Bombay High Court

Bombay High Court Refuses To Entertain PIL Against Rahul Gandhi Over Remarks On Savarkar

The Bombay High Court on Tuesday (July 15) refused to entertain a PIL seeking directions to Congress leader Rahul Gandhi to stop ignoring the contribution of right-wing leader Vinayak Savarkar to the freedom struggle.A division bench of Chief Justice Alok Aradhe and Justice Sandeep Marne noted that the Supreme Court had dismissed a similar petition filed by the same petitioner - Pankaj...

'Stop Being So Sensitive': Bombay High Court Slams Influencer For Seeking FIR Against Farah Khan For Allegedly Hurting Hindu Sentiments

The Bombay High Court on Tuesday (July 15) slammed social media influencer Vikas Phatak aka Hindustani Bhau seeking registration of FIR against Bollywood filmmaker Farah Khan for allegedly hurting sentiments of Hindus, orally questioning if he had filed the plea to garner publicity. The court further orally asked the petitioner to stop being so sensitive and told him not to burden the...

Bombay High Court Clears Way For Passenger Jetty Near Gateway Of India; Rejects Colaba Residents' Plea

The Bombay High Court today dismissed the petitions filed by residents of Colaba, challenging the construction of a Jetty facility in South Mumbai, near Radio Club and adjacent to the iconic Taj Mahal Palace Hotel and near the Gateway of India.A division bench of Chief Justice Alok Aradhe and Justice Sandeep V. Marne thus upheld the validity of the decision of the Maharashtra Government and...

Bombay HC Directs Amazon To Comply With Arbitral Tribunals' Interim Orders, Delist All Victorinox Products Being Sold By Ex-Dealer

The Bombay High Court has directed Amazon Seller Services Pvt. Ltd. to immediately delist all Victorinox-branded products being sold by its former dealer, Gute Reise India Pvt. Ltd., in compliance with an arbitral tribunal's interim order. The Court held that online platforms must act swiftly to enforce tribunal directions.Justice Somasekhar Sundaresan was hearing an urgent commercial...

Suit Cannot Be Dismissed On Grounds Of Res Judicata Without Giving Party An Opportunity To Respond: Bombay High Court

The Bombay High Court has ruled that the bar of res judicata under Section 11 of the Civil Procedure Code (CPC) cannot be invoked for the first time in a final judgment without framing an issue or giving parties an opportunity to respond. It has set aside a single judge's judgment that dismissed a suit invoking res judicata at the decree stage without prior notice.A division bench of...

Marriages 'Sacrosanct' In Hindus But Misuse Of Domestic Violence Act A Menace, Courts Must Encourage Settlement: Bombay High Court

The Bombay High Court recently while quashing a section 498A IPC case against a family observed that marital discords have now-a-days become a menace in the society and that because of the two persons fighting over petty issues, the concept of marriage, which is 'sacrosanct' for Hindus is suffering a setback. A division bench of Justices Nitin Sambre and Mahendra Nerlikar noted the 'trend'...

Courts Cannot Mandate Retrospective Correction Of Errors In Legislation: Bombay High Court

The Bombay High Court has held that courts cannot issue writs directing the legislature to correct alleged “clerical errors” in enacted laws or to give retrospective effect to legislative changes. It held that even if a change in the customs tariff is perceived as corrective or clarificatory, granting retrospective effect to such changes falls exclusively within the legislative...

Bombay High Court Weekly Round-Up: July 7 - July 13

Nominal Index [Citations: 2025 LiveLaw (Bom) 259 to 2025 LiveLaw (Bom) 280]Sujal Mangala Birwadkar vs State of Maharashtra, 2025 LiveLaw (Bom) 259UNS Women Legal Association (Regd) vs Bar Council of India, 2025 LiveLaw (Bom) 260Bharat Petroleum Corporation Ltd. vs Assistant Commissioner of Income Tax, 2025 LiveLaw (Bom) 261Srinwati Mukherji vs State of Maharashtra, 2025 LiveLaw (Bom)...

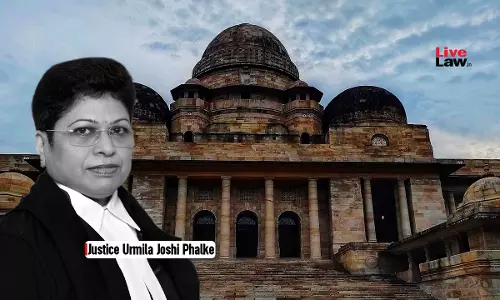

Right To Life Cannot Be Denied To Suspect, Obligation Of State & Courts To Ensure It Is Not Violated: Bombay High Court

The guarantee of 'right to life and liberty' cannot be denied to a suspect who is sought to be made an accused on an investigation and it is the obligation of the State and also of the Courts to ensure that there is no infringement of this 'indefeasible' right, the Nagpur bench of the Bombay High Court held on Friday. Single-judge Justice Urmila Joshi-Phalke, while granting bail to a...

Bombay High Court Weekly Round-Up June 23 - June 29

Nominal Index [Citations: 2025 LiveLaw (Bom) 231 to 2025 LiveLaw (Bom) 243]Shireen Jamsetjee Jejeebhoy vs Jamsheed Mehli Poncha, 2025 LiveLaw (Bom) 231Sudhir Brijendra Jain vs Rajendra Dhedya Gavit, 2025 LiveLaw (Bom) 232ABC vs State of Maharashtra, 2025 LiveLaw (Bom) 233Chetan Ahire vs Union of India, 2025 LiveLaw (Bom) 234Union of India Through The General Manager Central Railway vs PLR HC...

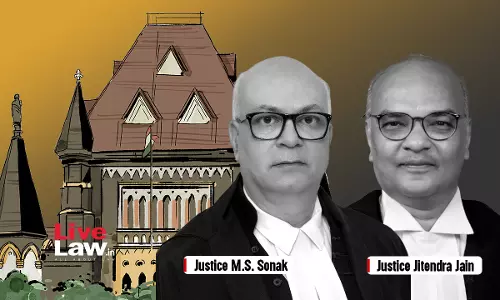

GST Order Can't Be A Copy-Paste Of Showcause Notice, Independent Reasoning Must Be Present: Bombay High Court

The Bombay High Court held that a GST order can't be a copy-paste of the show cause notice and that independent reasoning must be present. Justices M.S. Sonak and Jitendra Jain stated that “simply cutting and pasting the allegations in the show cause notice or mechanically reciting them verbatim does not inspire confidence that due consideration has been shown to the cause, and...

Major Relief For Anil Ambani As Canara Bank Withdraws Order Classifying Reliance Comm Loan Account As 'Fraud'

In a relief for industrialist Anil Ambani, the Canara Bank recently informed the Bombay High Court that it has 'withdrawn' its order classifying his loan account, related to Reliance Communications, as "fraudulent account."A division bench of Justices Revati Mohite-Dere and Dr Neela Gokhale accepted the statement and disposed of the petition filed by Ambani challenging the validity of the...