IBC News

IIHL Tells NCLAT It Has RBI Nod For Name Change, Seeks 8 Weeks To Drop 'Reliance' Brand

IndusInd International Holdings Ltd (IIHL), the successful resolution applicant for Reliance Capital, informed the National Company Law Appellate Tribunal (NCLAT) on Friday that it has received approval from the Reserve Bank of India (RBI) to change the company's name and expects the rebranding process to be completed within eight weeks.The submission came amid an ongoing trademark dispute...

NCLAT Cannot Record Settlement After Admission Of CIRP By NCLT: NCLAT New Delhi

The National Company Law Appellate Tribunal, Principal Bench, New Delhi, comprising Justice N. Seshasayee (Member-Judicial) and Arun Baroka (Member-Technical), has refused to record the settlement between the parties and remanded the matter back to the adjudicating authority. The appeal was filed challenging the adjudicating authority's order, which was passed without...

Arbitral Proceedings Cannot Continue Once Moratorium Under IBC Is In Effect, Creditors' Recourse Lies Before Liquidator: Madras High Court

The Madras High Court bench of Justice N. Anand Venkatesh held that arbitration proceedings cannot continue after commencement of liquidation, any order passed thereafter is not legally sustainable. However, considering that continuation of arbitration proceedings would be futile and that the petitioner had not been informed of the commencement of the liquidation, the court...

NBFC's Non-Compliance With RBI Directions Cannot Defeat Classification Of Loan As Financial Debt: NCLAT New Delhi

The NCLAT, Principal Bench, New Delhi, comprising Justice Ashok Bhushan (Chairperson) and Barun Mitra (Member-Technical), has held that the non-compliance with the RBI guidelines by an NBFC cannot defeat the classification of a loan as a financial debt u/s 7 of the IBC. Brief Background The appeal was filed challenging the impugned order passed by the NCLT Kolkata. In the...

NCLT Ahmedabad Admits Gensol-Linked Entity Blu-Smart Mobility Tech Into Insolvency

The National Company Law Tribunal (NCLT), Ahmedabad Bench, has recently admitted Blu-Smart Mobility Tech Pvt Ltd into Corporate Insolvency Resolution Process (CIRP) over an unpaid operational debt of ₹5.84 crore.The order , dated October 14, 2025 marks yet another Gensol-linked entity facing insolvency proceedings, following the admission of Gensol Engineering and Blu-Smart Mobility...

Under SARFAESI & RDB Acts, Dues Of Secured Creditors Take Precedence Over Govt Dues: Allahabad High Court

The Allahabad High Court has held that under Section 26-E of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 and Section 31B of the Recovery of Debts and Bankruptcy Act, 1993, the debts of the secured creditors will take precedence over all over debts including crown debts.The bench of Justice Shekhar B. Saraf and Justice Praveen Kumar...

Tax Demands Raised Post Approval Of IBC Resolution Plan Are Not Enforceable: Karnataka High Court

The Karnataka High Court recently reiterated that tax demands raised by revenue authorities after the approval of a resolution plan under the Insolvency and Bankruptcy Code (IBC) are unenforceable if the claims were not submitted during the Corporate Insolvency Resolution Process (CIRP).A single bench of Justice M Nagaprasanna observed,“There is no jurisdiction to parallelly...

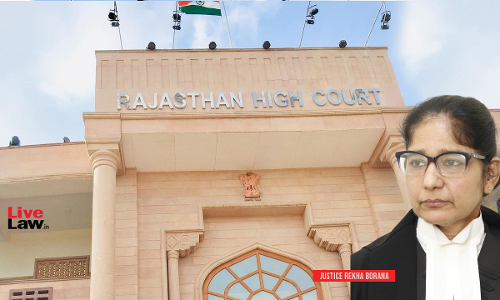

Bank Can Assign Debt Even If NPA Classification Is Later Declared Invalid: Rajasthan High Court

The Rajasthan High Court dismissed a writ petition filed against SBI's assignment of debt in favor of Alchemist Asset Reconstruction Company Ltd. (AARC) holding that even if NPA classification is later declared invalid, it does not affect the validity of assignment of debt. Justice Rekha Borana held that “the assignment cannot be invalidated merely because the NPA classification...

NCLT Mumbai Clears Yatra Online Ltd Subsidiaries' Merger With Parent Company

The National Company Law Tribunal (NCLT) at Mumbai, on Tuesday allowed a Scheme of Amalgamation involving Yatra Online Limited and six of its wholly owned subsidiaries.A coram comprising Judicial Member K R Saji Kumar and Technical Member Anil Raj Chellan allowed a plea filed under Sections 230 to 232 of the Companies Act, 2013, by the subsidiaries seeking sanction of the merger scheme....

IBC - Speculative Investors Can't Be Permitted To Misuse Insolvency & Bankruptcy Code Proceedings: Supreme Court

In a significant observation aimed at curbing the growing misuse of the Insolvency and Bankruptcy Code (IBC) in the real estate sector, the Supreme Court has reiterated that the Code cannot be used as a tool by speculative investors seeking quick financial returns rather than the genuine revival of distressed companies or protection of real homebuyers.Emphasizing the remedial and...

NCLT Ahmedabad Initiates Insolvency Proceedings Against Gensol Co-founder Puneet Singh Jaggi

The National Company Law Tribunal (NCLT), Ahmedabad Bench, on Monday initiated personal guarantor insolvency proceedings against Puneet Singh Jaggi, co-founder and whole-time director of Gensol Engineering Ltd.This follows a petition by Equentia Financial Services Pvt. Ltd. over an alleged default of ₹9.91 croreThe order was passed by a coram of Judicial Member Shammi Khan and Technical...

Reverse CIRP Can't Be Claimed As Right: NCLAT Upholds Insolvency Against Supertech Realtors

The National Company Law Appellate Tribunal (NCLAT) New Delhi upheld an admission order under section of the Insolvency and Bankruptcy Code, 2016 (IBC) against Supertech Realtors Pvt. Ltd. and dismissed an appeal filed by Ram Kishore Arora, its suspended director. A bench comprising Justice Ashok Bhushan and Mr. Barun Mitra (Technical Member) observed that once debt and default...