Tax

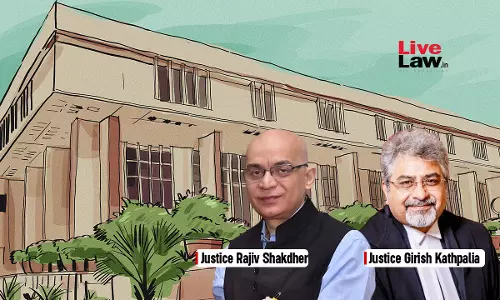

Delhi High Court Allows Income Tax Deduction On Upfront Loan Processing Fee To Indus Towers

The Delhi High Court has allowed income tax deduction on the upfront loan processing fee to the assessee, Indus Towers.The bench of Justice Rajiv Shakdher and Justice Girish Kathpalia has observed that merely because the loan processing charges were paid upfront but amortized over a period of five years, solely to be in consonance with the mercantile system of accounting, the deduction of...

Transfer Pricing | Delhi High Court Excludes Comparables On The Basis Of Functional Dissimilarity

The Delhi High Court has excluded the comparables on the basis of functional dissimilarity in the transfer pricing case.The bench of Justice Rajiv Shakdher and Justice Girish Kathpalia excluded three comparables, namely Infobeans Technologies Ltd., Cybercom Datamatics Information Solutions Ltd., and Infosys BPO Ltd., citing clear reasons for their exclusion.The appellant/department assailed...

GST | Opportunity Of Hearing Must Before Taking Adverse View: Allahabad High Court Quashes Penalty Order

The Allahabad High Court has held that principles of natural justice must be complied with before drawing any adverse inference.While quashing the penalty order and subsequent order of the appellate authority, Justice Piyush Agrawal held, “Once the authorities intend to take an adverse view, the petitioner has to be informed and put to notice to rebut the same and therefore, the impugned...

UPVAT | Exemption/Concession Form Not Produced During Assessment Due To Unavoidable Circumstances, Can Be Considered By Tribunal: Allahabad HC

The Allahabad High Court has held that if a form through which exemption/concession has been claimed under the Uttar Pradesh Value Added Tax Act, 2008 could not be produced at the time of assessment due to unavoidable circumstances, the same can be produced before the Tribunal. The Tribunal is bound to consider it before passing any order.The bench comprising of Justice Piyush Agrawal...

CBIC Issues Clarification Regarding Determination Of Place Of Supply

The Central Board of Indirect Taxes and Customs (CBIC) has issued a clarification regarding the determination of the place of supply.The Board has received representations from the trade and field formations seeking clarification with respect to the determination of place of supply in case of supply of service or transportation of goods, including through mail and courier; supply of services...

Income Tax Dept. Is Duty Bound To Provide All Material Information On Which Reliance Was Placed To The Assessee: Jharkhand High Court

The Jharkhand High Court has held that the Department is duty-bound and is mandatorily required to provide all material information or inquiry conducted on which reliance is being placed, along with supporting documents, to the petitioner as per the provisions of Section 148A of the Income Tax Act, 1961.The bench of Justice Rongon Mukhopadhyay and Justice Deepak Roshan has observed...

Madras High Court Directs Customs Dept. To Release Fresh Apples Imported From New Zealand On Furnishing Of Bank Guarantee Towards Differential Duty

The Madras High Court has directed the customs department to release fresh apples imported from New Zealand on the furnishing of bank guarantees towards differential duty. The Madras High Court has directed the customs department to release fresh apples imported from New Zealand on the furnishing of bank guarantees towards differential duty.The bench of Justice R. Mahadevan and Justice...

CBIC Circulars Are Binding On Service Tax Dept, Violations Will Make Actions Illegal: Jharkhand High Court

The Jharkhand High Court has held that the circulars or instructions issued by the Central Board of Indirect Taxes and Customs (CBIC) are legally binding on the department, and their violation will make the actions of the respondent illegal and ex-facie bad in law.The bench of Justice Rongon Mukhopadhyay and Justice Deepak Roshan has observed that the Department has violated Clauses 14.10...

Deemed Dividend Is Taxable Only In The Hands Of The Shareholder: ITAT

The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) has held that a deemed dividend is taxable only in the hands of the shareholder.The bench of Siddhartha Nautiyal (Judicial Member) and Annapurna Gupta (Accountant Member) has observed that the assessee firm was neither a registered shareholder nor a beneficial shareholder; there is no reason to tax the amount received by it by way...

ITAT Allows Income Tax Deduction On Interest Income From Investment In Co-Operative Bank

The Chennai Bench of Income Tax Appellate Tribunal (ITAT) has allowed the deduction under Section 80P(2)(d) of the Income Tax Act on the interest income from investments in cooperative banks.The bench of Mahavir Singh (Vice President) and Manjunatha.G. (Accountant Member) has observed that the Erode District Central Co-operative Bank is also governed by the Tamil Nadu Co-operative Societies...

Cognizant Technology Challenges ITAT Order Upholding Dividend Distribution Tax Demand On Buyback Of Rs 19,000-Crore Shares Before Madras High Court

The Cognizant Technology has challenged the order of the Income Tax Appellate Tribunal (ITAT) which upheld the dividend distribution tax demand on buyback of Rs. 19,000-crore shares before Madras High Court.The issue relates to assessment year (AY) 2017–18, during which assessee, Cognizant acquired 94 lakh equity shares from its stockholders in the US and Mauritius for a face value of Rs....

Finance Ministry Notifies 18% Of GST On Corporate Guarantees

The Central Board of Indirect Taxes and Customs (CBIC) has implemented an 18% Goods and Services Tax (GST) on corporate guarantees involving related entities, such as parent companies and subsidiaries, effective from Thursday, October 26th. The notification gives effect to the decision announced by the GST Council on October 8th. The CBIC order of the GST Rule is made...