Gujarat High Court

S.148A Income Tax Act | Gujarat High Court Quashes Reopening Of Assessment, Says AO Conducted Roving Inquiry Despite Being Given All Details

The Gujarat High Court quashed proceedings reopening the assessment of a man whose income had allegedly escaped assessment, after noting that despite the assessee explaining all banking transaction details, the assessing officer had travelled beyond the law and conducted a roving inquiry. For context, Section 148A of the Income Tax Act pertains to conducting of inquiry by assessing officer...

Income Tax Act | Gujarat High Court Quashes S.153C Assessment As Time-Barred, Rejects Revenue's Reliance On S.153(6)(i)

The Gujarat High Court quashed assessment order as well as a demand notice issued to an entity under Section 153C Income Tax Act after noting that the assessment order was issued invoking Section 153(6)(i) was beyond the limitation period. The petitioner had moved the high court for quashing Assessment Order dated 30.04.2024 as well as the demand Notice dated 30.04.2024 for the Assessment...

Gujarat High Court Upholds CESTAT's Order Rejecting Plea To Restore Delay Condonation Application Filed After 7 Yrs

The Gujarat High Court upheld an order of the Customs, Central Excise and Service Tax Appellate Tribunal which had dismissed a cooperative society's plea seeking restoration of its condonation of delay application on the ground that it was filed after an inordinate delay of 7 years.The court noted that the petitioner had not provided any explanation for such delay except that it was facing...

Gujarat High Court Grants Relief After Transfer Pricing Objections Were Mistakenly Filed Before Wrong Authority, Quashes Final Assessment

The Gujarat High Court recently granted relief to a company which had inadvertently filed its objections to a proposed transfer pricing adjustment for Assessment Year 2022-23 before the jurisdictional assessing officer instead of filing it before the faceless authority.The petitioner had sought quashing of final Assessment Order dated 02.05.2025 passed under Section 143(3) read with Section...

Customs Act | Gujarat High Court Upholds CARR Ruling Allowing Duty Free Import On Inshell Walnuts Treating It As 'Dietary Fibre'

The Gujarat High Court upheld ruling of Customs Authority for Advance Rulings granting exemption from payment of Basic Customs Duty for inshell-walnuts imported by an entity treating the goods as "dietary fibre". The respondent- assessee is a transferee of Duty-Free Import Authorisations issued against the export of Assorted Confectionary Products (SION E-1) and Biscuits (SION E-5).The...

S.153C Income Tax Act | Gujarat High Court Quashes Assessment Proceedings Citing 2-Yr Delay & Lack Of Date In 'Satisfaction Note'

The Gujarat High Court quashed a Section 153C Income Tax Act proceedings against a company after noting that the assessing officer's satisfaction note did not bear any date and that the note, though recorded in 2022 was "supplied" to the company only in 2024 i.e., after a delay of two years without any explanation. For context, Section 153C empowers the tax authority to assess the income of...

Ambaji Temple Is Public Property, Can't Curtail Pilgrims' Rights: Gujarat High Court Rejects Royal Family's Claim To Perform Special Rituals

The Gujarat High Court dismissed the claim of heirs of the erstwhile Danta royal family for "special privileges" to perform rituals at Ambaji Temple on the eight day of Navratri and in a certain way, thereby "curtailing" right of the pilgrims to offer prayers which it said cannot be allowed as the temple was a public religious institution. For context, there were multiple proceedings with...

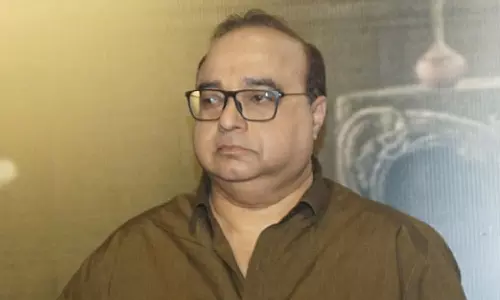

Gujarat High Court Permits Director Rajkumar Santoshi To Travel Abroad For 'Lahore 1947' Film Promotion, Relaxes Bail Condition

The Gujarat High Court on Tuesday (December 30) relaxed the bail condition imposed on film director Rajkumar Santoshi booked in a cheque dishonour case, permitting him to travel abroad between December 30-January 4, 2026 for promotion of his upcoming directorial movie 'Lahore 1947'. For context, Santoshi was convicted by trial court for offence under Section 138 Negotiable Instruments Act and...

Gujarat High Court Annual Digest 2025 [Citations 1 - 244]

Citations 2025 LiveLaw (Guj) 1 to 2025 LiveLaw (Guj) 244Depriving An Employee Of Leave Encashment Which Is Akin To Salary And Is Thus A Property Violates His Constitutional Right: Gujarat HCCase title: Ahmedabad Municipal Corporation v/s Sadgunbhai Semulbhai SolankiCitation: 2025 LiveLaw (Guj) 1Dismissing Ahmedabad Municipal Corporation's plea against a labour court order directing it to...

Gujarat High Court Asks Vadodara Municipality To De-Seal 4 Flats Used For Hospitality After Owner Undertakes To Seek Prior Permission

The Gujarat High Court on Tuesday (December 23) has directed the Vadodara Municipal Corporation to de-seal four flats belonging to an entity after the owner submitted that an undertaking shall be filed with the corporation that the flats will not be used for "hospitality purpose" without prior permission from the corporation. Justice Mauna M Bhatt was hearing a plea challenging the action...

Vadodara Car Crash: Gujarat High Court Grants Bail To 23-Yr-Old Booked For Rash Driving Causing Death Of One, Injuring Nine

The Gujarat High Court on Monday (December 22) granted regular bail to a 23-year-old student accused of rash and dangerous driving in the Vadodara car crash case earlier this year which had resulted in the death of one person and injured nine others. The court directed the applicant be released on bail on furnishing a bond of Rs. 1 Lakh with one surety of the like amount subject to...

PM Modi Degree Defamation Case: Gujarat High Court Reserves Verdict On Arvind Kejriwal's Plea Seeking Separate Trial From Sanjay Singh

The Gujarat High Court on Monday (December 22) reserved verdict on a petition moved by AAP Chief and former Delhi Chief Minister Arvind Kejriwal seeking separate trial from AAP leader Sanjay Singh in a criminal defamation case filed by Gujarat University over alleged remarks on Prime Minister Narendra Modi's education Degree.Justice MR Mengdey reserved the verdict after hearing all the...

![Gujarat High Court Annual Digest 2025 [Citations 1 - 244] Gujarat High Court Annual Digest 2025 [Citations 1 - 244]](https://www.livelaw.in/h-upload/2025/12/23/500x300_642564-gujarat-high-court-annual-digest-2025.webp)