News Updates

Rajasthan High Court Asks Woman Pressurized By Parents To Live With Child Marriage Partner To Approach Police For Security

The Rajasthan High Court has directed a woman, who was married off while a minor and now wishes to part her ways, to file a representation before the Superintendent of Police, Jodhpur (Rural) for appropriate security. Notably, the woman has approached the court with the grievance that her parents are pressuring her to live with the person with whom her marriage was solemnised while she was...

Unscrupulous Litigants Withdraw Anticipatory Bail Plea To Avoid Dismissal & File Successive Pleas, Waste Judicial Time: Punjab & Haryana HC

The Punjab and Haryana High Court recently deprecated the practice of filing successive bail applications, without any adequate ground/ change in circumstances.It also voiced concern over the unfortunate trend being adopted by "unscrupulous litigants" in which anticipatory bail is argued and when the Court is about to dismiss the petition, in order to avoid a detailed adverse order, the...

Depreciation To Be Carried Forward For Set Off In Succeeding Assessment Years: ITAT

The Delhi Bench of the Income Tax Appellate Tribunal (ITAT) headed by G.S. Pannu (President) and C.N. Prasad (Judicial Member) has ruled that in case the depreciation exceeds the business income, then the Assessing Officer should allow the depreciation to be carried forward for set off in succeeding assessment years.The respondent/assessee for the AY 2016-17 e-filed the return of...

Former Kerala High Court Judge Justice MC Hari Rani Passes Away

Justice M.C. Hari Rani, former Judge of the Kerala High Court passed away early on Wednesday.Justice Rani entered the judicial service in April 1982 as a Munsiff and worked at Thalassery, Kuthuparamba and Thaliparamba. She worked as Additional Sub-Judge at Palakkad and Thalassery, and as Principal Sub-Judge at Thalassery. In 1991, Justice Rani was promoted as a District Judge. She has...

CENVAT Credit Cannot Be Claimed On Expenses Incurred On CSR: Delhi CESTAT

The Delhi Bench of Customs, Excise & Service Tax Appellate Tribunal (CESTAT) has held that expenses incurred by a person on activities related to its Corporate Social Responsibility (CSR) cannot be termed as input services and thus, CENVAT Credit cannot be claimed on it. The Bench, consisting of members Rachna Gupta (Judicial Member) and P.V. Subba Rao (Technical Member), ruled...

Issuance Of Post Dated Cheques Is Not An Unqualified Admission Of Debt, NCLT Allahabad Dismisses Section 7 Application

The National Company Law Tribunal ("NCLT"), Allahabad Bench, comprising of Shri Rajasekhar V.K. (Judicial Member) and Shri Virendra Kumar Gupta (Technical Member), while adjudicating an application filed in N.C. Goel & Maya Goel v Piyush Infrastructure India Pvt. Ltd., has held that issuance of post dated cheques cannot be taken to be unqualified admission of debt, because...

Recovery Proceeding Deemed To Be Stayed If Appellant Pays 10% Of Disputed Tax Amount During Pendency Of Appeal: Jharkhand High Court

The Jharkhand High Court bench of Justice Aparesh Kumar Singh and Justice Deepak Roshan has held that upon deposit of 10% of the disputed tax amount during the pendency of appeals, recovery of any remaining balance is deemed to have been stayed in view of Section 107 Sub-section (6) and (7) of the CGST Act, 2017.The notice under Section 79 of the CGST Act, 2017 was issued by...

Court Can Pass An Order Of Interim Measures Under Section 9 Of The A&C Act Against A Third Party: Reiterates Bombay High Court

The Bombay High Court has reiterated that the Court is free to pass an order under Section 9 of the Arbitration and Conciliation Act, 1996 (A&C Act) to grant interim measures of protection against a third party who is impleaded in the petition filed under Section 9. The Single Bench of Justice G.S. Kulkarni held that the minority members of a Society cannot act against the will...

DGFT Notifies Additional Provisions For Allocation Of TRQ For Crude Soya Bean Oil And Crude Sunflower Oil

The Directorate General of Foreign Trade (DGFT) has notified the additional provisions for the allocation of Tariff Rate Quota (TRQ) for 20 lakh MT of crude soya bean oil and 20 lakh MT of crude sunflower oil for the financial years 2022–23 and 2023–24.The DGFT informed applicants that for each processing unit, they must present a self-certified copy of documentation proof...

'Desperate Attempt To Keep Claims In Limbo': Calcutta High Court Rejects Unsecured Creditor's Plea To Stay Dunlop E-Auction With ₹2 Lakh Cost

The Calcutta High Court on Monday came down heavily on an unsecured creditor seeking a stay of the e-auction process to liquidate plant and machinery of Dunlop India Ltd, opining that it is a desperate attempt to keep the claims of the creditors and workers uncertain and in a limbo for all times to come.Justice Moushumi Bhattacharya was adjudicating upon an application moved by one Miller...

Wife Remarrying After Husband's Death In Accident Does Not Disentitle Her From Compensation Under Employees' Compensation Act: Rajasthan High Court

The Rajasthan High Court has observed that remarrying of the deceased's wife does not disentitle her from claiming compensation for death of her husband under Employees' Compensation Act, 1923. The court added that the amount of compensation awarded by the trial court looking at the young age of the deceased and number of claimants cannot be said to be unreasonable.Justice Rameshwar Vyas,...

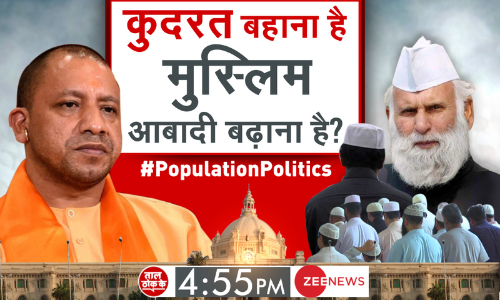

"There Was An Agenda To The Debate" : NBDSA Orders 'Zee News' To Take Down Its Video On Muslim Population

The News Broadcasting and Digital Standards Authority (NBDSA) on Monday directed Zee News to take down a show which was telecast last year by it on the issue of the Muslim Population titled "Kudrat Bahaana Hai, Muslim Aabaadi Badhaana Hai?"Dealing with a bunch of complaints made against Zee News for airing the above-named program, NBDSA Chairperson Justice A. K. Sikri observed thus:"While...