Tax

Statement Of Contractor Without Supporting Material Not Enough To Declare Transaction Benami: Allahabad HC Quashes Benami Transaction Proceedings

The Allahabad High Court has held that mere statement of the contractor doing construction work cannot be relied upon to declare such construction as benami transaction under the Prohibition of Benami Property Transactions Act, 1988. The Court held that “reasons to believe” in Section 24(1) of the Act must be based on cogent and relevant material.Section 24(1) of the Prohibition of...

Denial Of ITC To Customers Is One Of The Consequence Of Retrospective GST Registration Cancellation: Delhi High Court

The Delhi High Court has held that one of the consequences of cancelling a taxpayer's registration with retrospective effect is that the taxpayer's customers are denied the input tax credit availed in respect of the supplies made by the taxpayer.The bench of Justice Sanjeev Sachdeva and Justice Ravinder Dudeja has observed that simply because a taxpayer has not filed the returns for some...

Financial Activity Can't Glissade Into Situation Where Its Operations Become Impossible: Kerala HC Issues Directions On Status Of Nidhi Companies

The Kerala High Court recently held that any financial activity ought to be regulated reasonably within the ambit of law, and it cannot glissade into a situation where its operations become impossible, or are defeated by oppressive or impossible restrictions and regulations. The High Court held so while finding force in the apprehensions of the “Nidhi Companies” that amendment...

Dept's Failure To Consider Certificate Obtained From Supplier; Madras High Court Quashes ITC Mismatch Demand

The Madras High Court has quashed the demand in respect of the input tax credit (ITC) mismatch as the department has failed to consider certificates obtained by buyers.The bench of Justice Senthilkumar Ramamoorthy has observed that important records, such as the supplier's and the chartered accountant's certificates, were disregarded in the issuance of the demand order. Interference with...

Emery Cloth Is Cotton Coated Fabric And Liable To Be Exempted From Tax: Andhra Pradesh High Court

The Andhra Pradesh High Court has held that emery cloth is cotton coated fabric and liable to be exempted from tax.The bench of Justice Ravi Nath Tilhari and Justice Harinath Nunepally has upheld the Tribunal's ruling in which it was held that the emery cloth is covered in Item-59.03 of the First Schedule to the Additional Duties of Excise (Goods of Special Importance) Act, 1957 and therefore...

CA Certificate Not Matching With Details On ICAI Portal As Per UDIN, Delhi High Court Upholds Disqualification By IRCTC

The Delhi High Court has upheld the disqualification as the CA Certificate did not match details on the Institute of Chartered Accountants of India (ICAI) portal as per the Unique Document Identification Number (UDIN).The bench of Acting Chief Justice Manmohan and Justice Manmeet Pritam Singh Arora has observed that the discrepancy has arisen on account of the non-mention of the...

Gujarat High Court Allows CENVAT Credit On Welding Electrodes, Welding Wire, Etc. Used For Laying Rail Lines Outside Factory

The Gujarat High Court has allowed the cenvat credit on welding electrodes, welding wire, etc. used for laying rail lines outside factories.The bench of Justice Bhargav D. Karia and Justice Niral R. Mehta, while dismissing the appeal of the GST department, observed that CESTAT has correctly allowed the Cenvat credit on inputs, i.e., welding electrodes, wire FLR, filler wires, welding wires,...

GST Dept. Can't Compute Penalty Amount On Higher Value Than Invoice Value Without Proper Evidence: Calcutta High Court

The Calcutta High Court has held that the GST department cannot compute the penalty amount on a higher value than the invoice value without proper evidence and reason.The bench of Chief Justice T.S. Sivagnanam and Justice Hiranmay Bhattacharyya has observed that a transporter or owner of the goods is bound to carry certain documents as mentioned in the Act that are to accompany the goods. In...

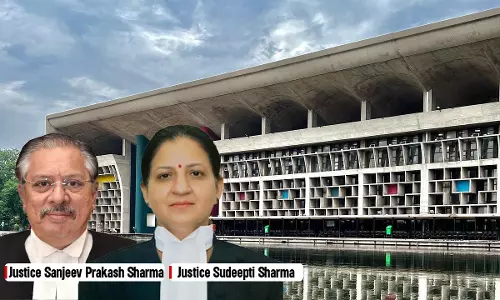

No Addition Is Permitted On Account Of Estimated Profit U/s 41(1) Simply Based On Assumptions: Punjab & Haryana High Court

The Punjab & Haryana High Court deleted the addition made by the AO u/s 41(1) of the Income tax Act on account of sale of copper wire, finding that the AO had made additions under the said provision simply on basis of presumption regarding the said sale, even after finding no stock in the premises.A Division Bench of Justice Sanjeev Prakash Sharma and Justice Sudeepti Sharma observed...

Fire Brick After Use In Kiln Is Not Liable To Excise Duty As Waste And Scrap: CESTAT

The Ahmedabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that the use of fire brick that is dismantled from the undershell of a kiln is not liable to duty as waste or scrap. The bench of Ramesh Nair (Judicial Member) and C.L. Mahar (Technical Member) has observed that periodically, fire bricks from the kiln are to be dismantled and then removed as they...

Assessee's Failure To Establish Genuineness Of Transaction With Cogent And Credible Evidence, Calcutta High Court Upholds Addition

The Calcutta High Court has held that merely proving the identity of the investors does not discharge the onus on the assessee if the capacity or credit worthiness has not been established.The bench of Chief Justice T.S. Sivagnanam and Justice Hiranmay Bhattacharyya has observed that the assessee has not established the capacity of the investors to advance money for the purchase of the shares...

CENVAT Credit Available On Input Services Used For Production Of Electricity Transferred To Its Sister Unit Free Of Cost: CESTAT

The Mumbai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that the assessee is entitled to cenvat credit on inputs and input services used for the production of electricity, which are transferred to its sister unit at Urse free of charge. The bench of Ajay Sharma (Judicial Member) has observed that there is no allegation about the sale of electricity in...