Tax

No GST Exemption On Sub-Contract Services To Educational Boards: Telangana AAAR

The Telangana Appellate Authority of Advance Ruling (AAAR) has ruled that there is no GST exemption on sub-contract services to educational boards.The two-member bench of B.V. Sivanaga and Neetu Prasad has observed that the exemption would be available when the services are provided "to" an educational institution for services relating to admission to or the conduct of examination by...

DTVSV Act Is A Remedial Statute; Neither A Taxing Statute Nor Amnesty Act: Delhi High Court

The Delhi High Court has held that the Direct Tax Vivad Se Vishwas Act, 2020 (DTVSV Act) is neither a taxing statute nor an amnesty act. It is a remedial or beneficial statute.The division bench of Justice Manmohan and Justice Manmeet Pritam Singh Arora has observed that any ambiguity in a taxing statute ensures the benefit of the assessee, but any ambiguity in the amnesty act or exemption...

CBEC Not Empowered To Modify the Scope of Exemption Notification issued by the Central Government: CESTAT

The Delhi Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that the Central Board of Excise and Customs (CBEC) is not empowered to modify the scope of an exemption notification that the Central Government has issued.The two-member bench of Rachna Gupta (Judicial Member) and P.V. Subba Rao (Technical Member) has observed that the exemption notification is issued...

Supreme Court Declines To Grant Relief In Department's SLP Against Judgement On Countervailing Duty

The Supreme Court, today has adjourned without issuing notice, the department's appeal against the Gujarat High Court's judgment in the case of countervailing duty (CVD).The bench of Justice Sanjeev Khanna, and Justice J K Maheshwari, while observing in favor of the domestic industry, repeatedly directed the government to follow the judgment of the Gujarat High Court to avoid...

Filing Of Form 10–IC Is Mandatory Condition To Claim The Benefit Of Reduced Corporate Tax Rate For The Domestic Companies: ITAT

The Mumbai Bench of the Income Tax Appellate Tribunal (ITAT) has held that in order to claim the benefit of a reduced corporate tax rate, domestic companies have to mandatorily file Form 10–IC.The two-member bench of Sandeep Singh Karhail (Judicial Member) and Om Prakash Kant (Accountant Member) has observed that the assessee did not file Form 10–IC before the due date of filing the return...

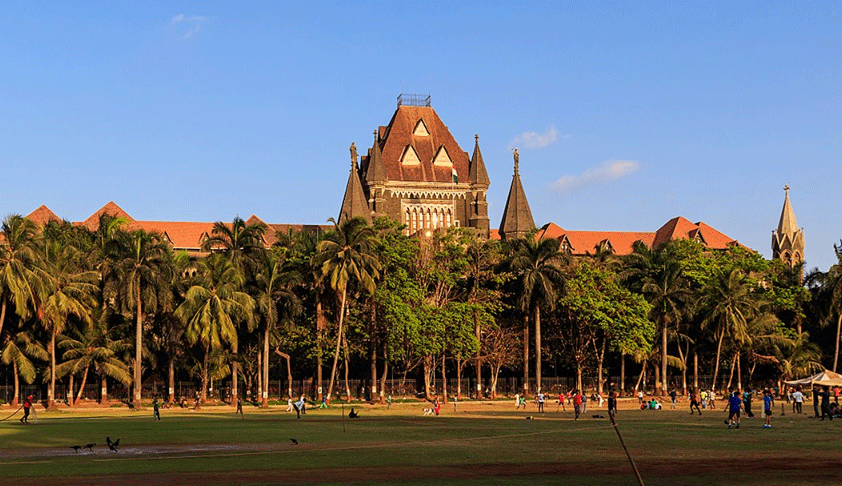

Bombay High Court Allows Nuvoco Vistas To File GST TRAN-1 For Availing Transitional ISD Credit

The Bombay High Court has allowed the assessee, Nuvoco Vistas, to file GST TRAN-1 to avail of the transitional Input Service Distributor (ISD) credit of service tax.The division bench of Justice K.R. Shriram and Justice A.S. Doctor has observed that the GST TRAN-1 or revised GST TRAN-1 filed by the units or offices will be based on the manual ISD invoices to be issued by the petitioner's...

Import Of New/Unused Jewellery For Remaking After Melting In An SEZ, Is Permissible; Bombay High Court Sets Aside Levy Of Customs Duty

The Bombay High Court has ruled that import of finished jewellery for the purpose of melting and remaking of fresh pieces of jewellery in a Special Economic Zone (SEZ), is an authorised operation. Therefore, the Court held that there is no prohibition on import of finished jewellery for remaking, without payment of Customs Duty, in terms of Rule 27(1) of the Special Economic Zones...

CBIC Empowers CCI To Decide Anti-Profiteering Issues

The Central Board of Indirect Taxes and Customs (CBIC) has empowered the Competition Commission of India (CCI) to decide on the anti-profiteering issues as of December 1, 2022."The Central Government, on the recommendations of the Goods and Services Tax Council, hereby empowers the Competition Commission of India, established under sub-section (1) of section 7 of the Competition Act, 2002 (12...

RBI Includes GSTN As A Financial Information Provider Under Account Aggregator Framework

The Reserve Bank of India has included the Goods and Service Tax Network (GSTN) as a financial information provider under the account aggregator framework.It was decided to include the Goods and Services Tax Network (GSTN) as a Financial Information Provider (FIP) under the Account Aggregator (AA) framework in order to facilitate cash flow-based lending to the Ministry of Micro, Small, and...

The Office Of NaFAC In Delhi Confer Jurisdiction When JAO Is Outside Delhi? Delhi High Court Refers The Issue To Larger Bench

The Delhi High Court has referred to the larger bench the question of whether the presence of National Faceless Assessment Centre (NaFAC) in Delhi is sufficient to hear a writ petition when the Jurisdictional Assessing Officer (JAO) is located outside of Delhi.The division bench of Justice Manmohan and Justice Manmeet Pritam Singh Arora has directed that the matter be placed before the...

Tata Steel Limited, Is Entitled To A Refund Of Excess CST Collected By IOCL And Remitted To State - Calcutta High court

The Calcutta High Court has held that Tata Steel is entitled to the concessional rate of tax as they have fulfilled the conditions in Section 8 of the Central Sales Tax Act.The division bench of Justice T.S. Sivagnanam and Justice Supratim Bhattacharya has observed that Tata Steel, as a purchasing dealer, has the capacity to maintain the claim for refund of the excess tax collected directly...

External Hard Disk Drives Eligible For Concessional Rate Of Additional Customs Duty: CESTAT

The Mumbai Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has reiterated that import of external/portable hard disk drives are eligible for concessional rate of additional customs duty, as provided under Notification No. 6/2006-CE, dated 1st March 2006, and Notification No. 12/2012-CE, dated 17th March 2012. Referring to the various judgments passed by...