News Updates

Delhi High Court Orders Medical Examination Of Candidate With Temporary Mental Illness To Assess If He Can Study MBBS

Update: AIIMS Medical Board assessed current disability of Petitioner to be less than 40%, i.e. mild disability. Accordingly, Petitioner is not entitled to reservation as a person with disability. Petition disposed as infructuous on April 5, 2022.In relief to a medical aspirant suffering from temporary mental illness, the Delhi High Court has ordered AIIMS to conduct his medical examination...

Only 'Indian Citizens' Can Initiate Proceedings Under Senior Citizens Act: Karnataka High Court

The Karnataka High Court has held that only 'Indian Citizens' can initiate proceedings under the Maintenance and Welfare of Parents and Senior Citizens Act, 2007. A Single Judge bench of Justice P. Krishna Bhat said, "It is evident that one of the essential elements for being designated a 'Senior Citizen' for the purposes of the Act is the person being an Indian citizen." The...

'What Kind Of Matter Is This?': Delhi High Court Refuses To Hear Plea To Award 'Bharat Ratna' To Industrialist Ratan Tata

The Delhi High Court today refused to hear a PIL seeking to award 'Bharat Ratna' to industrialist Ratan Tata. The plea sought the award citing Tata's invaluable service to the country and for leading an "unblemished life". At the outset, the Division bench of Acting Chief Justice Vipin Sanghi and Justice Navin Chawla made it clear that it is not for the Courts to decide as to who should...

Writ Is Not A Proper Remedy For Seriously Disputed Question Of Facts That Are Matters Of Evidence: Andhra Pradesh High Court

The Andhra Pradesh High Court recently dismissed the writ petition which brought up for consideration seriously disputed questions of facts that are matters of evidence, and held that the same falls outside the writ jurisdiction of the Court under Article 226 of the Constitution of India. Brief Facts of the case The Writ Petition was filed questioning the inaction of the...

Delhi High Court Dismisses Plea Challenging Eviction Of Chirag Paswan From Govt Bungalow

The Delhi High Court on Thursday refused to interfere with the eviction of Lok Janshakti Party (LJP) MP Chirag Paswan from a government Bungalow situated in city's Janpath area which was originally allotted to his later father, Former Union Minister Ram Vilas Paswan.Justice Yashwant Varma dismissed a petition filed by Reena Paswan, Chirag Paswan's mother. "This is not your party...

New Motor Vehicles Act Provisions Effective From April 1: Limitation For MACT Claims, Removal Of 2nd Schedule & More

New provisions of the Motor Vehicles Act relating to third party insurance and filing of claims before Motor Accident Claims Tribunal will come into force from tomorrow, April 1, 2022.The Central Government has notified that Sections 50 to 57 and 93 of the Motor Vehicles (Amendment Act) 2019 will come into force with effect from April 1, 2022.A notification issued by the Ministry of...

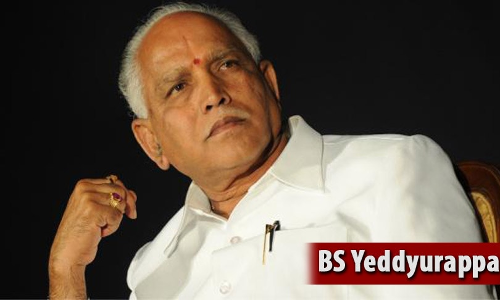

Land Denotification Case| Special Court Orders Registration Of Criminal Case Against Former Karnataka Chief Minister BS Yediyurappa

A Special Court in Bengaluru, has ordered the registration of a criminal case under provisions of the Prevention of Corruption Act, against former Chief Minister of the state BS Yediyurappa, in connection with a land denotification case pertaining to the 2006-07 period when Yediyurappa was the Deputy Chief Minister. Additional City Civil and Sessions Judge B. Jayantha...

The Corporate Democracy And Demarcation Of Powers Of NCLT & Civil Courts

The recent developments appear to suggest that Invesco, one of the investors of Zee, has decided to withdraw its requisition notice which sought the removal of MD and CEO Mr. Punit Goenka from Board of Directors ("Board") of Zee. Though the withdrawal might end the dispute, the Order of the Division Bench of the Hon'ble Bombay High Court ("Division Bench") will be significant in reaffirming the position as far as corporate democracy and shareholder's statutory rights are concerned. The...

Victim's Expression "Came On Top Of Me" Must Be Construed As 'Penetrative Sexual Assault' Under POCSO Act: Meghalaya High Court

The Meghalaya High Court has recently held that the expression "came on top of me" must be construed as a euphemism for commission of 'penetrative sexual assault'. A Division Bench Chief Justice Sanjib Banerjee and Justice W. Diengdoh observed, "The later statement of the victim recorded in course of her deposition at the trial must be seen in the milieu of how a woman in this...

Show-Cause Notice And The Final Order By Public Authority Having Different Reasons Is Grave Illegality: Andhra Pradesh High Court

In a recent case, Justice Satyanarayana Murthy of Andhra Pradesh High Court, passed a detailed order stating that show-cause notice and the final order cannot have different reasons or grounds as it denies the noticee the opportunity to rebut the allegations. Facts of the case The facts of the case are that the petitioner was serving in the Indian Army since 2005 as soldier....

Non-Availability Of Form GST ITC-02A On GSTN Portal: Rajasthan High Court Allows ITC In GSTR-3B

The Rajasthan High Court bench of Justice Sandeep Mehta and Justice Vinod Kumar Bharwani has allowed the Input Tax Credit (ITC) under GST in GSTR-3B Return as FORM GST ITC-02A was not available on the GSTN Portal at the time of its insertion. The petitioner, a registered dealer under the GST regime, with two industrial units registered in Udaipur. The Union of India prescribed Form...

"Direct Attack On Democracy": AAP MLA Moves Delhi High Court Seeking SIT Probe Into Vandalization At CM Arvind Kejriwal's Residence

Aam Aadmi Party MLA Saurabh Bhardwaj has approached the Delhi High Court seeking an SIT investigation into the incident of attack and vandalization of official residence of Chief Minister Arvind Kejriwal yesterday, alleging it to be done by "goons of the Bhartiya Janata Party" under the garb of protest. Calling it a direct attack on democracy, the petition moved through Advocate Bharat...