Tax

Allahabad HC Decines Plea Claiming Road Tax Exemption Should Be Allowed For Registration And Not Purchase Of Electric Vehicles In UP

The Allahabad High Court has dismissed a writ petition claiming exemption from payment of road tax on an electric vehicle purchased from Jammu. The Petitioner had claimed that since road tax is levied for operating the vehicle within the State, no distinction can be made on the basis that the vehicle in question has been purchased within the State or from outside. It had...

Income From Sale Of Immovable Properties To Be Treated As 'Capital Gains,' Not 'Business Income': Kerala High Court

The Kerala High Court has stated that income from the sale of immovable properties is to be treated as 'capital gains,' not 'business income' for taxation purposes. The Division Bench of Justices A.K. Jayasankaran Nambiar and K.V. Jayakumar observed that “the requirement of ensuring uniformity and consistency in tax assessments cannot be overlooked, especially while categorizing...

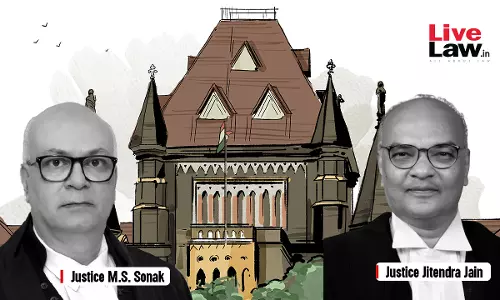

Appeal Can't Be Dismissed Due To Non-Payment Of Pre-Deposit If Department's Portal Acknowledges Compliance: Bombay High Court

Observing that provisional acknowledgement automatically generated on Department portal shows that the requisite pre-deposit has been made, the Bombay High Court held that the Assessee had duly complied with the necessary pre-deposit required u/s 107(6) of the CGST Act.The Division Bench of Justice M.S Sonak and Justice Jitendra Jain observed that in a similar matter in Bytedance...

[Deemed Dividend] Accumulated Profits Of Company U/S 2(22)(e) Of Income Tax Act Are Computed After Adjusting Depreciation: Telangana HC

The Telangana High Court has held that for purposes of taxation, “accumulated profits” of a company are to be calculated after adjusting depreciation as per the Income Tax Act, 1961. In ruling so, a division bench of Chief Justice Alok Aradhe and Justice J. Sreenivas Rao cited two rulings of the Bombay High Court which held that “depreciation as granted in accordance with...

Income Tax Return Is Different From Average Annual Financial Turnover Document: Gauhati High Court Explains

The Gauhati High Court has held that the words “Turnover” and “Income Tax Return” are different and exemption to a bidder from submitting the former in a tender process would not exempt it from furnishing the ITR, for the prescribed years. “The primary purpose of reporting Annual Turnover is to provide a clear picture of a company's revenue-generating capacity. It is...

Tax Weekly Round-Up: November 11 To November 17, 2024

HIGH COURTS Allahabad HC 1. GST | Assessee Entitled To Fresh Notice If Initial Notice U/S 73 Was Missed Due To Being Uploaded Under 'Additional Notices' Tab: Allahabad HC Case title: M/S Ashish Traders v. State of U.P. Case no.: WRIT TAX No. - 1882 of 2024 The Allahabad High Court has held that an assessee is entitled to fresh notices demanding unpaid tax or short tax...

Retrospective GST Cancellation In Absence Of Specific Reasons Will Take Effect From Date Of Issuance Of SCN: Delhi HC

The Delhi High Court has reiterated that the GST Department must record reasons that weigh on it to propose retrospective cancellation of an assessee's registration. Citing absence of such reasons in the case at hand, the division bench of Justices Yashwant Varma and Dharmesh Sharma said cancellation of Petitioner's GST registration would stand only from the date of issuance of the...

Taxpayers Can't Seek Writ Remedy By Bypassing Statutory Requirements Of Pre-Deposit: Bombay High Court

The Bombay High Court held that circumstances in which the appeals require some percentage of the demanded tax to be pre-deposited, do not render the appellate remedies any less efficacious.The High Court held so while considering an issue as to whether the demands are covered under the exemption notification or the notification providing for nil rate of taxes. The Division Bench of Justice M...

Customs Act | Interest U/S 28AA Is Automatic When There Is A Default Or Delay In Payment Of Duty: Bombay High Court

The Bombay High Court ruled that the demand for interest u/s 28AA of the Customs Act raised for non-payment of demand, within three months of raising the demand, is properly tenable on the part of the Customs Authority.Interest u/s 28AA is automatic, when there is a default or delay in payment of duty, added the Court. Section 28AA of the Customs Act provides that any judgment, decree, order...

Writ Courts Shall Not Act As Court Of Appeal Against Decision Of Lower Court Or Tribunals To Correct Errors Of Fact: Bombay High Court

The Bombay High Court recently clarified that writ courts shall not trench upon an alternate remedy provided by statute (Income tax Act) for granting any relief, by assuming jurisdiction under Article 226 of the Constitution.Similarly, writ courts shall not act as a court of appeal against the decision of the lower court or Tribunals, to correct errors of fact, observed the Division Bench...

Exporter Can't Be Denied Interest On Refund U/S 56 Of CGST Act For Period Of Delay Attributable To Revenue Dept: Bombay High Court

The Bombay High Court recently clarified that an exporter (Petitioner) is entitled to interest u/s 56 of the CGST Act for the period starting from the expiry of 60 days from the date of filing the shipping bill up to the date of grant of refund, although during the interregnum, the exporter's name was red flagged on the Customs' portal.The High Court held so while considering the prayer...

Tax Quarterly Digest: July To September 2024

1. [UP Trade Tax Act] Because Of Refund Due From Assessment Proceedings, Can't Escape Liability Of Depositing Tax Realized: Allahabad High CourtThe Allahabad High Court has held that a registered dealer cannot withhold the tax realised by him from a purchasing dealer only because he had deposited an excess amount of tax at the time of the transaction.The Court held that he cannot escape...

![[Deemed Dividend] Accumulated Profits Of Company U/S 2(22)(e) Of Income Tax Act Are Computed After Adjusting Depreciation: Telangana HC [Deemed Dividend] Accumulated Profits Of Company U/S 2(22)(e) Of Income Tax Act Are Computed After Adjusting Depreciation: Telangana HC](https://www.livelaw.in/h-upload/2024/08/05/500x300_553674-chief-justice-alok-aradhe-justice-j-sreenivas-rao-telangana-hc.webp)