All High Courts

Kerala HC Sets Aside Rule To Levy Additional Fee For Buildings Exceeding 3000 Sq Feet On Land Falling Under Conservation Of Paddy Land & Wetland Act

The Kerala High Court has declared Rule 12(9) of the Kerala Paddy Land and Wetland Rules framed under the Kerala Conservation of Paddy Land and Wetland Act, 2008 levying a fee for the area of a building exceeding 3000 square feet proposed in lands falling under the Act as ultra vires.Justice Mohammed Nias C. P. directed that no such fee shall be demanded from the petitioners while considering...

Compounding Of Offences Allowed Under IT Act, HC's Inherent Jurisdiction U/S 482 CrPC Cannot Be Invoked For Quashing: Orissa HC

The Orissa High Court has refused to entertain a petition filed for quashing the offence under Sections 276(B) of the Income Tax Act, 1961, stating that the Petitioner-accused should have sought compounding of the offence. Justice Sibo Sankar Mishra observed, “In the present regime, where the compounding of the offence is permissible, the jurisdiction of this Court under...

Appointment Of Second Commissioner Without Assigning Reasons Violates Order 26 Rule 10(3) CPC: Jharkhand High Court

The Jharkhand High Court in a recent ruling has emphasized that appointing a second Pleader Commissioner without assigning reasons for ignoring the report of the first Commissioner violates the provisions of Order 26, Rule 10(3) of the Civil Procedure Code (CPC) and is to be condemned.Justice Sanjay Kumar Dwivedi, presiding over the case, criticized the lower court's decision, stating,...

Patna High Court Annual Digest 2024

Nominal Index [Citations: 2024 LiveLaw (Pat) 1-133]Ajay Kumar Mahto vs The State of Bihar and Ors 2024 LiveLaw (Pat) 1M/s Flipkart Internet Pvt vs The State of Bihar and Ors 2024 LiveLaw (Pat) 2Ravi Shankar and Anr vs The State of Bihar and Ors 2024 LiveLaw (Pat) 3M/s Nav Nirman Construction vs The Union of India & Ors 2024 LiveLaw (Pat) 4Urmila Devi Jain & Ors vs. Ashok Kumar &...

Staying Criminal Proceedings Pending For 34 Yrs, Allahabad HC Seeks Affidavit From UP Govt Officials On State's Litigation Policy

On Friday, the Allahabad High Court stayed the entire criminal proceedings in a 34-year-old case against a man accused of rioting, taking into account the inordinate delay caused by the State/prosecution in concluding the case. A bench of Justice Saurabh Lavania also directed the Uttar Pradesh government's Director General (Prosecution) and Additional Chief Secretary (Home Department)...

Delhi High Court Weekly Round-Up: January 06 To January 12, 2025

Citations 2025 LiveLaw (Del) 8 to 2025 LiveLaw (Del) 27NOMINAL INDEXBonanza Enterprises v. The Assistant Commissioner Of Customs & Anr. 2025 LiveLaw (Del) 8 Aditya Kumar Mallick vs Union of India and Anr. 2025 LiveLaw (Del) 9 Mr. Pawan Gupta & Anr. vs. Miton Credentia Trusteeship Services Limited & Ors. 2025 LiveLaw (Del) 10 Akhil Bhartiya Dharma Prasar Samiti v. UOI & Ors...

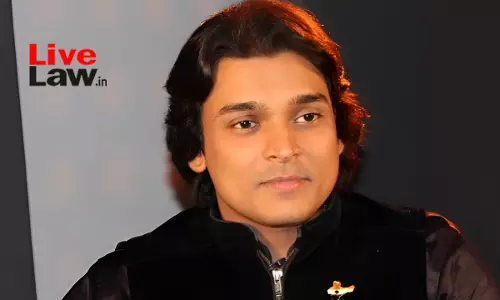

Rahul Easwar Moves Kerala HC Seeking Anticipatory Bail In Complaint Filed By Actress

Rahul Easwar moves Kerala High Court seeking anticipatory bail in the complaint registered by Malayalam movie actress.Reportedly, Rahul Easwar made adverse comments against the dressing style of the actress while discussing the Boby Chemmanur case in news channel debates. Boby Chemmanur is currently in judicial custody in the case of sexual harassment filed by the actress.The actress through...

Karnataka High Court Permits Bangalore University To Conduct B.Com Examination As Per Original Scheduled From Jan 13

The Karnataka High Court, stayed the interim order passed by a Single judge bench, directing the Bangalore University to reschedule the B.Com examination of the first, third and fifth semesters that were scheduled to be held on 13.01.2025, 15.01.2025, 17.01.2025, 20.01.2025 and 21.01.2025. The single bench issued the direction in view of the schedule of the CA foundation examination and...

Date Of Receipt Of Corrected Award Would Be Taken As Disposal Date U/S 34(3) Of Arbitration Act, Even When Application U/S 33 Has Been Filed: Delhi HC

The Delhi High Court Bench of Justice Subramonium Prasad has held that taking the date of receipt of the corrected award as the starting point and not as the date of disposal would actually go contrary to the plain reading of Section 34(3) of the Act. This will apply even in cases where an application under Section 33 of the Act has been filed. Brief Facts: The parties entered into...

'Recovery Of Excess Amount From Retired Employee For Period More Than Five Years Before Order Of Recovery Is Impermissible', Patna High Court

A Division Bench of the Patna High Court comprising Justice Arvind Singh Chandel allowed a Petition challenging an Order of Recovery from a Retired Clerk who was paid an excess amount due to alleged wrong pay fixation. The Court reiterated that the recovery of excess amount paid by mistake is not permissible in cases where the recovery is made in case of employees belonging to...

Income Tax Act | Reassessment Notice To Merged Entity U/S 148A(d) Not Invalid Merely Because SCN Was Issued In Name Of Ceased Entity: Delhi HC

The Delhi High Court has made it clear that merely because notice under Section 148A(b) of the Income Tax Act, 1961 is issued in the name of an amalgamating company which had ceased to exist, subsequent notice issued under Section 148A(d) in the name of merged entity cannot be declared invalid. A division bench of Acting Chief Justice Vibhu Bakhru and Justice Swarana Kanta...

AO Bound To Ascertain 'Correctness' Of Information Available Against Assessee, 'Decide' Whether It Is Sufficient To Reopen Assessment: Delhi HC

The Delhi High Court has turned down the contention that an Assessing Officer, at the stage of passing an order under Section 148A(d) of the Income Tax Act, 1961 for initiation of reassessment proceedings, is not required to form any opinion as to the genuineness or veracity of the information available against an assessee. A division bench of Acting Chief Justice Vibhu Bakhru...