Madhya Pradesh High Court

Madhya Pradesh HC Orally Questions Air India, Indigo For Lack Of Connectivity To Jabalpur In PIL For Increasing Flights To The City

While hearing a PIL for increasing flights to Jabalpur, the Madhya Pradesh High Court on Tuesday (December 17) orally questioned Air India that if it has a short flight commuting from Delhi to Chandigarh then why cant there be a flight to Jabalpur, emphasizing on increasing the connectivity on this route noting the demand. During the hearing the court also orally questioned Indigo airlines...

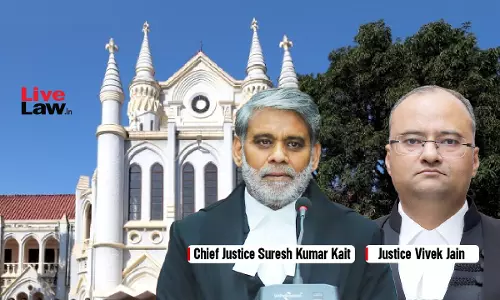

Rise In Sexual Offences Against Children Serious: Madhya Pradesh HC Initiates Suo Motu PIL, Questions Centre/State On POCSO Act Implementation

Taking into account the "substantial growth of sexual offences against children below the age of 18 years" in the state, the Jabalpur bench of the Madhya Pradesh has initiated a suo-moto PIL to enquire from the Central as well as the State Governments as to what steps have been taken on the implementation of the POCSO Act. A division bench of Chief Justice Suresh Kumar Kait and Justice...

Continued Detention Of Saudi Born "Rohingya Refugee" In Jail Despite Completion Of Sentence Violates Article 21: Madhya Pradesh High Court

While considering the case of a man–born in Saudi Arabia and claiming to be a Rohingya refugee–the Gwalior Bench of Madhya Pradesh High Court said that his detention in the city's Central jail after completion of his sentence for allegedly having a foreign passport violated his right to life under Article 21 of the Constitution of India.It further directed that till the man's nationality...

Madhya Pradesh High Court Designates 27 Lawyers As Senior Advocates

The Madhya Pradesh High Court has designated 27 lawyers as Senior Advocates out of the 48 lawyers who had applied for the position.The interview of the 48 candidates who had applied for designation was scheduled on 3rd December 2024 before the Permanent Committee for Designation of Senior Advocates.Thereafter, the following 27 lawyers were designated as Senior Advocates:Aditya...

Madhya Pradesh High Court Directs State To Give Complete Details Of Alleged 'Unauthorized Religious Shrines' Constructed In Police Stations

The Madhya Pradesh High Court on Monday (December 16) asked the State government to submit complete details of the alleged unauthorized religious shrines which are stated to be constructed inside police stations across the state, including the number of such constructions and the date on which they were constructed. The present plea was filed by a retired central government employee, now...

Madhya Pradesh HC Orders Removal Of Registrar, Chairman Of Nursing Registration Council Due To Alleged Illegality In Recognizing Colleges

While hearing a plea on alleged irregularities and illegalities in the process of granting recognition to nursing colleges in the state, the Jabalpur bench of the Madhya Pradesh High Court directed the state government to "forthwith" remove the Registrar and Chairman of Madhya Pradesh Nursing Registration Council (MNRPC).In doing so, the court said that there was "every likelihood" of...

Madhya Pradesh HC Lays Procedure For Pregnancy Termination In Rape Cases, Pulls Up Trial Court For 'Cruel' Approach Towards Minor Survivor

In a plea concerning termination of over 20-week pregnancy of a minor girl who was stated to be gang raped, the Indore bench of the Madhya Pradesh High Court has given a detailed procedure to be followed by police authorities, district courts and high court registry in order to ensure timely legal and medical help.In doing so the high court criticized the "acute insensitive approach" displayed...

Filing Of Affidavits Or Self-Serving Documents Insufficient To Prove Employer-Employee Relationship: MP HC

Madhya Pradesh High Court: A single judge bench of Justice Milind Ramesh Phadke dismissed a petition filed by Ashok Singh Tomar. Tomar challenged the Labour Court's order that dismissed his claim for reinstatement and back wages after he was terminated. The High Court ruled that Tomar provided insufficient evidence to establish an employer-employee relationship. It noted that just...

Employer Has Right To Lead Evidence Even After Faulty Domestic Enquiry: MP HC

Madhya Pradesh High Court: A single bench of Justice Vivek Jain dismissed a petition filed by a workers' union against an award of Central Government Industrial Tribunal (CGIT). The award was passed in favour of a dismissed worker. He was dismissed on account of unauthorized absence and the CGIT had upheld his dismissal. The Court held that an employer can lead evidence before a tribunal...

Students Have No Locus To File Plea For Affiliation Of A College: Madhya Pradesh HC Expresses Surprise At Law College Not Wanting Recognition

While hearing a plea regarding grant of recognition of a college, the Jabalpur bench of the Madhya Pradesh High Court on Friday (December 13) orally remarked that students had "no locus" to seek affiliation of a college expressing its "surprise" as to why the college was not present before the court seeking recognition.On the last date of hearing i.e. November 13, the counsel for the...

Madhya Pradesh HC Issues Contempt Notice To Tehsildar For Violating Orders By Allowing Liquor Vend To Operate In 'Sealed' Premises

The Madhya Pradesh High Court on Friday (December 12) while hearing issued a contempt notice to a Tehsildar for wilfully disobeying court's earlier order by allowing a liquor vend to operate in a premises which was supposed to be sealed and vacated.While the court asked the Tehsildar to file an explanation as to why he permitted a liquor vend to open, it however orally said that it seemed to be...

Husband, In-Laws 'Falsely Implicated' By Wife In View Of Matrimonial Dispute Between Parties: Madhya Pradesh HC Quashes Rape, Dowry FIR

While quashing a rape and dowry FIR against a husband and his kin, the Indore Bench of the Madhya Pradesh High Court said that the petitioner and his family members were "falsely implicated", adding that the lodging of the FIR at the wife's instance appeared to be an act of "wreaking vengeance". The court said this after noting that there existed a pending civil suit filed by the...