News Updates

Canceling Firearm License Without Recording A Finding That It Was Misused Isn't Justified: Allahabad High Court

The Allahabad High Court has observed that in absence of any finding recorded by authorities that a person has misused the firearm in question or there is any other disability on his/her part, the exercise of power in canceling the firearm license is not justified.The Bench of Justice Gautam Chowdhary observed thus while hearing a writ plea filed against an order of May 1989 passed by...

French Mastiff Dog 'Bruno' | Calcutta HC Directs Alleged Owner To Return Dog To NGO; Orders Police Enquiry Over Cruelty Allegations

The Calcutta High Court on Thursday directed the concerned police authorities to conduct an enquiry to find out whether the alleged owner in whose possession a French Mastiff dog named 'Bruno' is currently residing is actually the real owner. The Court also ordered that the dog should be returned to the concerned NGO from the possession of the alleged owner. A Single Bench had earlier...

State Govt. 'Appropriate Government' For Grant Of Remission Of Sentence For Convicts Under SC/ ST Act: Madras High Court

Madras High Court has held that the appropriate government for grant of remission of sentence to a person convicted under the Scheduled Castes and Scheduled Tribes (Prevention of Atrocities) Act, 1989 is the state government and not the Union government.A Division Bench of Justices P.N Prakash and R. Hemalatha concluded that the executive power of the Union, as well as the state,...

Accused Charged With Serious Offence Must Not Be Stripped Of The Valuable Right Of Impartial Trial: Allahabad HC

The Allahabad High Court on Wednesday observed that an accused who is charged with a serious offence, must not be stripped of his/her valuable right of a fair and impartial trial because it would be a negation of the concept of due process of law.The Bench of Justice Sanjay Kumar Singh observed thus while dealing with a 482 CrPC Application filed against the order of Additional Sessions...

Employee Permitted To 'Work From Home' As A Concession Can't Claim Change In Territorial Jurisdiction : Kerala High Court

The Kerala High Court recently held that mere permission to work from home is not sufficient to confer jurisdiction on the Court within whose jurisdiction the employee is working. Justice Sunil Thomas answered the question of jurisdiction for legal claims of remote employees and ruled that merely because they are permitted to work from home and the employer was aware that the employee was...

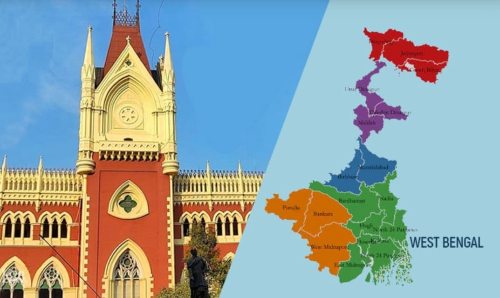

'An Election Gimmick': Calcutta HC Dismisses BJP Candidates' Plea Alleging Threats By Rival Party Members Amid Municipal Polls

The Calcutta High Court on Wednesday dismissed a petition filed by BJP candidates contesting in the upcoming West Bengal Municipal elections, seeking police protection from the State so that they get a fair chance to compete in the elections. The Court noted that several discrepancies had been found in the allegations levelled and further labelled such allegations to be an 'election...

Delhi Riots: High Court Refuses To Entertain Application Challenging Maintainability Of Plea To Investigate Politicians For Alleged Hate Speech

The Delhi High Court on Thursday refused to entertain an impleadment application challenging the maintainability of the plea seeking registration of FIR against various politicians for allegedly making hate speeches to incite the Delhi riots of 2020. The impleadment application was filed in a plea moved by Shaikh Mujtaba, seeking registration of FIR and investigation against BJP leaders...

Kerala Football Association A Private Organization, Not Amenable To Writ Jurisdiction: High Court Dismisses Plea Assailing ₹25K Entry Fee For State Tournament

The Kerala High Court on Wednesday held that a writ petition is not maintainable against the Kerala Football Association since it was a private organisation and was not discharging public functions. Justice P.V. Kunhikrishnan held so in a petition challenging a circular issued by the Association mandating a deposit of Rs. 25,000/- with tax as eligibility criteria to participate in the...

Appointment In Public Services Secured Through Fraudulent Concealment Void Ab Initio, Long Continuation In Service Immaterial: Allahabad High Court

The Allahabad High Court, sitting in Lucknow, recently held that when employment in a public service is obtained by playing fraud, the long continuation in such service would be immaterial to uphold the appointment.Justice Dinesh Kumar Singh observed,"it is evident that the petitioner has suppressed the material fact and played fraud for securing public employment and, therefore, his...

No Relaxation In Requirements Stipulated In Recruitment Advertisement Unless Power Is Specifically Reserved: Gujarat High Court

"When a particular schedule is mentioned in an advertisement, the same has to be scrupulously maintained. There cannot be any relaxation in terms and conditions of the advertisement unless such a power is reserved," the Gujarat High Court held recently.The Bench comprising Justice Biren Vaishnav made this observation in a Special Civil Application filed by one Parulben...

Proceedings For 'Refund Of Advance' Civil In Nature, 'Dishonest Intention' Must Exist From Inception Of Transaction To Attract 420 IPC: Telangana HC

The Telangana High Court recently reiterated that the dispute regarding non-refund of money is of civil nature. For criminal prosecution under the offence of cheating or criminal breach of trust, it has to be proved that the accused persons had an intention to cheat/deceive the victim from the inception and accused dishonestly misappropriated the property entrusted to...