A plain reading of the provisions of Passport Act, 1967 and the beneficial Notification...

Rights Conferred By Hindu Succession Act Prevail Over Rights Claimed By Nominee U/S 39(7) Of Insurance Act: Allahabad High Court

The Allahabad High Court has held that Hindu Succession Act, 1956 prevails over the Insurance Act, 1938 as the rights guaranteed to the successor under the former cannot be defeated by the rights guaranteed to the nominee under the latter enactment.While dealing with the claim of the mother-nominee over the insurance money of her deceased daughter against the rights of the daughter of...

Bombay HC Orders Woman To Give Voice Sample To Verify Husband's Claim About Extra-Marital Affair, Says Magistrate Has Power Under DV Act

If there is adequate material on record, a person can be compelled to give voice samples, even in Domestic Violence cases, the Aurangabad bench of the Bombay High Court recently held while allowing a husband's appeal seeking a direction to his wife to provide her voice sample so as to prove her 'extra-marital' affair. Single-judge Justice Shailesh Brahme order a woman to provide her...

Rajasthan HC Retains Sexual Harassment Charge Against Man For Showing Adult Videos To Child, Says Intent To Be Assumed When Harassment Is Proved

Rajasthan High Court ruled that comprehensive reading of Sections 11 and 30 of POCSO Act reflected that in prosecution for sexual harassment, the Special Court was mandated to presume existence of the sexual intent once the prosecution had proved commission of the act constituting sexual harassment.These observations were given by Justice Manoj Kumar Garg while hearing a revision petition...

J&K High Court Cancels Advocate's License After 16 Years Over Fake LL.B Degree

The Jammu and Kashmir High Court has cancelled the enrollment of Advocate Sajad Ahmad Shah, nearly 16 years after he began practicing law, upon discovering that he had obtained his license based on a fake and forged LL.B degree.Shah who is resident of Srinagar, was enrolled with the Bar Council of Jammu and Kashmir and his name was subsequently entered into the Roll of Advocates in...

When Does Lis Pendens Cease To Operate? Bombay High Court Re-Examines S.52 Of Transfer Of Property Act Post-Alienation

The Bombay High Court while re-visiting Section 52 of the Transfer of Property Act has clarified the circumstances under which the Lis Pendens ceases to operate.The Bench of Justice Sharmila U. Deshmukh observed that “Post alienation by way of sale or surrender, the immovable properties are no longer available for distribution and what remains is money claim based on accounts and valuation...

Sambhal Row | 'Juma Mosque A Centrally Protected Monument, It Isn't A Religious Place Or Public Worship Site': ASI To Allahabad HC

The Allahabad High Court on Tuesday reserved orders on a revision plea filed by the Shahi Jama Mosque Committee at Chandausi (Sambhal), challenging the trial court's order dated November 19, which directed the appointment of an Advocate Commissioner to survey the mosque premises in a suit claiming that the mosque was built after demolishing a temple. A bench of Justice Rohit Ranjan...

Wife Leaving Job To Care For Child Not Voluntary Abandonment Of Work, Entitled To Maintenance: Delhi High Court

The Delhi High Court has held that a wife cannot be denied maintenance merely because she is qualified and was employed, if she was compelled to quit to take care of the child.Justice Swarana Kanta Sharma observed, “...the responsibility of caregiving to a minor child falls disproportionately upon the parent with custody, often limiting their ability to pursue full-time employment,...

High Court Asks Punjab Govt Not To Harass Congress MLA Pratap Singh Bajwa On Pretext Of Investigation Over “Active Bombs”Remark

The Punjab & Haryana High Court on Tuesday (May 13) asked Punjab Government authorities to not to harass Congress MLA and State's Leader of Opposition Pratap Singh Bajwa in the name of investigation.Bajwa was booked in an FIR for making allegedly remarking on a TV show that “50 bombs have reached Punjab”.Justice Tribhuvan Dahiya directed to ensure that the Bajwa is "not...

Rampant Misuse Of S.16 GST Act For Wrongful Availment Of ITC Will Create 'Enormous Dent' In GST Regime: Delhi High Court

The Delhi High Court has once again flagged concerns over rampant misuse of Section 16 of the Central Goods and Services Tax Act 2017 by traders, for wrongful availment of Input Tax Credit.The provision enables businesses to get input tax on the goods and services which are manufactured/ supplied by them in the chain of business transactions. It is meant as an incentive for businesses who...