Bombay High Court

Accusing Husband Of Extra-Marital Affair, Insulting Him In Front Of Friends Is Cruelty: Bombay High Court

The conduct of a wife refusing to have a physical relationship with her husband and accusing him of having an extra-marital affair, while insulting him in front of his friends, will amount to cruelty to the husband, the Bombay High Court held on Thursday. A division bench of Justices Revati Mohite-Dere and Dr Neela Gokhale also said that the wife insulting the husband in front of his friends...

Bombay High Court Rejects PIL Accusing Global Fashion Giant PRADA Of Copying "Kolhapuri Chappals"

The Bombay High Court on Wednesday (July 16) dismissed a Public Interest Litigation (PIL) seeking a restraining order against global fashion giant PRADA from commercializing and using "toe ring sandals" which is alleged to be deceptively similar to the GI tagged "Kolhapuri Chappal" without authorisation. In doing so the court observed that the proprietors who had been granted GI registration...

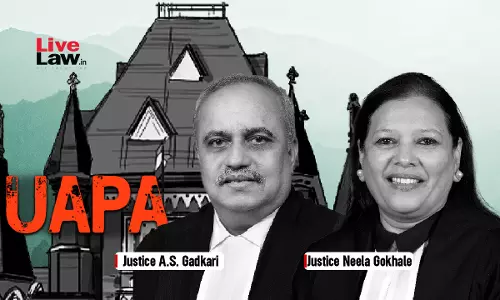

Bombay High Court Dismisses Plea Challenging Constitutionality Of UAPA, Sedition Offence

The Bombay High Court on Thursday dismissed the petitions challenging the constitutional validity of the Unlawful Activities (Prevention) Act (UAPA) and also of the section 124A (sedition) of the Indian Penal Code (IPC).A division bench of Justices Ajay Gadkari and Dr Neela Gokhale while pronouncing their judgment today said, "The UAPA in its present form is constitutionally...

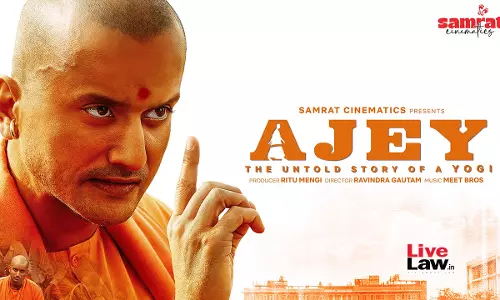

'Will Decide On Certification In Two Days': CBFC Tells Bombay High Court In Plea By Makers Of Film Based On Yogi Adityanath

The Central Board for Film Certification (CBFC) on Thursday told the Bombay High Court that it will decide within two working days on a plea for certification by makers of a movie titled "Ajey: The Untold Story of a Yogi." The makers of the movie had approached the High Court seeking a direction to decide their application for certification as soon as possible.A division bench of Justices...

'Elephants' Right To Quality Life Prevails Over Its Use For Religious Customs': Bombay High Court

In a conflict between the 'right to quality life' of an animal and the right of humans to use the animals, particularly elephants for religious rites, the former must be considered, held the Bombay High Court on Wednesday (July 16) while allowing the transport of an elephant - Mahadevi, from Maharashtra's Kolhapur district to an elephant sanctuary in Gujarat's Jamnagar district. A division...

Collector Can Review Its Administrative Orders Even Without Express Provisions Conferring Such Power: Bombay High Court

The Bombay High Court has held that the Collector has inherent power to review administrative orders even in the absence of an express statutory provision, so long as the decision relates to administrative, not quasi-judicial, functions. The Court upheld a 2013 order restoring the names of two partners in a country liquor licence, which had earlier been deleted after the death of the...

'Reservation In PSU Contracts For SC/ST Contractors Does Not Violate Article 14': Bombay High Court Upholds BPCL Tender Conditions

The Bombay High Court has upheld the validity of Bharat Petroleum Corporation Ltd.'s (BPCL) tender conditions that provide for reservations and concessions to Scheduled Caste (SC) and Scheduled Tribe (ST) bidders in petroleum transport contracts, holding that affirmative action need not be restricted to public employment alone.A division bench of Chief Justice Alok Aradhe and Justice Sandeep...

Party Cannot Be Compelled To Undergo Medical Examination To Facilitate Adversary In Proving Case: Bombay High Court

The Bombay High Court has rejected a request to conduct a medical examination of the elderly woman defendant on the ground that the Court cannot direct a party to undergo a medical examination unless the Court finds it absolutely necessary to determine the core question in controversy. The Court held that when there are serious disputes and conflicting allegations over a defendant's...

Direction Of Disclosure Or Attachment Of Assets Cannot Be Passed Against A Person Who Is Not A Party To The Arbitral Award: Bombay HC

The Bombay High Court has held that a foreign arbitral award cannot be enforced against a person who was not a party to the arbitration proceedings. It ruled that forcing such a person to disclose assets or face coercive enforcement would be without jurisdiction under Part II of the Arbitration and Conciliation Act, 1996.Justice Somasekhar Sundaresan passed the ruling while allowing two...

Bombay High Court Refuses To Entertain PIL Against Bullock Cart Racing In Maharashtra

The Bombay High Court on Tuesday dismissed a Public Interest Litigation (PIL) objecting to the bullock cart racing in Maharashtra on the ground that before the race, the animals are subjected to cruelty.A division bench of Justices Alok Aradhe and Sandeep Marne noted that the issue has already been decided by the Constitution bench of the Supreme Court by a judgment pronounced on May 18,...

Makers Of Film On Yogi Adityanath Move Bombay High Court Over Delay In Certification

The makers of the film "Ajey: The Untold Story of a Yogi" have moved the Bombay High Court against the 'arbitrary' and 'unexplained' delay on the part of the Centra Board of Film Certification (CBFC) in deciding its application for certification of the film, which is slated to release on August 1.A division bench of Justices Revati Mohite-Dere and Dr Neela Gokhale issued notice on the plea...

Bombay High Court Protects Singer Sonu Nigam's Right To Privacy, Directs Lawyer Sonu Nigam Singh To Use His Full Name In 'X' Account

Observing that the right of the citizens to free speech is not an 'unbridled' one, the Bombay High Court last week, while protecting the 'privacy' of Bollywood playback singer Sonu Nigam, directed a lawyer not to use 'Sonu Nigam' as the display name of his account on social media platform X (formerly Twitter).Single-judge Justice Riyaz Chagla asked the lawyer from Bihar, to use his full...