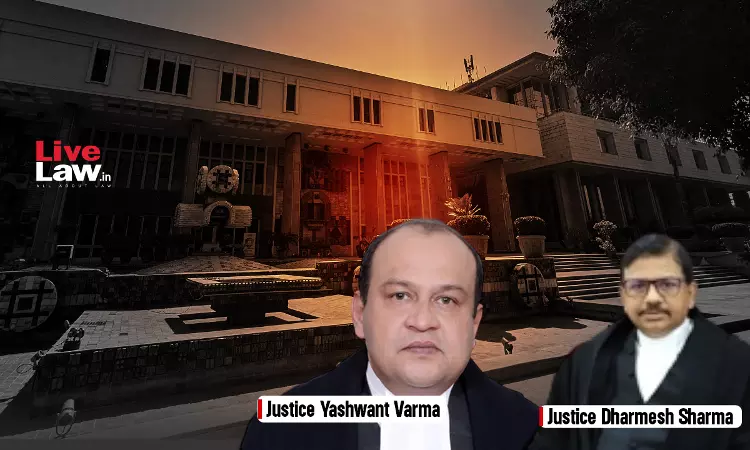

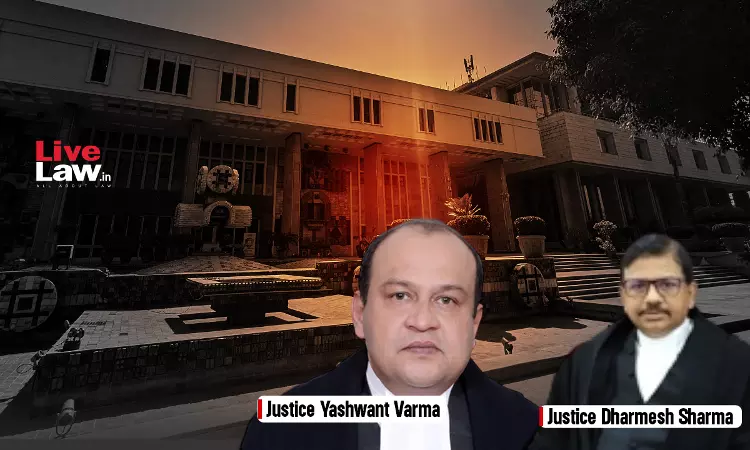

The Delhi High Court has reiterated that the GST Department must record reasons that weigh on it to propose retrospective cancellation of an assessee's registration. Citing absence of such reasons in the case at hand, the division bench of Justices Yashwant Varma and Dharmesh Sharma said cancellation of Petitioner's GST registration would stand only from the date of issuance of the...