Bombay High Court

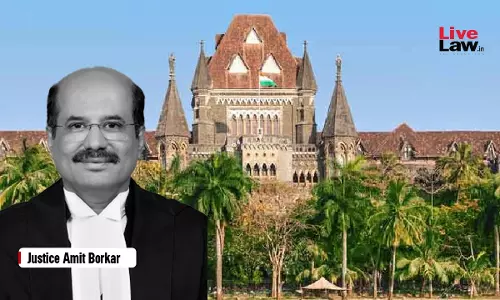

[Cooperative Societies Act] Audit Reports/Inquiry Orders Are Only Preparatory Steps, Not 'Orders' For Revision: Bombay High Court

The Bombay High Court has held that a Special Report submitted under Section 81(5B) of the Maharashtra Cooperative Societies Act, 1960, and an order directing inquiry under Section 88 are not “orders” or “decisions” amenable to revisional jurisdiction under Section 154 of the Act. The Court observed that if Section 154 is interpreted to include audit reports under Section 81, the...

Fresh Deemed Conveyance Plea Not Maintainable After Earlier Rejection On Merits; Quasi-Judicial Authorities Bound By Res Judicata: Bombay HC

The Bombay High Court has held that once a quasi-judicial authority has adjudicated an application for deemed conveyance on merits and rejected it without granting liberty to file a fresh application, it cannot subsequently take a contrary view on the same issue merely because a fresh application is presented in a modified form. The Court observed that such a course would undermine the...

More Women Joining Workforce To Become Economically Independent, State Cannot Deny Maternity Benefits: Bombay High Court

At the time when more and more women are joining the workforce for becoming economically independent, the authorities by denying them maternity leave benefits cannot compromise their role as a care giver to the child, observed the Bombay High Court while ordering the Brihanmumbai Municipal Corporation (BMC) to pay and extend the benefits to a Doctor, working in the civic-run KEM hospital, at...

Bombay HC Grants ₹50 Lakh COVID Compensation To MSRTC Supervisor's Widow; Says Field Staff Faced Same Risk As Drivers During Pandemic

The Bombay High Court has held that supervisory staff deputed to manage traffic operations during the COVID-19 pandemic were exposed to the same risk as drivers and conductors, and are therefore entitled to compensation of Rs. 50 lakhs under the applicable Government Resolution and MSRTC circulars. The Court observed that the deceased did his job at the risk to his life in a time when the life...

PIL In Bombay High Court Seeks Structural Safety Audit Of All Metro Lines In Mumbai After Slab Collapse Accident

An advocate has filed a Public Interest Litigation (PIL) seeking structural safety assessment of all the construction sites of various lines of Mumbai Metro after the tragic accident took place in the city wherein one man lost his life and three were seriously injured after a portion of the slab of an under-construction of Metro Line 4B fell on an autorickshaw and a private car. Notably,...

Person Not Christian Just Because There Are Paintings Of Holy Cross, Statue Of Lord Jesus In His House: Bombay High Court

Mere presence of a painting of the Holy Cross or a statue of Lord Jesus Christ in a person's house cannot be used as a ground to hold that the said person or his forefathers have converted into Christianity, held the Bombay High Court recently. Sitting at the Nagpur seat, a division bench of Justice Mukulika Jawalkar and Justice Nandesh Deshpande quashed and set aside an order of a District...

Municipal Corporation Of Greater Mumbai Fire Brigade Is Part Of Same Industrial Establishment Under Standing Orders Act: Bombay High Court

The Bombay High Court has held that the Fire Brigade Department is an integral part of the Municipal Corporation of Greater Mumbai and constitutes an industrial establishment within the meaning of the Industrial Employment (Standing Orders) Act, 1946. The Court observed that there is unity of ownership, management, finance and functional integrity between the Corporation and its Fire...

