News Updates

21 Yrs Have Elapsed: Kerala High Court Quashes Perjury Case Against Hostile Witness In ‘Kalluvaathukkal Liquor Tragedy' Case

The Kerala High Court recently quashed proceedings against a witness who had turned hostile in the ‘Kalluvaathukkal liquor tragedy' case. The court was of the view that since the main accused persons were convicted in the trial and the evidence of the hostile witness did not have any impact on the case, prosecuting the witness 21 years after giving evidence, would be an abuse of the...

No Maintenance Under Domestic Violence Act For "Refusal Or Neglect" To Maintain Wife: Bombay High Court

When no domestic violence is found in a domestic violence case, maintenance cannot be awarded to wife on the ground that husband refused and neglected to maintain her, the Bombay High Court held recently.Justice SG Mehare of Aurangabad bench observed that the concept of “refusal and neglect to maintain wife” given in section 125 CrPC does not exist in the Protection of Women From...

Kerala High Court Dismisses PIL Seeking Ban On Non-Therapeutic Circumcisions

The Kerala High Court recently dismissed a Public Interest Litigation filed by Non-Religious Citizens (NRC), a cultural organisation based in Kerala, seeking to declare the practice of non-therapeutic circumcision illegal. A division bench of Chief Justice S Manikumar and Justice Murali Purushothaman observed that the petitioners relied on newspaper reports to support their contentions and...

Uttarakhand High Court Directs State To Disclose Status Of Lokayukta Institution, Expenditure Incurred Since Inception

The Uttarakhand High Court bench comprising Chief Justice Vipin Sanghi and Justice Alok Kumar Verma has directed the State to disclose the status regarding the establishment of the Lokayukta Institution, as well as the expenditure incurred on the said institution since its inception, year-wise up to 31st March 2023 within three weeks.The court was hearing the PIL filed by a resident...

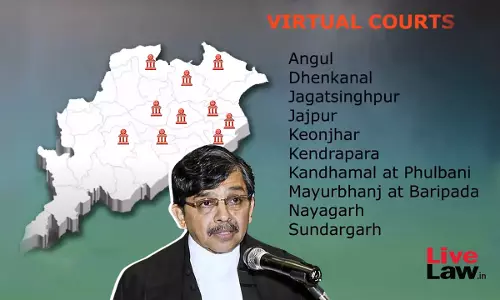

Chief Justice Muralidhar Inaugurates Virtual High Courts In 10 More Districts Of Odisha

Chief Justice of the Orissa High Court Dr. Justice S. Muralidhar on Monday inaugurated 10 ‘Virtual High Courts’ in 10 more districts of the State of Odisha. On 3rd February this year, the High Court had established Virtual High Courts in 10 of the 30 Districts in the 1st phase, which were inaugurated by CJI DY Chandrachud virtually.After receiving encouraging feedback about the 1st phase,...

Section 46(4) CrPC: Madras High Court Directs State To Frame Guidelines For Obtaining 'Prior Permission' Of Magistrate To Arrest Women At Night

The Madras High Court has directed the State government to ensure compliance with Section 46 of the Criminal Procedure Code (CrPC) and frame guidelines for obtaining 'prior permission' of Judicial Magistrate to arrest women at night in exceptional circumstances. Section 46 of CrPC which deals with procedure to be followed while making an arrest, specifically bars arrest of women...

AO Has Reduced The Procedure To An Empty Formality, To Be Deprecated: Calcutta High Court

The Calcutta High Court had quashed the Assessment Order and held that the assessing officer has reduced the procedure to an empty formality, which has to be deprecated.The division bench of Justice T.S. Sivagnanam and Justice Hiranmay Bhattacharyya has observed that the first 21 pages of the assessment order are a verbatim extract of the show cause notice. On pages nos.22 and 23 in...

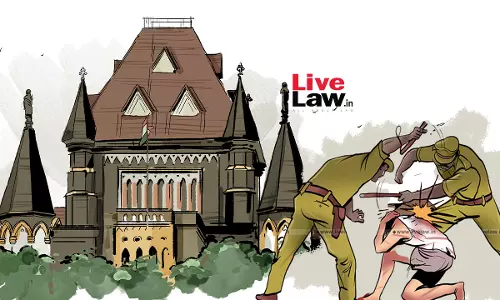

Custodial Torture Not Official Duty: Bombay Hight Court Directs Sessions Court To Enhance Charges Against Police Officers From Hurt To Murder

Observing that a sanction isn’t required to prosecute police officers in cases of death due to custodial torture, the Bombay High Court directed a Special CBI Court to charge three police officers with murder of a 23-year-old man in 2009.Justice PD Naik set aside an order of the Sessions Court simply upholding charges under section 323 (hurt) of the IPC, based on the CBI’s investigation,...

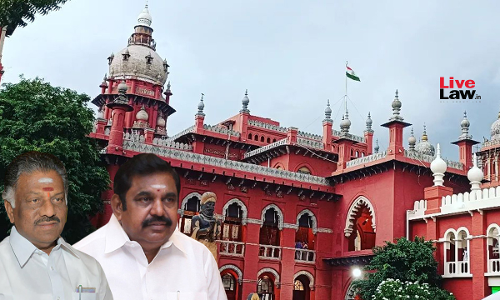

EPS vs OPS: Madras High Court Rejects Applications By Expelled AIADMK Leaders For Stay Of General Council Resolutions

The Madras High Court has rejected the applications filed by expelled AIADMK leaders seeking a stay on the operation of the General Council resolutions by which they were dismissed from the party. The court also rejected the applications filed by the leaders seeking a stay on the General Council elections.Justice Kumaresh Babu passed the orders on pleas by expelled leaders of the AIADMK party...

In A First, Punjab And Haryana High Court Seeks ChatGPT's Response On Bail Jurisprudence Across The World

In a first, the Punjab and Haryana High Court, while dealing with a bail plea, sought the response of the artificial intelligence (AI) chatbot developed by OpenAI, ChatGPT to get a broader outlook of the bail jurisprudence across the world.To assess the worldwide view on bail when the assault is laced with cruelty, the bench of Justice Anoop Chitkara used the AI tool and put the...

DGFT Has No Authority To Violate The Foreign Trade Policy, Power Lies Only With Central Govt: Karnataka High court

The Karnataka High Court has held that only the Central Government can make provision for prohibiting, restricting, or regulating the import or export of goods or services, or technology and not the Director General of Foreign Trade (DGFT).The single bench of Justice S.R. Krishna Kumar has observed that only the Central Government can formulate and announce the Foreign Trade Policy...

'Acts Of Violence, Violent Speeches Not Protected': Delhi HC Sets Aside Order Discharging Sharjeel Imam, Others In Jamia Violence Case

The Delhi High Court on Tuesday set aside trial court's decision to discharge Sharjeel Imam, Safoora Zargar, Asif Iqbal Tanha and eight others in the Jamia violence case, and framed charges against them under various provisions of Indian Penal Code. The judgment was passed on Delhi Police’s plea against the trial court order discharging the accused in the 2019 Jamia violence case.Delhi...