Delhi High Court

Delhi High Court Quashes Cheating Case Against Central Bank Of India Officers; Says Bank Can Adjust OTS Deposit On Borrower's Default

The Delhi High Court has quashed criminal proceedings initiated against the Central Bank of India and its senior officials, holding that a bank can adjust the amount deposited under a One Time Settlement (OTS) scheme if the borrower defaults on the settlement terms.Justice Neena Bansal Krishna set aside the summoning order and the criminal complaint against the officers under Sections 420 (cheating), 406 and 409 (criminal breach of trust), and 120B IPC.The bench observed, “First and foremost,...

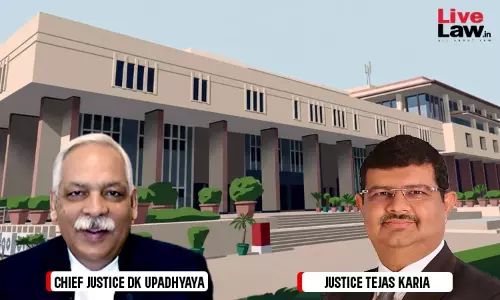

Delhi High Court Defers Constitution Of School-Level Fee Regulation Committees, Says Timelines Prima Facie Unworkable

The Delhi High Court on Saturday deferred implementation of Delhi government's mandate to private schools to constitute a school level fee regulation committee (SLFRC) for the upcoming academic session.A division bench comprising of Chief Justice DK Upadhyaya and Justice Tejas Karia was dealing with a petitions filed by various school associations, including the Forum of Minority Schools and...

Subsequent Denial Of Bail To Co-Accused Not 'Supervening Circumstance' To Cancel Bail: Delhi High Court

The Delhi High Court has held that the subsequent denial of bail to co-accused persons cannot, by itself, be treated as a “supervening circumstance” warranting cancellation of bail already granted to an accused, in the absence of any allegation that the accused has misused the liberty granted by the court.Justice Neena Bansal Krishna thus dismissed a petition seeking cancellation...

Wife Pursuing S.498A IPC Case Against Husband In India After Accepting Divorce Settlement In US Is 'Abuse Of Process': Delhi High Court

The Delhi High Court has held that a wife cannot be permitted to continue criminal proceedings under Section 498A IPC in India after having accepted a divorce decree and monetary settlement passed by a competent court in the United States.Justice Neena Bansal Krishna thus quashed an FIR registered against the husband and in-laws, observing that the complainant-wife having voluntarily...

'Rigour Of Law Applies To All': Delhi High Court Rejects Centre's Bid To Revive Writ Dismissed Thrice For Non-Prosecution

The Delhi High Court has refused to restore a writ petition filed by the Union of India, holding that government departments are not entitled to any preferential or lenient treatment in matters of delay and procedural defaults.Justice Renu Bhatnagar also dismissed the Centre's application seeking condonation of a 395-days delay and restoration of a writ petition that had been dismissed...

CBI Moves Delhi High Court Against Discharge Of Arvind Kejriwal, Manish Sisodia & Others In Liquor Policy Case

The Central Bureau of Investigation (CBI) has moved the Delhi High Court challenging the discharge of Aam Aadmi Party supremo Arvind Kejriwal, Manish Sisodia and others in the corruption case related to the alleged liquor policy scam. The move comes hours after the trial court judge passed the order. The central probe agency has said that the trial court, in the impugned order, has...

Delhi High Court Sets Aside CAT Order Quashing Disciplinary Proceedings Against Sameer Wankhede In Cordelia Cruise Ship Drugs Case

The Delhi High Court on Friday set aside an order passed by the Central Administrative Tribunal (CAT) quashing the disciplinary proceedings against IRS officer Sameer Wankhede in the 2021 Cordelia cruise drug bust case. A division bench comprising Justice Anil Kshetarpal and Justice Amit Mahajan allowed the plea filed by the Central Government challenging the order passed by the Tribunal...

469 CrPC | Limitation Commences From Date Of Knowledge Of Police Officer, Not Subsequent Date Of FIR: Delhi High Court

The Delhi High Court has held that the period of limitation under Section 469 CrPC begins from the date on which the police officer acquires knowledge of the commission of an offence, and not from a later date when the FIR is formally registered. Applying this principle, Justice Neena Bansal Krishna quashed a CBI chargesheet as being barred by limitation.The bench was dealing with a...

Delhi High Court Refuses To Entertain Husband's Plea Seeking ₹100 Crore Compensation Over Wife's Death During Nepal Unrest

The Delhi High Court on Thursday refused to entertain a petition filed by a husband seeking Rs. 100 crore compensation, a judicial enquiry and fixation of accountability over the death of his wife, an Indian citizen, during violent civil unrest in Kathmandu, Nepal, in September 2025.Justice Purushaindra Kumar Kaurav was informed by the husband's counsel that he was restricting the relief...

Allowing Petitions To Languish Under Objections To Save Limitation 'Can't Be Countenanced': Delhi High Court

The Delhi High Court has refused to condone a 281-day delay in filing a criminal revision petition, holding that a litigant cannot claim the benefit of an earlier filing date after allowing a petition to remain under objections for months and later withdrawing it on technical grounds.Justice Swarana Kanta Sharma was dealing with a criminal revision petition filed against a trial court ...

Labour Court Can't Re-Appreciate Evidence After Upholding Domestic Enquiry: Delhi High Court Restores Termination Of MTNL Workman

The Delhi High Court has held that once a Labour Court upholds the fairness and validity of a domestic enquiry, it cannot thereafter re-appreciate evidence or act as an appellate authority to substitute the findings of the Enquiry Officer.Justice Shail Jain held,“Once a domestic inquiry is held to be fair and in compliance with the principles of natural justice, the Labour Court does not sit...

Unnao Custodial Death: Delhi High Court Asks AIIMS To Examine Jaideep Sengar's Health After CBI Flags 'Fake' Cancer Prescriptions

The Delhi High Court has directed constitution of a Medical Board at All India Institute of Medical Sciences to independently assess the health condition of Jaideep Singh Senger, brother of Unnao rape case convict Kuldeep Sengar.A division bench comprising Justice Navin Chawla and Justice Ravinder Dudeja was dealing with Senger's application seeking interim suspension of his sentence on...