Latest News

Section 47 Of CPC Is Not Attracted In Proceedings For Execution Of An Arbitral Award: Telangana High Court

The Telangana High Court has ruled that in proceedings for execution of an arbitral award the whole gamut of CPC is not attracted, and a Court while dealing with an application under Section 36 of the Arbitration and Conciliation Act, 1996 (A&C Act) for enforcement of an award is not bound by the provisions of Section 47 of the Code of Civil Procedure, 1908 (CPC) and is not required...

'Speeches Within The Ambit Of The Constitution, Cannot Be Called Anti-National: Sharad Pawar To Bhima Koregaon Commission

MP Sharad Pawar, supremo of the ruling coalition, the Nationalist Congress Party in Maharashtra told an inquiry commission on Thursday that the speeches at the Elgar Parishad event, must have been an outcry against oppression and atrocities which wouldn't be an offence in law. Pawar said that a person giving speech within the ambit of the Constitution of India and Parliamentary...

Application Under Section 11(6) Not Maintainable For Appointment Of Arbitrator In Absence Of A Written Agreement Between Parties: Supreme Court

The Supreme Court has ruled that there is a difference between the arbitrator appointed under Section 11(5) and under Section 11(6) of the Arbitration and Conciliation Act, 1996 (A&C Act) and failing any written agreement between the parties on the procedure for appointing an arbitrator (s) under Section 11(2), application for appointment of arbitrator (s) shall be maintainable...

"Using Loudspeakers In Mosque Not A Fundamental Right": Allahabad HC Dismisses Plea Seeking Nod To Play Azan On Loudspeakers

The Allahabad High Court has observed that the law has now been settled that the use of loudspeakers from mosques is not a fundamental right. The Bench of Justice Vivek Kumar Birla and Justice Vikas Budhwar said this while dealing with a writ plea filed by one Irfan.Essentially, Irfan had moved to the High Court feeling aggrieved by an order passed by SDM Tehsil Bisauli, District Budaun...

Sharing Or Use Of Biometric Information For Any Purpose Other Than Authentication Under Aadhar Act Is Impermissible: UIDAI Tells Delhi High Court

The Unique Identification Authority of India (UIDAI) has informed the Delhi High Court that sharing or use of biometric information for any purpose other than the generation of the Aadhaar number and authentication under the Aadhaar Act, 2016 is impermissible. The Authority has also informed the Court that biometric information is unique to an individual and therefore is sensitive...

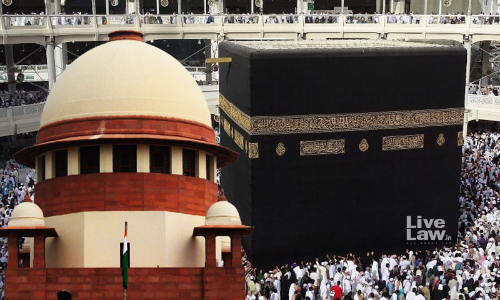

'Haj Group Organisers Cannot Claim GST Exemption Under 'Service By Way of Conduct of Religious Ceremony': ASG Submits Before Supreme Court

The Supreme Court on Thursday resumed hearing on a string of petitions filed by various tour operators and state Hajj organisers on differential GST levied on Haj pilgrims.The tour operators are challenging the levy of GST on Hajis who avail themselves of services offered by registered private tour operators on the grounds that no tax law can be applicable on extra territorial activities...

Delhi High Court Upholds Order Of Revenue Department Imposing Enhanced Compounding Charges On Subsequent Offences

The Delhi High Court has upheld the order of the revenue department imposing enhanced compounding charges on subsequent applications for compounding of offences relating to late deposit of Tax Deducted at Source (TDS). The Bench, consisting of Justices Manmohan and Dinesh Kumar Sharma, held that compounding of offences cannot be taken as a matter of right and it is for the law...

Gujarat MLA Jignesh Mevani Gets 3-Month Jail Term By Local Court For Holding Protest March In 2017 Disobeying Magistrate's Order

A Court in the Mehsana District of Gujarat today sentenced Gujarat Independent MLA Jignesh Mevani and 9 others to 3 months of imprisonment while holding them guilty of committing offence punishable under Section 143 IPC.Additional Chief Judicial Magistrate J.A. Parmar noted that all 10 were members of Mevani's Rashtriya Dalit Adhikar Manch and when they were asked to not go ahead with...

Where More Efficacious Remedy Is Available U/S 41(h) Specific Relief Act, Party Is Under Legal Obligation To Opt It: Punjab & Haryana High Court

Punjab and Haryana High Court on April 28, 2022, while dealing with a revision petition, held that it is well-settled law that in light of statutory provisions under Section 41(h) of the Specific Relief Act, where a more efficacious remedy is available, the party is under a legal obligation to opt for that remedy. The bench comprising Justice Fateh Deep Singh appreciated the...

WB Post Poll Violence| Calcutta HC Allows CBI To Commence Investigation Afresh After Filing Of Chargesheet By State Police For Same Offence

The Calcutta High Court on Monday upheld a Single Judge order allowing the Central Bureau of Investigation (CBI) to take up investigation afresh in respect of a case pertaining to the West Bengal post poll violence even after the charge sheet had already been filed by the State police for the same offence and the case had already been committed for trial. The Court vide order dated August...

BREAKING| SC Collegium Recommends Elevation Of Justices Sudhanshu Dhulia & JB Pardiwala To Supreme Court

The Supreme Court collegium has recommended the elevation of Gauhati High Court Chief Justice Sudhanshu Dhulia and Gujarat High Court judge Jamshed Burjor Pardiwala as Supreme Court judges. The 5-member collegium headed by Chief Justice of India NV Ramana made the recommendations.The Supreme Court, with 32 judges at present,has 2 vacancies out of the sanctioned strength of 34 judges. However,...

Kerala High Court Directs GST Dept. To Facilitate Revision Of Form GST TRAN-1 By Making Necessary Arrangements On The Portal

The Kerala High Court bench of Justice Bechu Kurian Thomas has directed the GST department to facilitate the revising of Form GST TRAN-1 and filing of Form GST TRAN-2 by making necessary arrangements on the web portal. The petitioner/assessee was a registered dealer under the Kerala Value Added Tax Act, 2003 as well as the Central Sales Tax Act, 1956. The assessee is in the business...