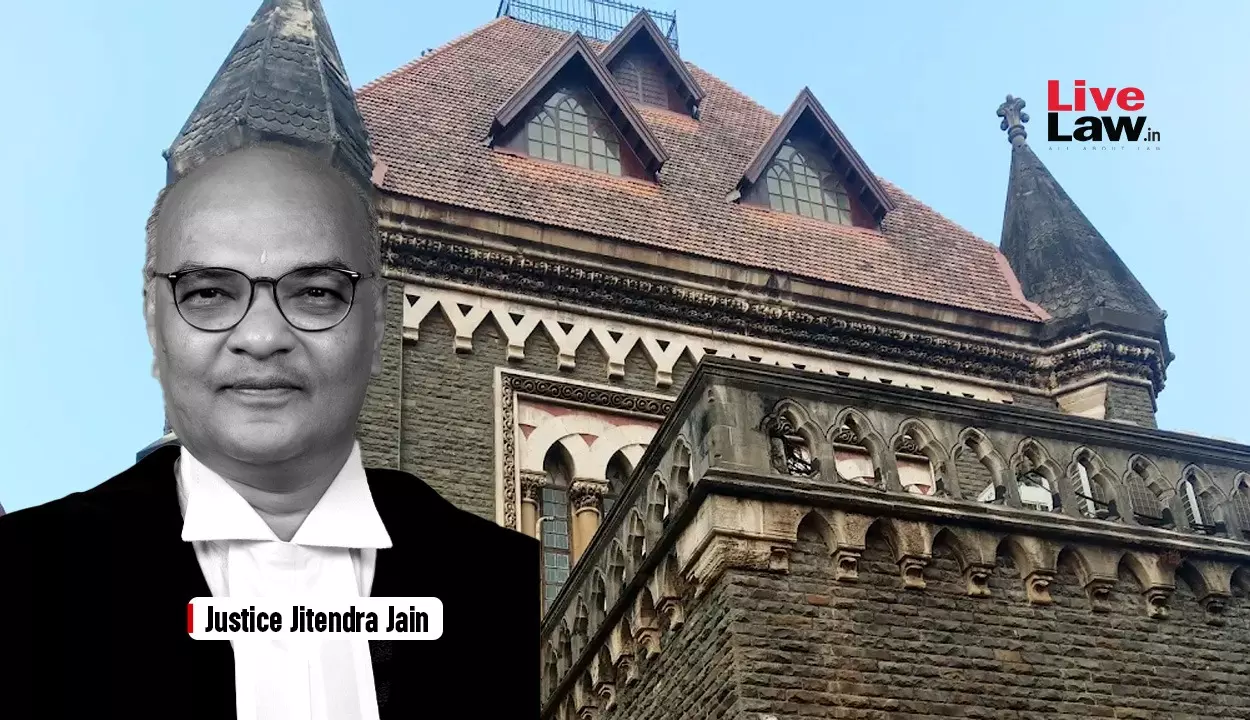

Low Deterrent Effect, Diminished Fear Of Law Fuel Violations In India; Penal Provisions Need Firm Enforcement: Bombay High Court

The Bombay High Court recently invoked Benjamin Franklin and explained how laws in India continue to be violated only because of low deterrent effect and how important it is in a civilised society, to obey law out of principle rather than just fear of punishment. Single-judge Justice Jitendra Jain explained that penal provisions have a dual effect - one to penalise an offender or defaulter...

'Stamp Duty Revision Must Conclude Within 6 Years': Bombay High Court Quashes ₹1 Cr Deficit Demand In Slum Rehab Deal

The Bombay High Court has held that the six-year limitation prescribed under Section 53A of the Maharashtra Stamp Act, 1958, governs the entire revisional process, from initiation to passing of the final order, and not merely the issuance of notice. The Court observed that a fiscal statute must be construed strictly and that permitting initiation within six years but completion thereafter...

Absence Of Medical Officer's Opinion On Sexual Assault Not Fatal To Prosecution Under POCSO Act: Bombay High Court

In a significant ruling, the Bombay High Court recently held that in cases under the Protection of Children from Sexual Offences (POCSO) Act, a person cannot be acquitted just because the medical officer does not give any opinion about sexual assault. Single-judge Justice Ravindra Joshi, while upholding a man's conviction under section 376(2)(i) of the Indian Penal Code (IPC) and sections 6...

Threat Of Suicide To Force Girl To Accompany Accused Constitutes Kidnapping: Bombay High Court

If a man threatens a girl to come along with him else he will commit suicide, the same would amount to 'enticing' her and a clear case of kidnapping is made out in such circumstances, held the Goa bench of the Bombay High Court recently.Single-judge Justice Shreeram Shirsat while upholding a man's conviction under section 363 (kidnapping) and section 376 (rape) of the Indian Penal Code (IPC)...

Mental Healthcare Act Can't Be Used As Litigation Weapon: Bombay High Court Rejects Plea To Subject Father To Mental Examination

Passing orders directing Mental Health Review Board (MHRB) under section 105 of the Mental Healthcare Act of 2017 to ascertain a person's mental health based on the proof adduced by his or her opponent, would create a mechanism that may be weaponised by an adversarial party instead of protecting the 'rights' of the person, held the Bombay High Court recently.Notably, section 105 enables...

![[Cooperative Societies Act] Audit Reports/Inquiry Orders Are Only Preparatory Steps, Not Orders For Revision: Bombay High Court [Cooperative Societies Act] Audit Reports/Inquiry Orders Are Only Preparatory Steps, Not Orders For Revision: Bombay High Court](https://www.livelaw.in/h-upload/2023/05/19/500x300_472964-justice-amit-borkar.webp)