News Updates

Unmarried Daughter Can Claim Marriage Expenses From Parents Under 'Hindu Adoptions & Maintenance Act': Chhattisgarh High Court

The Chhattisgarh High Court recently held that an unmarried daughter can claim marriage expenses from her parents under the provisions of the Hindu Adoptions and Maintenance Act, 1956.The bench of Justice Goutam Bhaduri and Justice Sanjay S. Agrawal held thus while hearing and allowing a petition filed by a 35-year-old woman, Rajeshwari.The case in brief Appellant/Rajeshwari moved an...

Non Specification Of Penalty Provisions In Penalty Notice And Denial Of Immunity; Delhi High Court Holds That Assessee Is Eligible For Immunity, Says Tax Payer Should Be Incentivised.

The Delhi High Court has ruled that the action of income tax authorities denying the benefit of immunity from penalty under Section 270AA of Income Tax Act to the assessee on the ground that penalty was initiated under Section 270A for misreporting of income is arbitrary since the penalty notice issued by the authorities failed to specify the limb under which the penalty proceedings...

Payment Of Equated Yearly Instalments And Interest On Delayed Payment Is Exigible To GST: Telangana AAR

The Telangana Bench of Authority for Advance Ruling, consisting of members B. Raghu Kiran and S.V. Kasi Visweswara Rao, has ruled that payment of Equated Yearly Instalments made under Annuities Model, including interest on delayed payments made to a contractor, is exigible to GST. The Applicant M/s. Hyderabad Metropolitan Water Supply and Sewerage Board filed an application before...

Meghalaya High Court Suggests Army To Conduct Surprise Checks On Its Vehicles To Prevent Possible Durg Trafficking

The Meghalaya High Court has put up a significant suggestion that 'flying army checker' teams could be deployed for surprise checks on Army vehicles so as to ensure that drugs are not transported in or through army trucks.The Bench of Chief Justice Sanjib Banerjee and Justice W. Diengdoh came up with this suggestion while hearing a Public Interest Litigation (PIL) plea filed by one M....

Madras High Court Quashes Suspension Of Former ABVP President Dr. Subbiah Shanmugham

The Madras High Court on Thursday quashed the order of suspension of former ABVP President Dr. Subbiah Shanmugham, Government Surgical Oncologist for alleged association with a political organisation. The bench of Justice D. Krishnakumar further directed the Tamil Nadu Government to complete the departmental enquiry against Dr. Subbiah within a period of 12 weeks. The Court also directed...

Pink Police Harassment: State Urges Kerala High Court To Let Concerned Officer Pay The Compensation Ordered By Single Judge

The State government argued before the Kerala High Court that the concerned pink police officer who harassed a minor girl and her father last year should pay the compensation ordered by the Single Judge. (Pink police is a special women protection squad of Kerala police).The said officer was found guilty of having harassed them in public gaze casting accusations of theft on the duo and the...

Madras High Court Quashes Defamation Petition Against Edappadi Palanisamy And O Panneerselvam

The Madras High Court on Thursday quashed the defamation proceedings against Edappadi K. Palanisamy and O. Panneerselvam on the file of Additional Special Court for Trial of Criminal Cases related to Elected Members of Parliament and Members of Legislative Assembly of Tamil Nadu, Chennai. Allowing the petition filed by Palanisamy and Panneerselvam, Justice M Nirmal Kumar held...

Issue Of Notice Of Hearing Is A Statutory Requirement Under Section 75(4) Of CGST Act Before Imposition Of Tax Or Penalty: Andhra Pradesh High Court

The Andhra Pradesh High Court recently allowed the writ petition by an assesse as there was no notice given to him before contemplating to pass an adverse Tax Assessment Order which is violative of Section 75(4) of CGST Act, 2017. Brief Facts of the Case The petitioner executed certain works entrusted to it by M/s Tata Projects Limited, and issued Tax invoices to M/s Tata. It...

Attachment of Immovable Properties Of Director Despite settlement of Tax Dues Under Tax Resolution Scheme: Gujarat High Court Condemns Dept.

The Gujarat High Court bench of Justice J.B. Pardiwala and Justice Nisha M. Thakore has condemned the act of the department for attaching the personal immovable properties of the director even though the tax dues were settled under the Tax Resolution Scheme. The writ-petitioner/assessee, a company which is a taxable entity, has incurred liability towards the payment of tax under...

'Not Always Possible To Produce Indian Spouse For Processing OCI Card Application': Delhi High Court Upholds Single Judge's Order

The Delhi High Court has upheld an order passed by the single judge excusing an Iranian woman from producing her estranged Indian husband before the authorities for processing her OCI (Overseas Citizen of India) card application.The single judge had held that presence of both spouses for the purpose of processing an OCI card application is not mandatoryUpholding this view, the Division Bench...

High Court Warns Of Contempt Over Delhi Govt's Failure To Appoint Additional Staff At Indira Gandhi Super Speciality Hospital

The Delhi High Court on Wednesday warned of initiating contempt proceedings against officials of the Administrative Reforms Department of the Delhi government, over their failure to comply with its previous direction for expeditious appointments at the Indira Gandhi Super Speciality Hospital in Dwarka.The Bench of Acting Chief Justice Vipin Sanghi and Justice Navin Chawla observed that there...

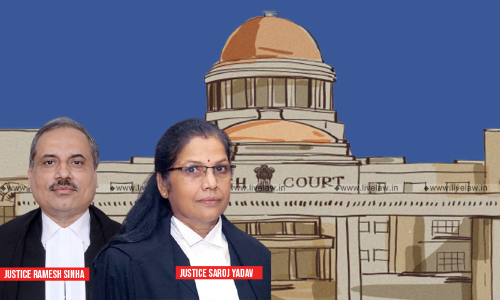

Allahabad High Court Grants Bail To Murder-Convict In Jail For Over 16 Yrs In View Of SC's Order In 'Saudan Singh' Case

Taking into account the recent ruling of the Supreme Court in the case of Saudan Singh Vs. State of Uttar Pradesh (Crl.Appeal No.308/ 2022), the Allahabad High Court on Wednesday granted bail to one Fareed who has already served over a total of 16 years in jail.The Bench of Justice Ramesh Sinha and Justice Saroj Yadav also took into account the recent observations made by the Supreme Court in...