Tax

No Basis For Reassessment If Nature & Source Of Receipts Are Verified, AO Doesn't Find Any Contradictory Evidence: Delhi High Court

The Delhi High Court stated that once nature and source of receipts have been satisfactorily proved and AO has not contradicted information given by assessee, there lies no cause for initiating the reassessment action. The Division Bench of Justices Yashwant Varma and Ravinder Dudeja observed that “………Once the nature and source of receipts have...

Once Income From AOP/BOI Is Included In Assessee's Taxable Income, Any Post-Tax Share Received Cannot Be Taxed Again: Madhya Pradesh High Court

The Madhya Pradesh High Court ruled that if an assessee has already included income from an Association of Persons (AOP) or Body of Individuals (BOI) in their taxable income, any post-tax share received from the AOP/BOI cannot be taxed again in the assessee's hands. The Division Bench of Justices Sushrut Arvind Dharmadhikari and Anuradha Shukla observed that “……the assessee was...

GST Rate On Bricks With Less Than 90% Fly Ash Content To Be Charged At 5% Instead Of 18%: Gujarat High Court Clarifies

The Gujarat High Court on 25th September (Wednesday) held/clarified the Goods and Services Tax (GST) applicable to fly ash bricks and blocks with less than 90% fly ash content. The court ruled that the products qualify for the lower GST rate of 5%, than 18% GST rate on products not meeting the 90% fly ash threshold and quashed and aside the orders of the Advance Ruling Authority and...

Kerala High Court Strikes Down Rule 96(10) of CGST Rules Retrospectively, Finds Them Ultra Vires To CGST Act

The Kerala High Court struck down Rule 96(10) of the Central Goods and Service Tax Rules holding that it was ultra vires to the Section 16 of the Integrated Goods and Service Tax Act and was manifestly arbitrary.Justice P. Gopinath noted that Section 16 has not imposed any restriction in availing refund of taxes paid on input goods and input services or claiming refund of IGST after payment...

Two Adjudication Orders Against One Show Cause Notice For The Same Period Is Not Permissible: Delhi High Court

The Delhi High Court stated that two adjudication orders against one show cause notice for the same period is not permissible.The Division Bench of Justices Yashwant Varma and Ravinder Dudeja was dealing with a case where a show-cause notice had been issued to the assessee under Section 74 of the CGST Act, 2017. This notice was duly adjudicated by the department, resulting in an order....

Proceedings U/S 130 Of UPGST Act Not Applicable If Excess Stock Is Found At Time Of Survey: Allahabad High Court

Recently, the Allahabad High Court has held that proceedings under Section 130 of the Uttar Pradesh Goods and Service Tax Act, 2017 cannot be initiated where stock is found excess at the time of survey. Section 130 of the UPGST Act provides for confiscation of goods and penalty in cases where supply, transport of goods has been made in contravention to the provisions of the Act with...

Assessment Order Passed Before Expiry Of Time To File Reply Is Liable To Be Set Aside: Kerala High Court

The Kerala High Court stated that any assessment order issued before the time allowed for filing a reply has no legal validity and can be overturned.The Bench of Justice Gopinath P. observed that “…….the assessee had filed an appeal against the order is no ground to refuse relief to the assessee as the original order was clearly issued in violation of principles of...

Condonation Of Delay Application Should Focus On Sufficient Reason, Not Merits Of Claim U/S 119(2)(B) Of Income Tax Act: Kerala High Court

The Kerala High Court stated that an application for condonation of delay should focus on whether there was sufficient reason to condone the delay under Section 119(2)(B) of the Income Tax Act, rather than on the merits of the assessee's claim.Section 119(2)(B) of the Income Tax Act, 1961 empowers CBDT to direct income tax authorities to allow any claim for exemption, deduction, refund and...

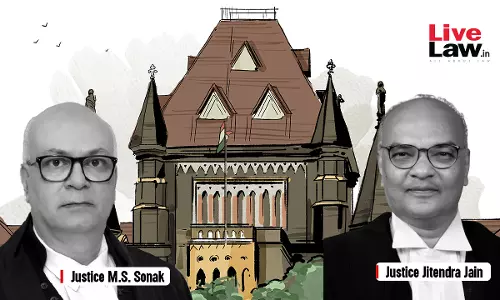

Outstanding Demand Under Maharashtra Settlement Can't Be Adjusted Against Refund Payable Under Maharashtra VAT Act: High Court

The Bombay High Court held that authorities under MVAT Act while exercising powers under Maharashtra Settlement of Arrears of Taxes, Interest, Penalties or Late Fees Act, 2022, cannot invoke provisions of Section 50 of MVAT and that too in review proceedings under Settlement Act.The Division Bench of Justice M. S. Sonak and Justice Jitendra Jain observed that there is no provision...

Temporary Suspension Of Business Activity On Account Of Ill Health Does Not Warrant Cancellation Of Taxpayer's GST Registration: Delhi HC

Finding that proper officer passed the order cancelling taxpayer's GST registration with retrospective effect, the Delhi High Court clarified that such order does not indicate any reason for cancelling the GST registration much less from retrospective effect.The High Court found that the only allegation against the assessee was that it was non-existent, which was sufficiently addressed by...

GST Order Cannot Be Challenged Citing No Personal Hearing If Hearing Not Requested After Receipt Of SCN: MP High Court Dismisses Plea

The Madhya Pradesh High Court at its Indore bench, dismissed a writ petition which was filed by Future Consumer Limited, challenging an order passed by the Deputy Commissioner of State Tax under Section 73 of GST Act. The petitioner stated that they were denied the right to personal hearing under Section 75(4) of the Act. The division bench comprising of Justice Vivek Rusia and Justice...

Transfer Pricing | Entities Operating On Economic Upscale Can't Be Included As 'Comparables' Of Those Working On Cost-Plus Pricing: Delhi HC

The Delhi High Court has reiterated that entities commanding high profit margins cannot be included as comparables of those working on cost-plus markup basis, to determine Arm's Length Price for international transactions. A division bench of Justices Yashwant Varma and Ravinder Dudeja thus ordered the exclusion of TCS E-Serve International Ltd., TCS E-Serve and Infosys BPO Limited...