High Courts

Can Suit For Infringement Lie Against Proprietors Of Registered Trademark? Delhi High Court Refers Issue To Larger Bench

The Delhi High Court has referred to a larger the following questions of law in relation to trademark infringement:“(i) Whether a suit for infringement can lie against the proprietor of a registered trademark, with respect to the use of such trademark? (ii) Whether, assuming such a suit can lie, the Court can pass any interlocutory order, injuncting the use, by the defendant, of the...

Whether Compensation Cess Is Leviable On Goods Supplied To Merchant Exporter: Gujarat High Court Asks GST Council To Decide

The Gujarat High Court has referred a matter to the GST Council to decide on whether the compensation cess is leviable on goods supplied to merchant exporter. The Division Bench of Justices Bhargav D. Karia and D.N. Ray observed that “……..no notification is issued by the Central Government or State Government under the Compensation Cess Act and therefore, the assessee...

Rights Of Prior User Prevail Over Registered Trademark Holder: Delhi HC Grants Interim Relief To German Society's Institutes In India

Reaffirming the principle that rights of prior user are superior to that of a proprietor holding a registered trademark, the Delhi High Court granted interim injunction in favour of Goethe-Institut, a German society which runs six educational institutes in India in the name of 'Max Mueller Bhavan', offering German language courses.Justice Mini Pushkarna restrained the use of 'Max...

'Unnatural Sex' With Wife A Punishable Offence, Marital Rape Exception Doesn't Apply To S. 377 IPC: Himachal Pradesh High Court

Himachal Pradesh High Court categorically disagreed with the Uttarakhand High Court's July 2024 judgment, which held that a husband cannot be prosecuted for unnatural sex with his wife under Section 377 of the IPC.

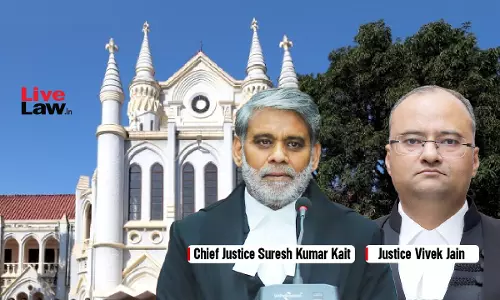

Irregularly Appointed Staff, If Confirmed, Can't Be Terminated Arbitrarily: MP High Court

Madhya Pradesh High Court: A division bench consisting of Justice Suresh Kumar Kait and Chief Justice Vivek Jain, reinstated a university employee terminated after over 25 years of service. The court ruled that his appointment was merely irregular and not illegal, and that subsequent confirmation of service had regularised his post. The court held that confirmed employees cannot...

Insurance Company Liable To Indemnify Driver If Premium For Accident Coverage Has Been Paid: Himachal Pradesh High Court

The Himachal Pradesh High Court dismissed an appeal by United India Insurance Co. Ltd., holding that although the 'Act only policy' in motor vehicle insurance covers only third-party damages and injuries but if the Insurance Company is charging premium for personal accident coverage of the driver, it is liable to indemnify the driver.Justice Satyen Vaidya: “Since the insurer has charged...

Person Involved In Minor Offences Should Not Be Deprived Of Appointment In State Services: Punjab & Haryana High Court

The Punjab and Haryana has held that persons involved in minor offences should not be deprived of the opportunity to serve in state services.The development comes while upholding the validity of a provision of the Punjab Police (Haryana Amendment) Rules, 2015, which denies appointment to candidates against whom the charges have been framed for offences punishable with imprisonment for three...

Lok Adalats Don't Have Inherent Power Of Review On Merits U/S 22D Legal Services Authorities Act: Kerala High Court

While hearing a Writ Petition before it, the Kerala High Court held that Section 22D of the Legal Services Authorities Act, 1987 does not grant the power of review on merits to Permanent Lok Adalats established under the Act.The Writ Petition was preferred challenging the decision of the Lok Adalat, which found that it does not have the power of review under Section 22D of the Act to...

No Objections U/S 47 Of CPC Can Be Moved By Judgment Debtor Against Execution Of Award U/S 36 Of A&C Act: Delhi High Court

The Delhi High Court Bench of Justice Jasmeet Singh has observed that a judgment debtor is not entitled to move objections under Section 47, CPC in an application for execution of award under Section 36, Arbitration and Conciliation Act, 1996 (“ACA”) as it would amount to effectively opening a second round for challenging the Award which would undermine the provision of section...

'Draconian': Punjab & Haryana High Court Slams Practice Of Opposing Bail When Accused Refuses To Testify Against Himself

"Opposing the release of an accused on bail solely because he refuses to testify against himself is a draconian practice that, in good conscience, cannot be allowed to continue unchecked by the Court", said the Punjab & Haryana High Court while allowing a pre-arrest bail in vehicle theft case.Justice Harpreet Singh Brar noted that in the status report filed by the State it has been...

Right To Promotion Not Conferred From Date Of Vacancy Unless Rules Permit Retrospective Effect: J&K HC Rejects Claim For Backdated Promotion

The High Court of Jammu & Kashmir and Ladakh has held that an employee has a right to be considered for promotion only when the employer takes up the matter for filling the promotional posts. The court ruled that merely because a promotional post exists does not confer a right to claim promotion from the date of its vacancy.“An employee cannot claim retrospective seniority or...

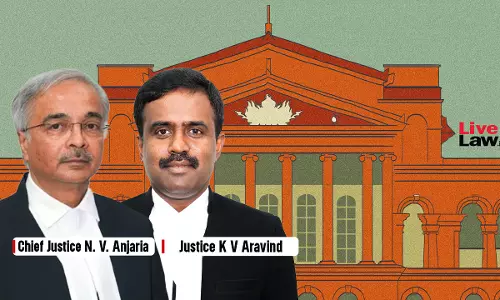

Once Parties Intend To Resolve Their Dispute By Arbitration, It Is Needless For Court To Decide Whether Partnership Was At Will: Karnataka HC

The Karnataka High Court bench of Chief Justice N. V. Anjaria and Justice K. V. Aravind has held that when both parties have agreed to resolve their disputes regarding the nature of the partnership through arbitration, it is unnecessary for the Court to determine whether the partnership is one "at will." Such issues are more appropriately left for adjudication by...