Latest News

Supreme Court Restrains Declaration Of Result For J&K Cricket Association Elections Over Alleged Fraud, Electoral Roll Manipulation By BCCI Sub-Committee

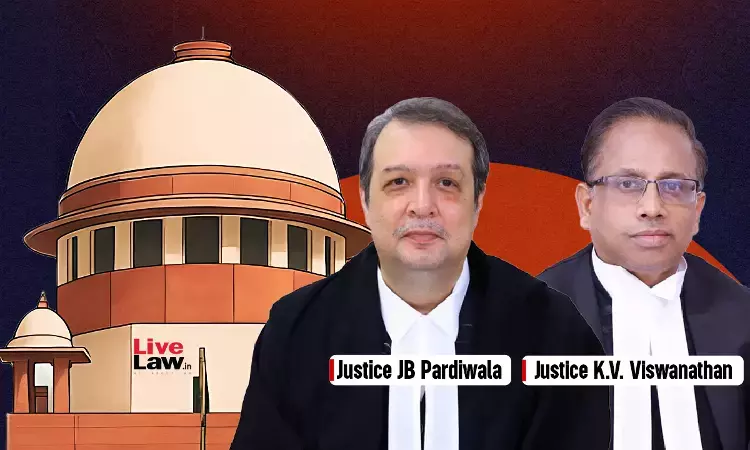

The Supreme Court yesterday restrained declaration of election results for the Jammu and Kashmir Cricket Association (JKCA), pursuant to allegations of fraud and manipulation of electoral roll levelled against members of Sub-Committee of the Board of Control for Cricket in India (BCCI).A bench of Justices Vikram Nath, Sandeep Mehta and NV Anjaria passed the order, while issuing notice on a...

Delhi Court Frames Charges Against Lalu Prasad Yadav, Tejashwi Yadav & Others In Land For Jobs Scam; Calls Them 'Criminal Syndicate'

A Delhi Court on Friday framed charges against RJD Chief Lalu Prasad Yadav in the corruption case related to the alleged land for jobs scam case registered by the Central Bureau of Investigation (CBI).Special Judge Vishal Gogne of Rouse Avenue Courts said Yadav and his family acted as a criminal syndicate and there was overarching conspiracy on their part.“The court finds on the touchstone...

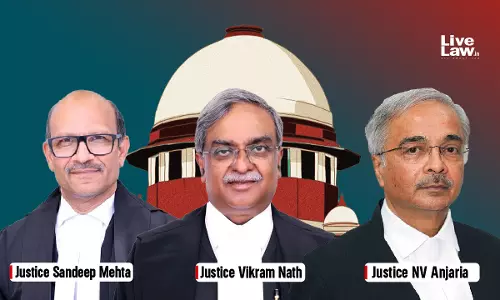

Stray Dogs Case : Live Updates From Supreme Court Hearing [Day 3]

The Supreme Court to continue hearing today at 10.30 AM the Stray Dogs caseBench: Justices Vikram Nath, Sandeep Mehta and NV AnjariaFor the past two days, the matter has been heard extensively, with the Bench primarily examining the issue of stray dogs in institutional premisesIntervenors (dog lovers and NGOs) are praying for modification of the Court's earlier directions, so that stray dogs...

Business Law Daily Round-Up: January 08, 2026

IBC NCLAT Limits Ansal Properties' Insolvency To Sushant Golf City and Rajasthan ProjectsFunding Rival Bids, Using Same IP Proves Bid Rigging, NCLAT Upholds CCI Penalty Against Klassy EnterprisesCalling Guarantor 'Director' In SARFAESI Notice Doesn't Invalidate Invocation Of Guarantee: NCLATNCLAT Upholds Eviction Of Subsidiaries From Corporate Debtor's Properties During LiquidationBank...

Stock Brokers Can Take Up Other Regulated Activities Under SEBI's New Regulations

Stock brokers can now take up other regulated financial activities, with approval, after the market regulator notified a fresh set of regukations that replaces the three-decade-old framework governing the broking industry. The Securities and Exchange Board of India (Stock Brokers) Regulations, 2026, notified on Wednesday, formally repeal the 1992 regulations and bring all...

CCI Closes Digital Market Abuse Complaint Against Sundar Pichai, Apple, Amazon and Others

The Competition Commission of India (CCI) has closed a complaint alleging large-scale anti-competitive conduct and abuse of dominance in India's digital ecosystem by several individuals and global technology companies, including Sundar Pichai, Apple LLC, Amazon Seller Services Pvt. Ltd., Flipkart Internet Pvt. Ltd. The competition watchdog held that no prima facie case...

Delhi Commercial Court Bars Faridabad Smoking Paper Maker From Using 'BONGCHIE', 'PERFECT ROLL' Marks

A Commercial Court in Delhi has permanently restrained Ish Nagpal, a Faridabad-based manufacturer, from using the trademarks “BONGCHIE” and “PERFECT ROLL” on smoking paper products. The court made the ruling after counterfeit goods bearing the marks were recovered from his premises. In a judgment dated January 5, 2026, District Judge Harish Kumar of the Commercial Court at Tis...

![Stray Dogs Case : Live Updates From Supreme Court Hearing [Day 3] Stray Dogs Case : Live Updates From Supreme Court Hearing [Day 3]](https://www.livelaw.in/h-upload/2025/08/21/500x300_616690-stray-dogs-live-updates-sc.webp)