IBC News

ED Cannot Retain Attached Assets After Approval of Resolution Plan : NCLAT

The National Company Law Appellate Tribunal on Tuesday held that any attachment of assets by the Enforcement Directorate (ED) under the Prevention of Money Laundering Act (PMLA) ceases to have effect once a resolution plan is approved under the Insolvency and Bankruptcy Code (IBC).A coram of Chairperson Justice Ashok Bhushan, along with Technical Member Barun Mitra observed that the section...

SARFAESI Charge Created Before GST Charge Takes Precedence Over It: Karnataka High Court

'If a claim is made under the IBC Act and there is no claim under the SARFAESI Act, RDB Act, or GST Act, the claim under the IBC Act can be implemented without issue. Similarly, if a claim is made under the GST Act and there are no claims under the SARFAESI Act, RDB Act, or IBC Act, the claim under the GST Act can be executed without difficulty'

Bank Cannot Retain One Company's Fixed Deposit For Group Company's Loan: NCLAT

The National Company Law Appellate Tribunal (NCLAT) at Delhi has recently held that a bank cannot retain a fixed deposit belonging to one company to recover dues from another, even if they are part of the same group.The case involved Reliance Communication Infrastructure Limited (RCIL), which had placed a fixed deposit of Rs. 27.60 crore with the Industrial and Commercial Bank of China...

KMC Is Secured Creditor U/S 232 Of Kolkata Municipal Corporation Act: NCLAT New Delhi

The NCLAT, Principal Bench, New Delhi, comprising Justice Ashok Bhushan (Chairperson) and Barun Mitra (Member-Technical), has held that the Kolkata Municipal Corporation is a secured creditor by virtue of section 232 of the Kolkata Municipal Corporation Act, 1980. Background of the Case An asset of the corporate debtor was assessed for property tax by the...

Salman Khan Withdraws ₹7.24 Crore Insolvency Plea Against Jerai Fitness After Settlement

Actor Salman Khan has withdrawn his ₹7.24 crore insolvency petition against Jerai Fitness Limited after both parties reached a settlement.On Wednesday, the National Company Law Appellate Tribunal (NCLAT) recorded the consent terms and allowed the withdrawal. The bench comprised Chairperson Justice Ashok Bhushan and Technical Member Arun Baroka.The dispute related to unpaid dues under a...

Time Spent In DRT Recovery Proceedings Cannot Be Excluded U/S 14 Of Limitation Act: NCLAT

The National Company Law Appellate Tribunal (NCLAT) held that the benefit of section 14 of the Limitation Act cannot be extended to the creditor who had initiated recovery proceedings before the Debt Recovery Tribunal (DRT) under the Recovery of Debt and Bankruptcy Act, 1993. The Tribunal held that the benefit under section 14 of the Act can be given only when the forum before...

Unremitted TDS Deducted Before Liquidation Does Not Form Part Of Liquidation Estate: NCLT Bengaluru

The National Company Law Tribunal (NCLT) Bengaluru bench of Shri Sunil Kumar Aggarwal, Member (Judicial) and Shri Radhakrishna Sreepada, Member (Technical) held that an unremitted Tax Deducted at Source (TDS) amounts deducted by the corporate debtor before the liquidation are assets held in trust for the government and therefore stand excluded from the liquidation estate under section 36...

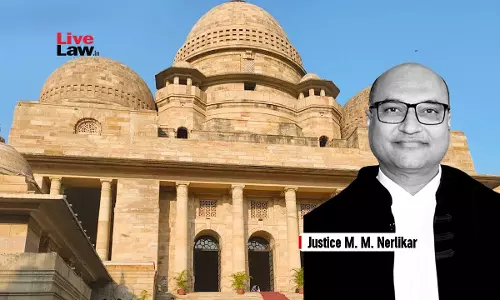

Prior IBC Proceedings Don't Bar Criminal Prosecution Of Directors Under S. 138 Negotiable Instruments Act: Bombay High Court

The High Court of Bombay, Nagpur Bench, comprising Justice M.M. Nerlikar, has held that the prior initiation of IBC proceedings does not bar criminal prosecution of directors under section 138 of the Negotiable Instruments Act. Background of the Case The petitioner extended a short-term loan of Rs. 15 lakhs to the respondent through its directors. A post-dated cheque was issued as...

CCI Dismisses Abuse Of Dominance Complaint Against Google Over Play Store Ban

The Competition Commission of India (CCI) on Monday dismissed a complaint filed by Liberty Infospace Pvt. Ltd. against Google, ruling that the tech giant did not abuse its dominant position by terminating the company's developer account on the Google Play Store.The Commission found no prima facie violation under Section 4 of the Competition Act, 2002, and closed the case without directing...

IBC Monthly Digest: September 2025

Supreme Court Committee Of Creditors Continues To Exist Till Resolution Plan Is Implemented Or Liquidation Order Is Passed : Supreme Court Case No.: KALYANI TRANSCO Vs MS BHUSHAN POWER AND STEEL LTD. | C.A. No. 1808/2020 and connected matters Citation: 2025 LiveLaw (SC) 954 In the JSW Steel matter, the Supreme Court held that the Committee of Creditors (CoC) under the...

No Concept Of “Symbolic Possession” Under IBC, IRP Is Entitled To Take Actual Control Of Corporate Debtor's Assets: NCLAT

The National Company Law Appellate Tribunal (NCLAT) Chennai bench of Justice Sharad Kumar Sharma (Judicial Member) and Jatindranath Swain (Technical Member) has dismissed an appeal filed by two promoters of M/s Orion Water Treatment Private Limited holding that there is no concept of symbolic possession under the Insolvency and Bankruptcy Code, 2016 (IBC) once Corporate...

Only Existing Members Of Company Can Seek Relief Against Oppression & Mismanagement: NCLAT Chennai

The National Company Law Appellate Tribunal (NCLAT) at Chennai has recently ruled that only existing members of a company are entitled to seek relief for oppression and mismanagement under Section 244 of the Companies Act, 2013, even in so-called "exceptional circumstances."The tribunal set aside an order of the National Company Law Tribunal (NCLT), Chennai which had allowed two former members...