News Updates

Rejection Of GST Refund Application On The Ground Of Delay Not Valid, Extension Of Limitation Applicable: Allahabad High Court

The Allahabad High Court bench consisting of Justice Surya Prakash Kesarwani and Justice Jayant Banerji observed that the refund application under the Goods and Service Tax (GST) cannot be rejected merely on the ground of delay."We find that the refund application of the petitioner could not have been rejected by the respondent merely on the ground of delay, ignoring the order of the...

'Wakf Board Meddling In Administration Of Nagore Dargah': Ad Hoc Board Of Administrators Files Affidavit Before Madras HC

Nagore Dargah's Ad-Hoc Board of Administrators has filed an affidavit before the Madras High Court stating that they have done everything in the best interests of the Dargah and the Tamil Nadu State Wakf Board has been meddling in the day to day administration of dargah from June 2018."...the counsel for the Tamil Nadu Wakf Board had claimed to represent us though we did not authorize him and...

Lawyer Appears In Court Without Gown, Allahabad High Court Calls It 'Unfortunate'

The Allahabad High Court recently pulled up a Lawyer who appeared in the court without a gown and termed it as 'unfortunate'.The Bench of Justice Pritinker Diwaker and Justice Ashutosh Srivastava, however, did not refer the matter to the State Bar Council as it noted that he is a 'young' lawyer."Shri Sandeep, appeared in the Court without gown, this is unfortunate. However, considering the...

Section 125 CrPC Falls Within Constitutional Sweep Of Article 15 (3); It Intends To Protect Women, Children & Infirm Parents: Allahabad HC

The Allahabad High Court has observed that Section 125 Cr.P.C. is enacted for social justice and especially to protect women and children and also old and infirm parents and that this provision falls within the constitutional sweep of Article 15 (3), re-enforced by Article 39 of the Constitution of India. The Bench of Justice Shekhar Kumar Yadav observed thus as it stressed that this...

Testimony Of Interested Witness Has To Be Examined With Extra Care And Caution, Reiterates Allahabad High Court

While stressing that during the trial of a case, the testimonies of the interested witnesses have to be examined with extra care and caution, the Allahabad High Court today dismissed an appeal filed by the informant of the case challenging the acquittal order of the trial court in an attempt to murder case.Finding serious discrepancies in the statements of the interested witnesses in the...

Sedition Case: Delhi Court Proposes Day To Day Hearing Of Trial Against Sharjeel Imam In Anti-CAA Speeches Case

A Delhi Court on Tuesday proposed day to day hearing of the trial against Sharjeel Imam in a case relating to the alleged inflammatory speeches made by him in Aligarh Muslim University and Jamia area in Delhi against the Citizenship Amendment Act.Additional Sessions Judge Amitabh Rawat today formally framed charges against Imam in his presence and read out and explained the said charges...

Govt. Reduces GST To 5% On Domestic Maintenance, Repair and Overhaul Services In Aviation Industry

The Ministry of Civil Aviation has notified the reduction in Goods and Service Tax (GST) from 18% to 5% on Domestic Maintenance, Repair, and Overhaul Services. The press release stated that the average number of passengers carried in the pre-COVID financial year (2019–20) was around 4 lakh per day. On March 6, 2022, domestic airlines in India carried around 3.7...

'Underwent A Traumatic Experience, Was Panic Stricken & Disoriented': Calcutta HC Dismisses Plea Of Delayed Lodging Of FIR, Upholds Conviction Of Gang Rape

The Calcutta High Court has recently observed that a delay of a few hours in lodging of the FIR by a victim of gang rape will not vitiate the prosecution case since it is natural for the victim to remain disoriented and confused after having gone through such a traumatic experience thereby justifying such a delay. A Bench comprising Justice Joymalya Bagchi and Bivas Pattanayak was...

Karnataka Education Act Empowers Government To Prescribe Uniform: Karnataka High Court In Hijab Case

The Karnataka High Court on Tuesday upheld the validity of the Government order dated February 5, providing for prescription of dress code in educational institutions. A full bench of Chief Justice Ritu Raj Awasthi, Justice Krishan S Dixit and Justice J M Khazi said, "Section 133(2) of the (Education) Act which is broadly worded empowers the government to issue any directions...

NEET-UG | Students Domiciled In Maharashtra But Passing 10th/ 12th Standard From Outside Not Eligible To Avail State Quota: Bombay High Court

The Bombay High Court has held that a medical aspirant domiciled in Maharashtra, but having passed 10th or 12th standard from outside the state shall not be eligible to avail the benefit under State quota for the purpose of NEET-UF examination."It is permissible to lay down the essential educational requirements, residential/domicile in a particular State in respect of basic...

IPL 2022: Delhi High Court Orders Blocking Of Rogue Websites Illegally Streaming Cricket Matches

The Delhi High Court has ordered for blocking of 8 rogue websites alleged to be illegally streaming cricket matches of TATA Indian Premier League (IPL) 2022. Considering the fact that the match is starting from 26th March, 2022, Justice Pratibha M Singh was of the view that there was an imminent need to protect the investment of the plaintiffs, Star India Private Limited, as also to ensure...

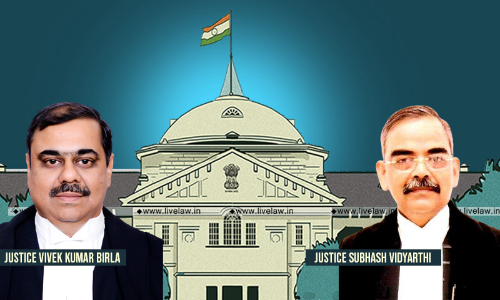

Uttarakhand High Court Forms Committee To Look Into The Haldwani Medical College Ragging Incident, Take Action

Taking note of the recent ragging incident that took place in the Haldwani Medical College, the Uttarakhand High Court has formed a committee to inspect the College premises, examine the video footage available and also examine the students and take appropriate action in the matter.The Bench of Acting Chief Justice Sanjaya Kumar Mishra and Justice Ramesh Chandra Khulbe issued this direction on...