Tax

Time Barred Appeal Is Not Maintainable In Absence Of Sufficient Cause For Condonation: Vishakhapatnam ITAT

On finding that the assessee had neither substantiated his case before the Tribunal or before the CIT(A), the Visakhapatnam ITAT rejected the condonation and dismissed the appeal filed by the assessee in-limine. The Bench of the ITAT comprising of Duvvuru Rl Reddy (Judicial Member) and S Balakrishnan (Accountant Member) observed that “Even though the CIT(A) and the Tribunal has...

Reassessment Can't Be Based On Reasons Borrowed From Other Dept. Or Justice M.B. Shah Commission Report: Bombay High Court

The Bombay High Court has held that the reasons for reopening clearly show that the assessing officer, except borrowing the information from the third report of the Justice M.B. Shah Commission, failed to record independently to his own satisfaction any reason so as to direct the reopening of the assessment. The bench of Justice Bharat P. Deshpande and Justice Valmiki Menezes did not see...

Indirect Tax Cases Weekly Round-Up: 21 April To 27 April 2024

Delhi High Court CA Certificate Not Matching With Details On ICAI Portal As Per UDIN, Delhi High Court Upholds Disqualification By IRCTC Case Title: M/S Sunshine Caterers Private Limited Versus Union Of India The Delhi High Court has upheld the disqualification as the CA Certificate did not match details on the Institute of Chartered Accountants of India (ICAI) portal as per...

Assessee Has Not Benefited From Round-Tripping Of Share Transactions; Mumbai ITAT Deletes Addition U/s 68

On finding that the assessee has issued share application money and subsequently allotted shares which shows that the transactions are genuine and there is no material brought on record by tax authorities that the assessee has benefited from round-tripping, the Mumbai ITAT deleted the addition made u/s 68 of the Income Tax Act, 1961. The Bench of the ITAT comprising of Narendra...

Direct Tax Cases Weekly Round-Up: 21 April To 27 April 2024

Bombay High Court Tata Steel Entitled To Treat Contribution Of Rs. 212.52 Crores To CAF As Revenue Expenditure: Bombay High Court Case Title: PCIT Versus Tata Steel The Bombay High Court has held that Tata Steel is entitled to treat the contribution of Rs. 212.52 crores to the Compensatory Afforestation Fund (CAF) as revenue expenditure. Error On Part Of Auditor Should...

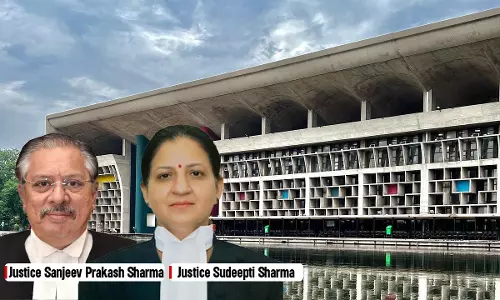

Once ITO Accepts Rate At Which Closing Stock Was Valued, No Addition To Net Profit Can Be Made Without Recomputing Trading Result U/s 145(1): Punjab & Haryana HC

Finding that the stock production and consumption records were maintained under the supervision of the Excise Authorities and there is no objection raised with regard to the said stock by the ITO, the Punjab & Haryana High Court held that the Assessing Officer could not have proceeded on a presumption alleging higher wastage shown by the assessee.The High Court found that in the present...

GST Act Empowers Proper Officer To Grant Upto Three Adjournments If Sufficient Cause Is Shown: Delhi High Court

The Delhi High Court has held that, as per Section 75(5) of the GST Act, if sufficient cause is shown, the proper officer shall adjourn the hearing; however, not more than three adjournments may be granted.The bench of Justice Sanjeev Sachdeva and Justice Ravinder Dudeja has observed that, in terms of Section 75(5) of the Act, three adjournments may be granted, but it is not mandatory for...

Assessee Has Incurred Expenses For Transfer As Per Scheme Of Arrangement Approved By NCLT; Mumbai ITAT Directs To Allow Stamp Duty & Registration Charges

On finding that when the assessee has incurred the amount in question to complete the transfer as per the scheme of arrangement approved by the NCLT, without which the transfer could not have been effected, the Mumbai ITAT held that the CIT(A) has rightly and validly decided the issue in favour of the assessee and directed the AO to allow the stamp duty and registration charges after...

Penalty Order On Ground Of Misreporting Of Income Not Justified When SCN And Assessment Order Alleged Under-Reporting: ITAT

The Hyderabad Bench of Income Tax Appellate Tribunal (ITAT) has held that the penalty order on the ground of misreporting of income was not justified when show cause notice and the assessment order alleged under-reporting.The bench of Laliet Kumar (Judicial Member) has observed that once the assessee himself admitted the fact that there was under-reporting of income, which was also accepted...

Taxing Unsold Flats In Real Estate Business Applicable From AY 2018-19; ITAT Deletes Notional Rent Addition For AY 2014-15

The Mumbai Bench of Income Tax Appellate Tribunal (ITAT), while deleting the notional rent addition for AY 2014–15, held that taxing unsold flats in real estate business is applicable from AY 2018–19.The bench of Sunil Kumar Singh (Judicial Member) and Narendra Kumar Billaiya (Accountant Member) has observed that the CIT(A) has erred in as much as it relied upon the provisions brought...

No Confiscation If Prior Permission Taken From Customs Dept. For Storage Of Non-Bonded Goods In Bonded Warehouse: CESTAT

The Mumbai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that the provisions of Sections 111(j) and 111(h) of the Customs Act cannot be invoked when prior permission is given by the customs authorities for the storage of non-bonded goods in a bonded warehouse after payment of due duty.The bench of S.K. Mohanty (Judicial Member) and M.M. Parthiban...

Payments Received Towards Interconnectivity Utility Charges From Indian Customers Is Not Royalty: ITAT

The Bangalore bench of the Income Tax Appellate Tribunal (ITAT) has held that payments received by the assessee towards interconnectivity utility charges from Indian customers or end users cannot be considered royalties to be brought to tax in India.The bench of Beena Pillai (Judicial Member) and Laxmi Prasad Sahu (Accountant Member) has observed that at no point in time, any possession,...