News Updates

Supreme Court Refuses To Interfere In Plea Challenging Notification To De Notify Galathea Bay Wildlife Sanctuary; Grants Liberty To Approach High Court

The Supreme Court on Friday dismissed as withdrawn a plea challenging notification dated January 25, 2021 ("impugned notification") issued by the Commissioner-cum-Secretary (E&F), Andaman and Nicobar Administration to de-notify the Galathea Bay Wildlife Sanctuary.The bench of Justices S Abdul Nazeer and Krishna Murari granted the petitioner liberty to approach the High Court. It was stated...

Release Funds Earmarked For Indian Women's Handball Team's Participation In Asian Jr. Championship: Allahabad HC Directs SAI

The Allahabad High Court today directed the Sports Authority of India (SAI) to release necessary funds for sponsoring the Women's Handball National team so that its participation in the 16th Asian Women Junior Handball Championship could be ensured. The Championship would be held in Kazakhstan from March 7 to March 14, 2022.The Bench of Justice Attau Rahman Masoodi, Justice Narendra Kumar...

Petitioners Not Being Employees Have No Legal Right To Stop Govt From Outsourcing Services: Madhya Pradesh High Court

The Madhya Pradesh High Court recently held that the Petitioners, who were working for an agency that was hired by the State, did not have a legal right to stop the government from outsourcing services in the interest of the economy and efficiency. Justice S.A. Dharmadhikari was dealing with a batch of petitions that were challenging the order passed by the State Government, whereby...

Kerala High Court Drops Proceedings Against Two Nuns Accused Of Sharing Rape Survivor's Photo With Media

The Kerala High Court on Thursday quashed the proceedings against two nuns for allegedly disclosing the identity of a rape survivor by sharing her photo with the media.The nuns had shared a photograph of the rape survivor along with a few priests via email to three media personnel, however, the name or identity of the survivor was not published in the reports. Moreover, the email...

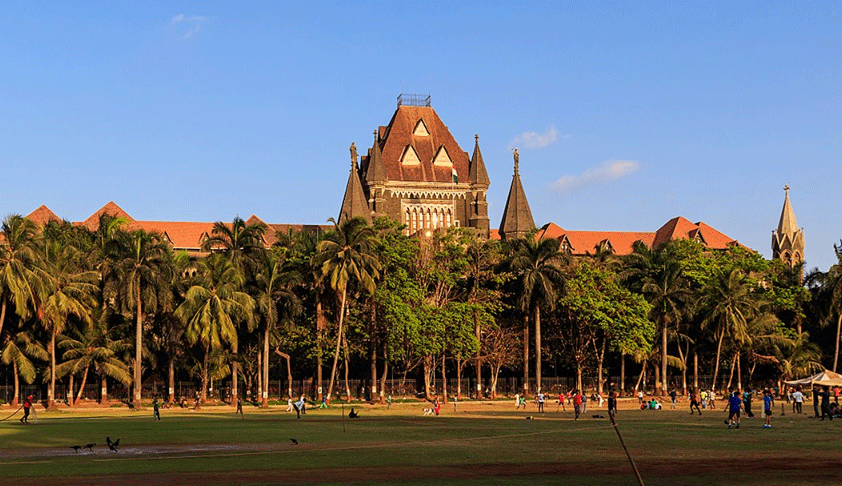

Over 500 Criminal Cases Pending Against MP/MLAs In Maharashtra, Goa; Maximum Cases In Amravati District, Zero In Naxal Belt Of Gadchiroli

Amravati district of Maharashtra has the highest number of pending cases against MPs and MLAs in Maharashtra, while the Naxal infested Gadchiroli doesn't have a single pending case against sitting and former legislators, data submitted to the Bombay High Court revealed. Out of nearly 500 cases pending in various trial courts in Maharashtra, Amravati and Parbhani have 45 and 40...

Telangana Court Imposes ₹10 Lakh Cost On Filmmaker Who Sought Injunction On Release Of Amitabh Bachchan Starrer 'Jhund'

A local Court in Telangana has dismissed a petition filed by Hyderabad filmmaker Nandi Chini Kumar, seeking to restrain the release of Amitabh Bachchan starrer 'Jhund', which hit the theatres today. The Court also imposed a cost of Rs. 10 lakh.Kumar had sought to recall January 2021 order whereby the civil suit filed by him seeking damages from Super Casettes (TSeries), producer of the film,...

'Exercise Discretion With Humane Consideration': MP High Court Directs State To Consider Request Of Visually Impaired Teacher For Preferable Posting

The Madhya Pradesh High Court recently directed the State Government to sympathetically consider the representation of a government school teacher, who was 100 percent visually impaired, for a posting based on her preference. The case of the Petitioner was that she was a resident of Waraseoni, District Balaghat and was 100 percent visually impaired. She was recently appointed as...

Can Special Judge Under Electricity Act Try Case Also Involving Offences Under IPC? Madhya Pradesh High Court Answers

Answering a reference requested by the lower court, the High Court of Madhya Pradesh, Indore Bench recently held that a Special Judge under the Electricity Act, 2003 can try a case, wherein the accused is also charged for offences punishable under the Indian Penal Code. The reference arose out of a case in which the accused was charged U/S 139 Electricity Act, and U/S 279,427 IPC....

"Witnesses' Statements Can't Be Discarded Even Though Recorded After More Than One Year": Court Frames Charges Against Six In Delhi Riots Case

A Delhi Court on Friday framed charges against six men in connection with a case concerning the North East Delhi riots of 2020 observing that statements of witnesses cannot be discarded at the stage of framing of charges even though recorded after more than one year of incident of violence. Additional Sessions Judge Virender Bhat framed charges against Bilal Ansari, Suhail @ Bholu, Imran,...

Courts Can't Direct Govt To Have A Particular Method Of Recruitment, Eligibility Criteria For Services: Allahabad High Court

The Allahabad High Court has observed that the prescription of qualifications and other conditions of service pertains to the field of policy and is within the exclusive discretion and jurisdiction of the State and that it is not open to the Courts to direct the Government to have a particular method of recruitment or eligibility criteria.The Bench of Justice Manju Rani Chauhan further...

'Costs Over 80 Crores A Year' : Plea Before Kerala High Court Challenges Pensions Granted To Ministers' Personal Staff In State

A Public Interest Litigation (PIL) has reached the Kerala High Court challenging the manner of appointment of personal staff to ministers in the State and the consequent pension benefits provided to them despite having served only a couple of years in office. Significantly, the plea estimated that the State is currently spending at least Rs. 80 crore per annum for paying pension."When...

Civil Court Not Barred By Education Act To Hear Recovery Suit Filed By Teacher 'Discharged' From Service Sans Order On Her Claim: Karnataka HC

The Karnataka High Court has held that a civil court has jurisdiction to hear and decide on a suit filed by a teacher claiming arrears in salary, if she is discharged from her duties on account of closure of the school and no order is passed by the school management on her claims seeking arrears in salary. A Division bench of Dr.Justice H.B.Prabhakara Sastry and Justice S....