News Updates

Fraudulent Claim of ITC, Revenue Interest is Protected by Attachment: Gujarat High Court Grants Bail

The Gujarat High Court bench of Justice Gita Gopi has granted bail to the accused of fraudulently availing the input tax credit (ITC) as the department has attached the immovable properties, which were much beyond the alleged GST evasion. The applicant, a designated partner and managing director of "Utkarsh Ispat LLP," which is in the business of purchasing mild steel scrap...

'Confinement Inevitable': Madras HC Denies Bail To NRI Company Director Accused Of Money Laundering, Supplying Inferior Quality Coal To PSUs

Madras High Court has refused to grant bail to Ahmed A.R Buhari, director and promoter of M/s Coastal Energen Private Limited (CEPL), accused of the offence under Section 3 of the Prevention of Money Laundering Act, 2002.Justice G. Jayachandran observed that the petitioner is alleged to have supplied Indonesian imported coal of inferior quality to Public Sector Undertakings (PSUs), routing...

IAMC Hyderabad Releases Quarterly Report, Claims Administering Disputes To The Tune Of 400 Million US Dollars

In the first Quarterly Report issued by International Arbitration and Mediation Centre (IAMC) since its inauguration, it has been claimed that disputes to the tune of 400 Million US Dollars have been administered by the Centre. The report also states that a variety of matters have been referred to the Centre by courts and tribunals, including two matters from the Supreme Court.In the...

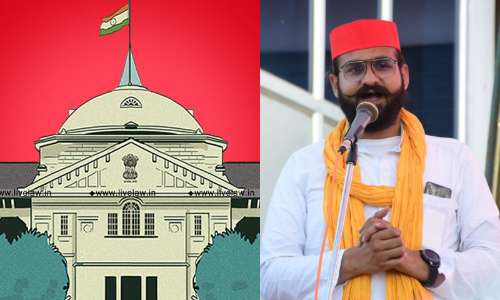

'Hisab Kitab' Remark Case: Allahabad High Court Stays Arrest Of Mukhtar Ansari's Son & Mau MLA Abbas Ansari

The Allahabad High Court has stayed the arrest of Mau Sadar MLA Abbas Ansari, the son of jailed politician Mukhtar Ansari in connection with the Hisab-Kitab Remark case registered against him for his alleged statement threatening the government officials with payback at a public rally in Mau district earlier this month.It may be noted that at a public rally during the election campaigning,...

No Manufacturing Activity Within State , ITC Cannot Be Denied Under JVAT Act: Jharkhand High Court

The Jharkhand High Court has ruled that Input Tax Credit can be denied on Inter-State sale or transfer of stock under Section 18(8)(ix) of the Jharkhand Value Added Tax Act, 2005 only when some manufacturing activity is undertaken by the assessee in the State. The Bench, consisting of Justices Aparesh Kumar Singh and Deepak Roshan, has held that in a taxing statue there is no room...

Delhi High Court Refuses To Entertain PIL Seeking Probe Into Organizations Allegedly Siphoning Off Covid-19 Crowdfunds For Terrorist Activities

The Delhi High Court on Tuesday refused to entertain a public interest litigation seeking probe into several foreign organizations that collected crowd funds under the garb of helping India amid the second wave of COVID-19 pandemic in April 2021 and allegedly siphoned off the same for funding terrorist activities.The Division Bench of Acting Chief Justice Vipin Sanghi and Justice Navin...

Director Can't Be Prosecuted U/S 138 Of Negotiable Instruments Act If Company Is Not Arraigned As Accused: Chhattisgarh High Court

The Chhattisgarh High Court recently held that a director could not be prosecuted under Section 138 of the Negotiable Instruments Act without the company being arraigned as an accused. Justice Gautam Bhaduri allowed the petition to quash the impugned orders and noted that only directors of the company are made the accused without making specific averments about the role played by them,...

K-Rail Silverline - No Illegality In State Invoking LARR Act For Land Acquisition : Kerala High Court

The Kerala High Court on Tuesday held that the State government was justified in acquiring land in furtherance of its K-Rail SilverLine Project invoking provisions of the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 (LARR Act)Justice N. Nagaresh observed that the Railways Act, 1989 would not apply to this case since the Silver...

CPC Second Appeal | Can't Interfere With Orders Solely On Ground Of Sympathy, Substantial Question Of Law Must: Delhi High Court

The Delhi High Court has observed that a High Court cannot interfere with an order in second appeal under sec. 100 of Code of Civil Procedure, solely on the ground of sympathy in the absence of any substantial question of law. Sec. 100 of the CPC gives a procedural right of second appeal to either of the parties to a civil suit who had been adversely affected by the decree passed by a...

Himachal Pradesh High Court Issues Notice On Plea To Restrain State Govt From Paying Income Tax Of MLAs, Ministers

The Himachal Pradesh High Court has issued a notice to the state government on a plea challenging the provisions of the Himachal Pradesh Legislative Assembly (Allowances & Pension of Members) Act, 1971 and Salaries & Allowances of Ministers (Himachal Pradesh) Act, 2000, which exempt legislators and ministers from income tax on their salaries and allowances. The bench of Chief...

Ejipura-Kendriya Sadana Flyover: Karnataka High Court Wants Project To Be Completed This Year, Tells Contractor To File Undertaking

The Karnataka High Court on Tuesday suggested M/S Simplex Infrastructures Ltd to file an undertaking in court by Monday indicating that it would complete the four-lane Ejipura-Kendriya Sadana flyover in the Koramangala area of Bengaluru in a time bound manner. A division bench of Chief Justice Ritu Raj Awasthi and Justice S R Krishan Kumar said, "Considering the facts that in case a...

Accused Can't Take Advantage Of Their Own Dilatory Tactics & Seek Bail If There Is Delay In Completing Trial: Andhra Pradesh High Court

The Andhra Pradesh High Court in a recent case observed that the accused had created hurdles from time to time so that the trial could not be completed. As a consequence, the accused/petitioner is not entitled to bail as it cannot take advantage of their own dilatory tactics. Brief Facts of the case The Criminal Petition was filed under Section 439 of the Code of Criminal Procedure...