News Updates

Department Should Not Have Invoked The Extended Time Period For Issuance Of Second Show Cause Notice Demanding Service Tax: CESTAT

The Ahmedabad Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that the second show cause notice should have been for a normal period of demand and the department should not have invoked the extended time period for demanding service tax.The bench of C.L. Mahar (technical member) has observed that a show cause notice has been issued on March 20, 2009,...

Penal Provision Of Central Excise Rules, 1944 Cannot Be Invoked Against The Accountant: CESTAT

The Ahmedabad Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that the penal provision of Rule 209 A of the Central Excise Rules, 1944, cannot be invoked against a person who is only involved in maintaining the accounts of the company.The bench of C.L. Mahar (technical member) has observed that as per Rule 209 A, the person who is to be penalized under...

Hindu Worshippers' Plea For ASI Survey Of Gyanvapi Premises: Varanasi Court Asks Mosque Committee To File Reply By May 19

The Varanasi District Court today granted 3 day time (till May 19) to the Anjuman Islamia Masjid committee (which manages Gyanvapi Mosque in Varanasi) to file their reply/objection, if any, on an application filed by 4 Hindu women worshippers seeking a survey of the entire Gyanvapi mosque premises by the Archaeological Survey of India (ASI) to find out as to whether the Mosque had...

Refund Cannot Be Denied To Any Person Who Has Borne The Incidence Of Tax: CESTAT

The Delhi Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that a refund cannot be denied to any person who has borne the incidence of tax.The bench of Justice Dilip Gupta (President) and Hemambika R. Priya (Technical Member) has observed that Rajasthan Housing Board (RHB) has also deducted the service tax payable by them by reverse charge mechanism from...

CESTAT Appeal Abates From The Date Of Approval Of The Resolution Plan By The NCLT: CESTAT

The Mumbai Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that from the date of approval of the resolution plan by the National Company Law Appellate Tribunal (NCLT), the appeal filed by the applicant has abated, and CESTAT has become functus officio in the matters relating to the appeal filed by Jet Airways.The bench of S.K. Mohanty (Judicial Member) and...

CBDT Notifies Income Tax Exemption To FSSAI

The Central Board of Direct Taxes (CBDT) has notified the income tax exemption to Food Safety and Standards Authority of India (FSSAI) under clause (46) of section 10 of the Income-tax Act, 1961.The Food Safety and Standards Authority of India is an Authority established by the Ministry of Health and Family Welfare, Government of India.The CBDT has exempted various incomes of...

Delhi High Court Quashes Penalty Order Under BMA On Failure Of Dept. To Consider Assessee’s Email

The Delhi High Court has quashed the penalty order under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (BMA) for non-consideration of the assessee’s email.The bench of Justice Rajiv Shakdher and Justice Tara Vitasta Ganju has observed that, as per the reply filed by the petitioner/assessee, his assertion was that the penalty proceedings should be...

Bombay High Court Quashes Reassessment Triggered On A Change Of Opinion As To The Calculation Of Tax Payable By The Assessee

The Bombay High Court has quashed the reassessment proceedings triggered by a change of opinion as to the calculation of tax payable by the assessee.The bench of Justice Dhiraj Singh Thakur and Justice Kamal Khata has found no substance in the AO’s reason to believe that income chargeable to tax has escaped assessment in so far as there is no mention of any tangible material that led to...

Transfer Of Goods By Power Grid Corporation To Its Contractor Does Not Involve Transfer Of Ownership, Hence No Sale: Jammu & Kashmir High Court

The Jammu & Kashmir High Court has held that sales tax is not leviable on materials purchased by Power Grid Corporation from outside the state and transferred to contractors.The bench of Justice Sanjeev Kumar and Justice Rajesh Sekhri has observed that the transaction between the assessee, Power Grid Corporation, and the contractors in which the assessee supplied the goods and...

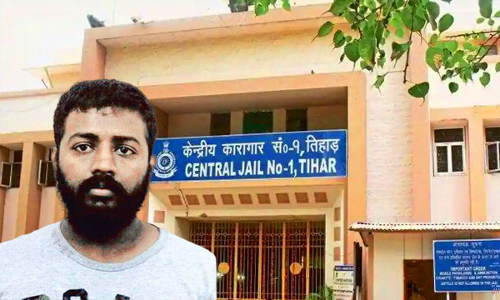

Supreme Court Dismisses Plea Of Sukesh Chandrashekhar & Wife Seeking More Time For Meeting With Lawyers

The Supreme Court, on Tuesday, refused to entertain a writ petition filed by alleged conman Sukesh Chandrashekhar and wife Leena Paulose seeking extension in the visitation time allotted by jail authorities to meet family, friends and legal representatives.Noting that the accused persons were not in a position to seek such ‘privileges’ and make such ‘extraordinary demands’, a ...

4 Hindu Women Worshippers Move Application In Varanasi Court For ASI Survey Of Entire Gyanvapi Mosque Premises

In a significant development in the Kashi Vishvanath-Gyanvapi Mosque dispute cases, 4 Hindu women worshippers have moved an application before the Varanasi District Judge seeking a survey of the entire Gyanvapi mosque premises by the Archaeological Survey of India (ASI) to find out as to whether the Mosque had been constructed over a pre-existing structure of the Hindu temple.The...

Weekly Digest Of IBC Cases: 8 May To 14 May 2023

Supreme Court IBC | Date Of Order Pronouncement & Time Taken To Provide Certified Copy Excluded From Limitation Period For Appeal To NCLAT: Supreme Court Case Title: Sanket Kumar Agarwal & Anr v APG Logistics Private Limited Citation: 2023 LiveLaw (SC) 406 The Supreme Court Bench comprising Chief Justice of India Dr. Dhananjaya Y Chandrachud and Justice J...