News Updates

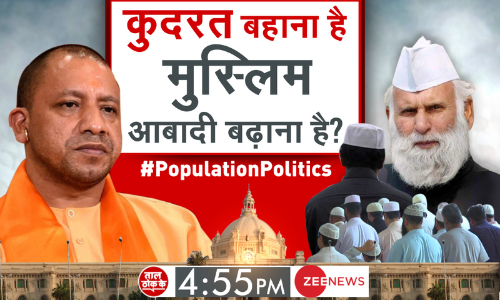

"There Was An Agenda To The Debate" : NBDSA Orders 'Zee News' To Take Down Its Video On Muslim Population

The News Broadcasting and Digital Standards Authority (NBDSA) on Monday directed Zee News to take down a show which was telecast last year by it on the issue of the Muslim Population titled "Kudrat Bahaana Hai, Muslim Aabaadi Badhaana Hai?"Dealing with a bunch of complaints made against Zee News for airing the above-named program, NBDSA Chairperson Justice A. K. Sikri observed thus:"While...

'Cannot Be Tolerated': Madras High Courts Asks Govt To Report On Action Taken Against Abuse Of Power Among Higher Police Officials

Coming down heavily on the abuse of power among higher police officials, the Madras High Court has observed that indiscipline amongst higher officials of the police department causes disaster consequences. When the higher officials are not maintaining the expected level of discipline, they may not be in a position to control the force, which would result in the...

"Explain Why": Bombay High Court Livid After MMRDA Demolishes Alleged Illegal Structure 15-30 Mins Before Court Hearing

The Bombay High Court took strong exception to the Mumbai Metropolitan Region Development Authority's (MMRDA) "haste" in demolishing an alleged unauthorised structure less than half an hour before the case was heard by the bench. The petitioner company claimed that the 1879 sq ft structure being branded as 'illegal' by MMRDA, was in existence for at least 15 years, having being...

Definition Of 'Resident' Under Income Tax Act Designed For Including Persons In Tax Net, Not For Determining Citizenship: Rajasthan High Court

The Rajasthan High Court has observed that the condition imposed by the Income Tax Act that a person residing in India for a continuous period of 180 days would be considered to be a resident of India, is for the purpose of bringing such person within the purview of the Income Tax Act. The court added that the definition is simply designed for the purpose of including the persons who are...

No Arrest During 2 Months' Cooling-Off Period After FIR Registration: Allahabad HC Issues Safeguards Against S. 498A Misuse

Allahabad High Court on Monday issued certain guidelines/safeguards to prevent the misuse of Section 498A of the Indian Penal Code (IPC). One of the guidelines issued by the Court states that after the registration of a First Information Report (FIR) under 498A IPC, no arrest or coercive action should be taken against the accused during the cooling-off period of two months. During...

18% GST payable On PV DC Cables: Maharashtra AAR

The Maharashtra Authority of Advance Ruling (AAR), consisting of Rajiv Magoo and T.R. Ramnani, has ruled that 18% GST is payable on PV DC cables. The applicant is in the business of manufacturing and supplying solar cables, commonly known as photo-voltaic DC cables (PVDC cables) under various brand names. The cables are made from copper conductors with cross-linked polyolefin...

Notice For Reopening Of Assessment Against Dead Person Is Invalid: ITAT Quashes Re-Assessment Order

The Delhi Bench of the Income Tax Appellate Tribunal (ITAT) has ruled that the notice for reopening of the assessment against the dead person is invalid. The two-member bench of Kul Bharat (Judicial Member) and Pradeep Kumar (Accountant Member) has observed that the Assessing Officer has accentuated the legal fallacy by continuing to proceed against the dead person by issuing notice...

Order Passed On The Same Day When Notice Was Issued Led To The Violation Of Principle Of Natural Justice: Gujarat High Court

The Gujarat High Court bench of Justice A.J. Desai and Justice Bhargav D. Karia has quashed the order under GST on the grounds that the notice as well as the order were passed on the same date, denying the opportunity of hearing to the assessee. The petitioner/assessee is a private limited company engaged in the business of flexible packaging materials. The petitioner received...

No Cess Applicable On Coal Used As An Input For Manufacturing Finished Goods Used For Domestic Supply: Calcutta High Court

The Calcutta High Court has ruled that cess is not applicable on the coal used as an input for manufacturing finished goods for the domestic supply. The single bench of Justice Md. Nizamuddin has observed that goods which are subject to a nil rate of cess would be construed as exempt supplies for purposes of the formula prescribed in Rule 89 (4) of the CGST Rules. Therefore, it...

Sergeant Denying Maintenance To Wife & Daughter Not Justified; Daily Life Expenses, Education Very Costly: Rajasthan High Court

The Rajasthan High Court has observed that in the present times, when the education itself is very costly and the daily life requires a respectable amount, the denial of maintenance to the wife and the daughter cannot be justified. The petitioner was thus directed to pay Rs. 15,000 per month maintenance to them.The Petitioner had filed the present criminal review petition under Section 19(4)...

Person With Single Testicle Not Unfit To Serve Indian Navy: Punjab & Haryana High Court

The Punjab and Haryana High Court has held that having 'single testicle' is not a disability that would render a candidate unfit for serving the Indian Navy. In reference to an order passed by the Centre declaring the Respondent herein unfit for enrolment in the Navy for the reason that he has a single testicle, a bench comprising Justice G.S. Sandhawalia and Justice Vikas Suri observed,"There...

Stridhan Cannot Be Retained By Family Of Husband On Annulment Of Marriage: Karnataka High Court

The Karnataka High Court has said that annulment of marriage cannot mean that all the articles that woman carried to the matrimonial house can be retained by the family of the husband. A single judge bench of Justice M Nagaprasanna refused to quash the criminal proceedings initiated by the ex-wife under section 406 of the Indian Penal Code (IPC), against her former husband and...