All High Courts

Dispute Arising From Sale Deeds Executed Between Partners As Part Of Business Arrangement Is Arbitrable: Kerala High Court

The Kerala High Court dismissed an appeal under Section 37 of the Arbitration and Conciliation Act, 1996 ("Arbitration Act") declining to interfere with an arbitral award dissolving a long-standing partnership and holding that the sale deeds executed between the partners were merely business arrangements, not intended to transfer or create title; consequently, the dispute did not...

Income Tax | Reopening Not Hit By Change Of Opinion If Earlier Proceedings Dropped Due To Lack Of Evidence: Calcutta High Court

The Calcutta High Court held that the mere reopening of an assessment under Section 148 of the Income Tax Act cannot be treated as a change of opinion if the earlier proceedings were dropped due to lack of evidence. Justice Raja Basu Chowdhury stated that on the basis of a change of opinion of the assessing officer, a notice under Section 148 of the said Act cannot be issued. For a...

S.153C Income Tax Act | Gujarat High Court Quashes Assessment Proceedings Citing 2-Yr Delay & Lack Of Date In 'Satisfaction Note'

The Gujarat High Court quashed a Section 153C Income Tax Act proceedings against a company after noting that the assessing officer's satisfaction note did not bear any date and that the note, though recorded in 2022 was "supplied" to the company only in 2024 i.e., after a delay of two years without any explanation. For context, Section 153C empowers the tax authority to assess the income of...

GST | Parallel Proceedings On Sanctioned Refund An 'Overstep': Orissa High Court Quashes Recovery Proceedings As Appeal Order Stands

The Orissa High Court in a matter concerning, Double Jeopardy on Refund of about Rs. 14 crores where recovery proceedings were initiated under Section 73 for Refund already sanctioned by the Appellate Authority, has quashed the Show Cause Notice for recovery. In a recent judgment, the Division Bench, comprising Chief Justice Harish Tandon and Justice Murahari Sri Raman, observed that...

No Interest On Excise Duty Payable In Revenue-Neutral Situation Even Though Duty Demand Attained Finality: Calcutta High Court

The Calcutta High Court held that statutory interest under Section 11AB of the Central Excise Act is not leviable where the entire transaction is revenue-neutral and the duty paid is available as Cenvat Credit to downstream units, causing no loss to the exchequer. Justices Rajarshi Bharadwaj and Uday Kumar stated that the Tribunal has recorded a clear finding that the situation...

Uttarakhand High Court Annual Digest 2025

NOMINAL INDEXWelham Boys' School Society & others Versus State of Uttarakhand & another 2025 LiveLaw (UTT) 1Javed Siddiqui and another Versus State of Uttarakhand and another 2025 LiveLaw (UTT) 2Bindiya Khatri and others. Versus State of Uttarakhand & others. 2025 LiveLaw (UTT) 3M/s SPDD VDPPL JV and another v. State of Uttarakhand and others 2025 LiveLaw (UTT) 4Madhuri Joshi...

Order Deciding Director's Authority Is Not An Arbitral Or Interim Award, Not Open To Section 34 Challenge: Karnataka High Court

The Karnataka High Court has held that an order passed by an arbitral tribunal deciding a preliminary or a factual issue such as whether the directors were authorised to execute agreements does not amount to an arbitral award or an interim award and therefore cannot be challenged under section 34 of the Arbitration and Conciliation Act, 1996 ("Arbitration Act"). A Division...

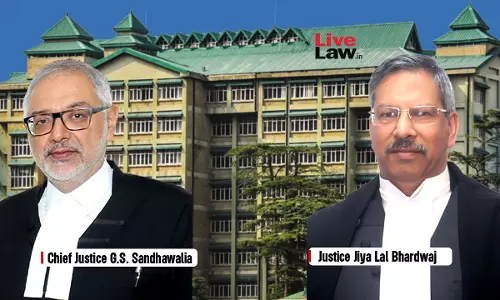

Discharge During Probation Not Punitive Merely Due To Pending Criminal Case: Himachal Pradesh High Court Dismisses Peon's Plea

The Himachal Pradesh High Court dismissed a writ petition filed by Faqeer Chand, who challenged his discharge from service during the period of probation while working as a Peon in the establishment of the High Court.The Court held that the impugned order was a discharge, passed in accordance with the terms of appointment and service rules, and did not amount to a punitive or...

Bombay High Court Holds Emergency Hearing From CJ's Residence After Court Staff Asked To Perform Election Duty

On Tuesday late evening, the Bombay High Court held an "emergency" hearing at the residence of the Chief Justice after it was informed about the Brihanmumbai Municipal Corporation (BMC) Commissioner issuing a communication to the staff of the city's subordinate courts directing them to report for "election duty" on December 30 for 2 hours in the evening.May it be noted that the High Court...

Delhi High Court Annual Digest 2025: Part I [Citations 1 - 450]

Citations 2025 LiveLaw (Del) 1 to 2025 LiveLaw (Del) 450Delhi High Court Directs Medical Treatment For HIV Positive Trans Woman Without Insisting On ID ProofTitle: ABC v. UNION OF INDIA AND ORSCitation: 2025 LiveLaw (Del) 1The Delhi High Court has directed Lok Nayak Hospital to provide medical treatment for a trans woman who tested HIV positive, without demanding from her...

“Prosecutrix Step By Step Made Improvements In Her Version”: HP High Court Upholds Acquittal In Rape And Criminal Intimidation Case

Himachal Pradesh High Court upheld acquittal of an accused in rape and criminal intimidation case, holding that that the testimony of the prosecutrix did not inspire confidence, as it was full of material contradictions and made improvements at every stage of the proceedings.The Court further remarked that the prosecutrix exaggerated her version over time, which made it impossible to rely on...

TP Chandrasekharan Murder Case: Kerala High Court Denies Parole To Life Convict To Conduct Funeral Rites Of Cousin

The Kerala High Court on Tuesday (December 30) refused to grant emergency leave to Jyothi Babu, one of the convicts in the T.P. Chandrasekharan murder case, to conduct the funeral rites of his cousin.T.P. Chandrasekharan, leader of the Revolutionary Marxist Party (RMP), was murdered due to political rivalry on May 4, 2012. Babu was convicted of the murder and is presently undergoing...

![Delhi High Court Annual Digest 2025: Part I [Citations 1 - 450] Delhi High Court Annual Digest 2025: Part I [Citations 1 - 450]](https://www.livelaw.in/h-upload/2025/12/30/500x300_643671-delhi-hc-annual-digest-2025.webp)