News Updates

Centre Notifies Appointment Of Two Judicial Officers As Judges Of Andhra Pradesh High Court

The Central Government has notified the appointment of two judicial officers as additional judges of the High Court of Andhra Pradesh for a period of two years from the date when they assume charge.They are :1. Smt. P. Venkata Jyothirmai2. Shri V. Gopalakrishna RaoUnion Law Minister Kiren Rijiju tweeted this information.It was on January 10 the Supreme Court collegium recommended their...

Centre Notifies Appointment Of Advocate Neela Gokhale As Bombay High Court Judge

The Central Government has notified the appointment of Advocate Dr. Neela Kedar Gokhale as an additional judge of the Bombay High Court for a period of two years from the date when she assumes charge.Union Law Minister Kiren Rijiju tweeted this information. It was on January 10 that the Supreme Court collegium made the recommendation for the elevation of Neela Gokhale.With her appointment,...

Delhi High Court Introduces Online Inspection Of Digitized Judicial Files, Live Streaming Of Hearings On Anvil

Chief Justice of India D.Y. Chandrachud on Tuesday inaugurated the software that will allow e-inspection of digitised judicial files of the Delhi High Court. CJI Chandrachud on the occasion said that the Delhi High Court has always been at the forefront and the apex court of the country generally tends to follow the facilities that the high court introduces.Speaking on the occasion, Delhi...

Bombay HC Grants Pre-Arrest Bail To Neighbour Booked Under SC/ST Act For Whistling, Says Making Sounds In His Own House Does Not Show Sexual Intent

The Bombay High Court recently granted anticipatory bail to three persons accused of committing atrocities against a member of a Scheduled Caste observing that mere creation of sound by accused in his own house cannot mean that it was with sexual intent.“Merely because some sound is created by a person in his house we cannot directly infer that it is with such an intention that it is...

Police Officers Take A Lot Of Abuse From People; Their Work Deserve Appreciation & Respect: Calcutta High Court

The Calcutta High Court on Tuesday said that the Police Officers take a lot of abuse from people but their work deserves appreciation and acknowledgment so that they are inspired to do more service effectively.The Bench of Justice Shampa Dutt (Paul) also added too often, the hard and dangerous work that the police officers do, goes unnoticed or at least unrecognized and that most people...

NDPS Act | Vehicle Piloting Another Vehicle Carrying Contraband Is Not Vehicle Used As Conveyance; Cannot Be Confiscated: Kerala High Court

The Kerala High Court recently considered the question as to whether a vehicle piloting or accompanying another vehicle, which is transporting Narcotic Drug and Psychotropic Substances could be held as vehicle used as conveyance in carrying the contraband so as to confiscate the same under Section 52-A of the Narcotic Drugs and Psychotropic Substances Act (NDPS Act), and answered the same in...

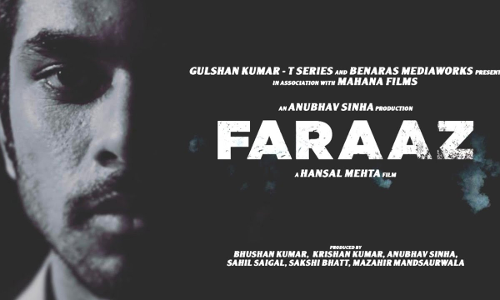

Can Films Inspired By True Life Events Be Injuncted At All? Delhi High Court On Plea Seeking Stay On Release Of ‘Faraaz’

Can the films which are inspired by true life events be injuncted at all, the Delhi High Court asked the two mothers, who are seeking a stay on the release of the movie Faraaz, on Tuesday.The movie, scheduled to be released on February 03, is based on the terrorist attack that took place on July 1, 2016 at Holey Artisan, Dhaka, Bangladesh. The two women lost their daughters in the...

Motor Accident Tribunal Should Grant ₹1 Lakh Compensation For Upto 10% Permanent Disability Suffered By Minor: Gujarat High Court Reiterates

The Gujarat High Court recently modified the judgment and award granted by the Motor Accident Claims Tribunal on the ground that the tribunal had not complied with the directions issued by the Supreme Court, prescribing Rs. 1 lakh compensation for a minor who sustains upto 10% permanent disability in a motor accident.The claimant had challenged the order of the tribunal which awarded...

High Court Asks Police To Clarify If 'Hate Speeches' Of Delhi Riots Also Subject Matter Of Any Proceedings Before Supreme Court

Hearing a batch of pleas seeking FIRs against various politicians for alleged hate speeches made during 2020 North-East Delhi riots, the Delhi High Court on Tuesday asked Delhi Police to inform it if the speeches before it are also subject matter of proceedings pending before the Supreme Court. A division bench of Justice Siddharth Mridul and Justice Talwant Singh granted time to Rajat...

Right To Property Constitutionally Guaranteed, State Can't Compel Landowners To Relinquish Their Land Except In Accordance With Law: Karnataka HC

The Karnataka High Court has said that if some landowners have relinquished their land it cannot be a ground to compel other landowners to do so except in accordance with law. A single judge bench of Justice Krishna S Dixit, partly allowed a bunch of petitions and restrained the Land Acquisition officer of Sagar City Municipal Council, from forcibly taking away the land of petitioners...

Bombay High Court Restrains ED From Taking Coercive Action Against Jet Airways' Founder Naresh Goyal, His Wife Till Jan 31

In a relief for former Jet Airways Chairman Naresh Goyal and his wife Anita, the Bombay High Court has directed the Enforcement Directorate (ED) not to take any coercive steps against them till January 31. The division bench comprising Justices Revati Mohite Dere and Prithviraj Chavan passed the order on a petition filed by the duo seeking quashing of the ECIR registered against them...

PFI Hartal: Kerala High Court Directs Claims Commissioner To Commence Proceedings For Quantification Of Damages From Next Week

The Kerala High Court on Tuesday directed the Claims Commissioner to commence proceedings for quantification of the loss caused on account of Flash Hartal called by Popular Front of India (PFI) in September 2022, from next week onwards.The Division Bench consisting of Justice A. K. Jayasankaran Nambiar and Justice Mohammed Nias C.P said:"Claims Commissioner to commence proceedings...