News Updates

'Carried Highly Explosive Substances & Objectionable Literature': Calcutta HC Upholds Life Sentence Of Pakistani National Arrested On His Way To J&K

The Calcutta High Court on Wednesday upheld the life sentence awarded to a Pakistani national belonging to terrorist organization Al-Badar, who was found to have entered Indian territory illegally through Bangladesh and was proceeding to Srinagar, Jammu & Kashmir for the purpose of carrying out terrorist activities. The convict was arrested by the Special Task Force (STF), Kolkata on...

Employees’ Salaries, Pension Paid Till December; January’s Payment Will Be Released Soon: MCD Commissioner To Delhi High Court

The Commissioner of Municipal Corporation of Delhi (MCD) Thursday informed the Delhi High Court that the salaries and pension of civic body’s employees have been paid and cleared till December last year and payment for the month of January will be done within two to three days. A division bench of Chief Justice Satish Chandra Sharma and Justice Subramonium Prasad was hearing a bunch of...

Lift Attachment Of Properties Attached Erroneously: Kerala High Court To Govt After State Says Assets Of Those Not Linked To PFI Also Attached

The Kerala High Court on Thursday directed that the properties of those persons who have no connection with the Popular Front of India and which were erroneously attached by the authorities have to be 'released' to them by lifting the attachment of the properties. "The 2nd respondent, [Home Department] Additional Secretary shall forthwith ensure that the properties of those persons who have...

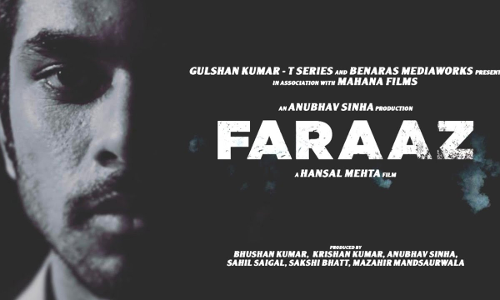

Delhi High Court Refuses To Stay Release Of ‘Faraaz’, Directs Filmmakers To ‘Scrupulously Adhere’ To Disclaimer

The Delhi High Court on Thursday refused to stay release of filmmaker Hansal Mehta’s movie Faraaz which is based on the terrorist attack that took place on July 01, 2016, at Holey Artisan, Dhaka, Bangladesh.A division bench of Justice Siddharth Mridul and Justice Talwant Singh directed the filmmaker and producers to “scrupulously adhere” to the disclaimer which states that the film...

[Kerala Co-operative Societies Act] Mere Endorsement Of Complaint By Minister Doesn't Eliminate Registrar's Discretion To Not Order Inspection: High Court

The Kerala High Court recently held that merely because a complaint had been filed before the Minister of Co-operation alleging misappropriation of funds and maladministration by the Managing Committee members of the Primary Agricultural Co-operative Society, which was then routed to the Joint Registrar through the Registrar of Co-operative Societies, who thus ordered inspection, it could not...

Rent Controller Can 'Direct' Landlord To Sue For Eviction Of Tenant After Prima Facie Satisfaction On Permanent Tenancy Claim: Kerala High Court

The Kerala High Court recently delved upon the scope of enquiry and competency of the Rent Controller to decide on disputes pertaining to the claim of permanent tenancy under Section 11(1) of the Kerala Buildings (Lease and Rent Control) Act, 1965.The division bench of Justice A. Muhamed Mustaque and Justice Shoba Annamma Eapen observed that as per the second proviso to Section 11(1) of...

Aircraft Imported For Private Purposes, No Customs Duty Exemption Allowed: Delhi High Court

The Delhi High Court has held that the aircraft was imported for private purposes and not for providing non-scheduled passenger or charter services. Therefore, the condition for customs duty exemption was not available to the assessee. The division bench of Justice Vibhu Bhakhru and Justice Amit Mahajan has observed that the appellant has not used the aircraft for providing air...

[Pharmacy Act 1948] State Govt Has No Absolute Power To Revoke Nomination Of A Nominated State Member To PCI: Tripura High Court

The Tripura High Court has held that the state government does not have absolute authority to cancel the nomination of a nominated State member to Pharmacy Council of India under the Pharmacy Act, 1948. The petitioner was nominated as the State Member of Pharmacy Council of India (PCI) under Section 3(h) of the Pharmacy Act, 1948 (the Act) on 29.11.2018 by the State Health...

Bombay High Court Monthly Digest - January 2023 [Citations 1 - 64]

Nominal Index [Citation 1 – 64]World Phone Internet Services Pvt. Ltd. v. One OTT Intertainment Ltd. In Centre 2023 LiveLaw (Bom) 1Lt. Col. Prasad Purohit v. National Investigation Agency 2023 LiveLaw (Bom) 2Vanashakti and Anr. v. Dharavi Redevelopment Project Slum Rehabilitation Authority and Ors. 2023 LiveLaw (Bom) 3Naresh s/o Netram Nagpure and Ors. v. State of Maharashtra 2023 LiveLaw...

'Feign Compliance' Of Guidelines Drowns Two Youth In Gushing Water, Sikkim High Court Directs Gati Hydro Power To Pay ₹70L To Widowed Mothers

The Sikkim High Court has awarded a compensation of Rs. 35 lakhs each to two widowed mothers whose young sons died by drowning in swollen river downstream caused due to sudden release of water by the Gati Hydro power project company, in non-compliance of government guidelines and directions previously issued by the Court in light of a similar mishap.Justice Meenakshi Madan Rai observed that...

Ensure 'Efficacious' Medical Treatment Of Former PFI Chairman On Regular Basis: Delhi High Court Directs Tihar Jail Medical Superintendent

The Delhi High Court on Thursday directed the Medical Superintendent of Tihar Jail to ensure that efficacious medical treatment is provided to former Popular Front of India (PFI) Chairman E Abubacker on a regular basis.A division bench of Justice Siddharth Mridul and Justice Talwant Singh was hearing Abubacker’s appeal challenging the order of the special judge rejecting his application...

'Their Best Interest Can Be Ensured Only If They Return To Native Country': Madras High Court Directs Mother To Return Twins To Father In US

While holding that the courts should always look into the best interest of the child in matters relating to custody, the Madras High Court has directed a mother to return her twin boys to their father in the US. The division bench of Justice PN Prakash (since retired) and Justice Anand Venkatesh said the children are now living in an environment which is alien to them since for nearly...

![[Kerala Co-operative Societies Act] Mere Endorsement Of Complaint By Minister Doesnt Eliminate Registrars Discretion To Not Order Inspection: High Court [Kerala Co-operative Societies Act] Mere Endorsement Of Complaint By Minister Doesnt Eliminate Registrars Discretion To Not Order Inspection: High Court](https://www.livelaw.in/h-upload/2023/02/01/500x300_456676-433779-384880-justice-v-g-arun.webp)

![[Pharmacy Act 1948] State Govt Has No Absolute Power To Revoke Nomination Of A Nominated State Member To PCI: Tripura High Court [Pharmacy Act 1948] State Govt Has No Absolute Power To Revoke Nomination Of A Nominated State Member To PCI: Tripura High Court](https://www.livelaw.in/h-upload/2019/09/28/500x300_365023-tripura-hc.webp)

![Bombay High Court Monthly Digest - January 2023 [Citations 1 - 64] Bombay High Court Monthly Digest - January 2023 [Citations 1 - 64]](https://www.livelaw.in/h-upload/2022/02/01/500x300_408700-bombay-high-court-monthly-digest.jpg)