News Updates

State Can Notify All Corporations, Municipalities & Panchayats U/S 58(f) Of Transfer Of Property Act: Kerala High Court

The Kerala High Court has recently held that the State Government is justified in notifying all Corporations, Municipalities and Panchayats in the State of Kerala under Section 58(f) of the Transfer of Property Act.A Division Bench of Chief Justice S. Manikumar and Justice Shaji P. Chaly thereby refused to interfere with a State notification in that regard and accordingly dismissed an appeal....

'Lives In Victim's Neighborhood, Took Advantage Of Her Mental Faculties': Delhi High Court Cancels Bail Of Rape Accused

The Delhi High Court has cancelled the bail of a man accused of raping a 37 year old woman suffering from bipolar mental disorder episodic mania and psychotic features after taking her undue advantage, while directing him to surrender in custody within a week. Justice Mukta Gupta noted that the Trial Court failed to notice that the accused was living in the neighbourhood of the prosecutrix,...

Madras High Court Directs De-Sealing Mylapore Club, Orders Re-Determination Of Rent Arrears

In a writ appeal arising from a dispute regarding payment of rent to Kapaleeswar temple by Mylapore Club, Madras High Court has directed the HR & CE Department to de-seal the premises of Mylapore Club.The first bench of Chief Justice Munishwar Nath Bhandari and Justice D Bharatha Chakravarthy has also instructed the respondents for revision/ re-determination of rent arrears by applying...

Denying Carry Forward Of Business Loss Based On Non-Completion Of Tax Audit Within Prescribed Time Not Justified: ITAT

The Cochin Bench of Income Tax Appellate Tribunal (ITAT) has ruled that denying the carry forward of business loss based on non-completion of tax audit/ statutory audit within prescribed time is not justified.The two-member bench of George Mathan (Judicial Member) and Ramit Kochar (Accountant Member) said, "there could be several reasons for not getting the statutory audit/tax-audit...

Obesity Is Not A Disease: 12% GST Payable On Pharmaceutical Pellets, Granules Except Orlistat Pellet: AAR

The Telangana Authority of Advance Ruling (AAR) has ruled that 12% GST payable on pharmaceutical pellets, and granules except Orlistat Pellet as obesity is not a disease. The two-member bench of B. Raghu Kiran (Central Tax) and S.V. Kasi Visweswara Rao (State Tax) has relied on the decision of the Supreme Court in the case of Commissioner of Central Excise Vs Wockhardt Life...

Can't Reopen Entire Premises Of Nizamuddin Markaz, Few People Can Offer Prayers For Shab-e-Barat, Ramzan: Centre Tells Delhi High Court

The Central Government on Friday informed the Delhi High Court that while few people can be permitted to offer prayers during the upcoming occasions of Shab-e-Barat and Ramzan festivals in the Nizamuddin Markaz, its entire premises cannot be reopened.Public entry was banned at the Nizamuddin Markaz in the aftermath of Tablighi Jamaat members testing positive for Covid-19 in 2020.Justice...

Construction Of Administrative Buildings For TSIIC Attracts 18% GST: AAR

The Telangana Authority of Advance Ruling (AAR) has ruled that 18% GST is applicable on construction of administrative buildings for Telangana State Industrial Infrastructure Corporation Limited (TSIIC).The two-member bench of B. Raghu Kiran (Central Tax) and S.V. Kasi Visweswara Rao (State Tax) has observed that the works contract executed by the applicant for construction...

Senior Citizens Act Does Not Contemplate Eviction Of Children, Tribunal Can Only Order Maintenance: Rajasthan High Court

The Rajasthan High Court observed that Maintenance and Welfare of Parents and Senior Citizens Act, 2007 (Act, 2007) does not envisage an order of eviction even by the District Magistrate, much less the Tribunal. The court dealt with the question whether pursuant to an application filed under Section 5 of Act, 2007 read with Rajasthan Maintenance of Parents and Senior Citizens Rules,...

"Can't Curtail Discussion In Academic World": Delhi High Court To Vikram Sampath In His Suit Against Audrey Truschke

The Delhi High Court on Friday refused to grant any urgent relief to historian Dr. Vikram Sampath, who is aggrieved over circulation of a google document, purportedly signed by various academicians who came in support of historian Audrey Truschke over allegations of plagiarism regarding Sampath's work on Vinayak Damodar Savarkar.Sampath claimed that the document was posted Truschke on...

Punjab & Haryana HC Again Directs Centre To File Reply On Pleas Challenging Haryana's 75% Job Quota For Locals Law

The Punjab and Haryana High Court has once again directed the Union Government to file its response on a bunch of pleas challenging the Haryana law (The Haryana State Employment of Local Candidates Act 2020) which provides 75% reservation for local people in the private sector jobs having a monthly salary of less than Rs 30,000.On February 22 as well, the Bench of Justice Ajay Tewari and...

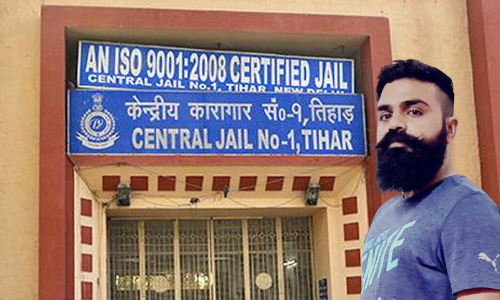

Tihar Inmate Ankit Gujjar Death Case: Delhi High Court Grants Time To CBI For Filing Further Status Report

The Delhi High Court on Friday granted time to the Central Bureau of Investigation (CBI) for filing further status report in connection with the alleged murder of inmate Ankit Gujjar, a 29-year old alleged gangster, who was found dead inside Tihar Jail.Rajesh Kumar, Special Public Prosecutor for CBI told Justice Manoj Kumar Ohri that while the agency has completed the investigation for...

Kerala High Court Notifies Directions For Road Safety Amid Rising Accidents Involving Sabarimala Pilgrims

In a judgment that runs beyond 120 pages, the Kerala High Court has issued a set of directions to ensure road safety and adherence with the provisions of the Motor Vehicles Act in the wake of the rising number of accidents reported concerning Sabarimala pilgrims travelling in buses and other contract carriages.A Division Bench of Justice Anil K. Narendran and Justice P.G Ajithkumar...