Tax

S.36 Income Tax Act | Deduction For Bad Debt Allowed Only If Assessee Lends In Ordinary Course Of Banking/Money Lending Business: Delhi HC

The Delhi High Court has made it clear that allowance in respect of bad debts as an expense under Section 36 of the Income Tax Act, 1961, is permissible only if:(a) the debt was taken into account for computing the income of the assessee in the previous year in which the amount is written off or prior previous years; or (b) represents money lent in the ordinary course of business of banking...

S.29 CGST Act | SCN Must Reflect Both Reasons And Intent Of Retrospective Cancellation Of Registration: Delhi High Court

The Delhi High Court has made it clear that an order cancelling GST registration of a trader with retrospective effect will not sustain unless the show cause notice preceding such decision reflects both the reasons and the authority's intent for retrospective cancellation.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar observed, “in the absence of reasons having...

Income Tax Act | Principal Commissioner Has Authority To Cancel Registration Of Assessee Without Waiting For Decision From Assessing Authority: Kerala HC

The Kerala High Court stated that principal commissioner has authority to cancel registration of assessee without waiting for decision from assessing authority. The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. observed that “the provisions of Section 12AA independently empower the Principal Commissioner to consider whether or not the circumstances mentioned...

Income Tax | Whether There Was Proper Notice Or Not Is Disputed Question Of Fact, Can't Be Challenged Under Article 226: Kerala High Court

The Kerala High Court stated that the issue as to whether there was a proper notice or not is a disputed question of fact and cannot be challenged under Article 226 of the Constitution of India. “…….As rightly observed by the learned Single Judge, the question as to whether there was a proper notice or not is certainly a disputed question of fact, which cannot be gone into in...

Tax Weekly Round-Up: March 03 - March 09, 2025

SUPREME COURTSupreme Court Upholds Allahabad HC Decision That Chargers Sold With Cell Phones Cannot Be Taxed Separately Under UP VAT Act 2008Case title: COMMISSIONER, COMMERCIAL TAXCase no.: U. P. LUCKNOW vs. M/S SAMSUNG (INDIA) ELECTRONICS PVT. LTD.| Diary No. - 20066/2021The Supreme Court recently upheld the decision of the Allahabad High Court which observed that the charger sold with a...

Goods Not Accompanied By E-Way Bill, Without Matching Description Shows Intention To Evade Tax: Allahabad High Court

The Allahabad High Court has held that the intention to evade tax is established by the fact that the goods in transit were not accompanied by e-way bill and the goods taxable at 18% were taxed only at 5%. The Court held that after 2018, it was mandatory for the assesee to download e-way bill with goods in transit. “It is mandatory on the part of the seller to download the e-way...

Transfer Pricing | Existence Of International Transaction Must Be Determined Before Benchmarking Analysis Is Commenced: Delhi HC

The Delhi High Court has held that before the Income Tax Department commences transfer pricing benchmarking analysis of an assessee's international transactions, the very existence of such 'international transaction' must be determined.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar, while dealing with the case of an Indian entity producing liquor for brands like...

Income Tax Department Cannot Attach Properties Indefinitely Without Pursuing Steps To Resolve Matter: Delhi High Court

The Delhi High Court has held that the Income Tax Department cannot, suspecting escapement of tax on income by an assessee, indefinitely attach its properties without taking further steps to resolve the matter.Single judge Justice Sachin Datta observed that Section 222 of the Income Tax Act, 1961 which empowers the Tax Recovery Officer to proceed with “attachment and sale of assessee's...

S.67 Of CGST Act & S.110 Of Customs Act Are Pari Materia; GST Department Must Give Notice To Assessee Before Extending Seizure Period: Delhi HC

The Delhi High Court has held that an assessee must be issued notice within six months of seizure of its goods under Section 67 of the Central Goods and Services Tax Act 2017, failing which the goods must be returned by the Department.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar further held that the period of seizure cannot be extended under Section 67)7) for...

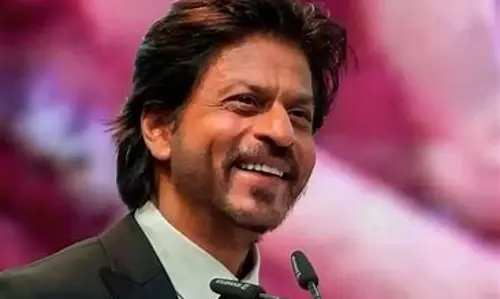

'Entire Case Based On Records Already Considered During Scrutiny': Mumbai ITAT Quashes Reopening Of Assessment Against Shah Rukh Khan For AY 2012-13

The Mumbai ITAT has quashed the reopening of assessment proceedings against the Assessee/ Appellant i.e., Shah Rukh Khan for AY 2012-13.The tribunal held that the reasons recorded while initiating the re-assessment, were completely silent as regards the allegation that income chargeable to tax has escaped assessment due to failure on the part of the assessee to disclose fully and truly...

Legal & Consultancy Services Under RCM Is Liable To Service Tax: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that legal & consultancy services under RCM is liable to service tax. The Bench of Binu Tamta (Judicial Member) and Hemambika R. Priya (Technical Member) has stated that “in absence of any reply or any supporting documents, Legal fees expense incurred by the assessee are...

'Highly Undesirable Practice, Wastes Judicial Time': Delhi High Court Laments Frequent Non-Appearance Of Govt Counsel In Customs Matters

The Delhi High Court recently expressed its displeasure at the frequent non-appearance of government counsel in customs related matters.A division bench comprising Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed, “It is noticed that in a large number of customs matters, the Counsels are either not appearing or appear without proper instructions. In cases of nonappearance, the...