News Updates

Summoned After Filing RTI On RSS, Man Approaches Bombay High Court

The Bombay High Court's Nagpur bench recently issued notice to the Maharashtra Government and Nagpur Police in a writ petition filed by a man against whom summons were issued after he filed an RTI query related to the Rashtriya Swayamsevak Sangh (RSS). A division bench of Justices Rohit B Deo and Y G Khobragade passed the order while hearing the plea filed by one Lalan Kishore Singh...

‘Huge Backlog Of Criminal Cases’: High Court Grants Last Opportunity To Delhi Govt For Filling Up Vacant Posts Of Public Prosecutors

The Delhi High Court has given one last opportunity to the Delhi Government to expedite the process of filling up vacant posts of Public Prosecutors in trial courts. A division bench of Chief Justice Satish Chandra Sharma and Justice Subramonium Prasad observed that the criminal justice system is already plagued with a “huge backlog of cases” which can be remedied only if vacancies of...

Avoidance Applications Survive CIRP, Can Be Heard After Approval Of Resolution Plan: Delhi High Court

The Delhi High Court Bench comprising of the Chief Justice Satish Chandra Sharma and Justice Subramonium Prasad, while adjudicating an appeal filed in Tata Steel BSL Limited v Venus Recruiter Pvt. Ltd. & Ors., has held that that avoidance applications filed under IBC survive even after approval of the resolution plan, in cases where Resolution Plans are unable to account for...

Assessee Not Entitled for Deduction without A Certificate Declaring The Warehouse as Part Of The Port: Bombay High Court

The Bombay High Court has held that the assessee cannot claim the deduction under Section 80IA(4) of the Income Tax Act in the absence of a certificate declaring the warehouse to be part of the port.The division bench of Justice Dhiraj Singh Thakur and Justice Kamal Khata has observed that the Jawaharlal Nehru Port Trust (JNPT) has declined to issue a certificate that the warehousing of...

Impossible For A Company To Get Its Accounts Audited On 31st March And Get The Approval In AGM On The Same Date: ITAT Upholds Addition

The Delhi Bench of the Income Tax Appellate Tribunal (ITAT) has held that it is impossible for a company to get its accounts audited on 31st March and present the same for approval in the Annual General Meeting on March 31st.The two-member bench of Kul Bharat (Judicial Member) and N.K. Billaiya (Accountant Member), while upholding the addition under Section 56(2)(viib), observed that...

Kerala Police To Probe Complaint About Lawyer Taking Money From Client In The Name Of Bribing HC Judge

The Kerala Police has started a preliminary investigation in a complaint that an advocate has taken money from a client in the name of paying bribe to a High Court judge for granting anticipatory bail.The police probe is based on a complaint made by the High Court registrar pursuant to a decision taken by a full court of all judges. The allegations are against Advocate Saiby Jose Kidangoor,...

Delhi High Court Upholds CIC Order Denying Information To Navy Commander On ACR Marks, Promotion Merit Lists

The Delhi High Court has observed that information relating to Annual Confidential Reports (ACRs) and senior personnel of Indian Navy would not be liable to be disclosed under the Right to Information Act, 2005. Justice Prathiba M Singh upheld an order passed by Chief Information Commission (CIC) rejecting an RTI application filed by a commander in the Indian Navy. He had sought the...

Coal Block Case: Delhi High Court Quashes PMLA Case Against EMTA Coal After CBI Files Closure Report In 2015 FIR

The Delhi High Court has quashed the ECIR and attachment orders passed by the Enforcement Directorate against EMTA Coal Limited and other individuals, observing that if there is an acquittal or discharge or a closure report has been filed in the predicate offence, the ECIR would not stand and the same would be liable to be quashed."In view of the settled legal position in Vijay Madanlal...

No Proposal To Shift Kerala High Court To Kalamassery: Registrar General To KHCAA President

Registrar General of Kerala High Court in a letter to the President of Kerala High Court Advocates' Association has clarified that there is no proposal to shift the High Court to Kalamassery."Instead, the Government has only been requested to allot additional land to the High Court for further development," the Registrar General said in the communication dated January 16.The clarification...

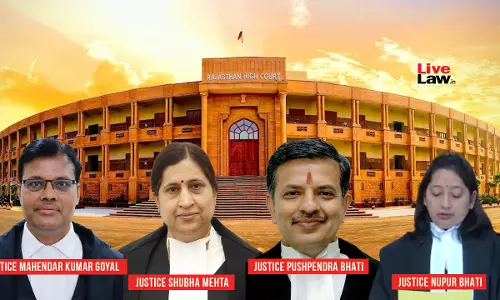

In A First, A High Court Has Two Husband-Wife Duo As Judges : Rajasthan HC

On Monday, nine new judges took oath as judges of the Rajasthan High Court. One of them is Dr. Nupur Bhati, wife of Justice Pushpendra Bhati, who has been a sitting judge of the same High Court since 2016. However, this is not the first time in the history of the Rajasthan High Court that a husband-wife duo will be sitting at the Bench. In June, 2022, when Justice Shubha Mehta took oath as...

IBC Cases Weekly Round-Up: 9 January To 15 January 2023

NCLAT AA Obliged To Direct For Liquidation Only If COC’S Decision To Liquidate Is In Accordance With IBC: NCLAT Delhi Case Title: Hero Fincorp Limited v M/s Hema Automotive Private Limited Case No.: Company Appeal (AT) (Insolvency) No.1540 of 2022 The National Company Law Appellate Tribunal (“NCLAT”), Principal Bench, comprising of Justice Ashok Bhushan (Chairperson)...

Bombay High Court Asks State Govt To Inform It About Its Policy On Removal Of Obstructions From Footpaths

The Bombay High Court on Monday asked the State to inform the court about its policies regarding obstructions on footpaths in Mumbai. A division bench of Justice GS Patel and Justice SG Dige, in a suo motu petition, expressed concern regarding the lack of space for pedestrians to walk due to structures like police chowkis, bus stops, and shops on the footpaths. The court also said...