Trending

NGT Takes Cognizance of GRAP-III & IV Violation Over Illegal Construction; Directs CAQM To Act Within 10 Days

The National Green Tribunal (NGT), Principal Bench, New Delhi, has taken cognizance of an environmental violation involving large-scale demolition and construction activities carried out in violation of GRAP-III and GRAP-IV restrictions.In Original Application No. 663/2025 (Shubham Verma vs. Central Pollution Control Board & Ors.), the Applicant alleged that Respondent No. 4...

Rajasthan High Court Lawyers Abstain From Work Over Working Saturdays, Bar Bodies To Meet Acting Chief Justice Tomorrow

Lawyers at the Rajasthan High Court, Jodhpur abstained from work on Monday (January 5) to protest against High Court's decision declaring the second Saturday of every month as a working day.A press release issued by the Rajasthan High Court Advocates Association, Jodhpur and Rajasthan High Court Lawyers Association, Jodhpur states that in a joint meeting held on January 3 a resolution was...

Is S.17A PC Act Sanction Needed When FIR Initially Mentioned Only IPC Offences? Supreme Court To Consider

The Supreme Court is set to examine whether prior approval in terms of Section 17A of the Prevention of Corruption Act is mandatory in a case registered invoking only IPC offenses against unknown persons, who are later found to include public servants.The development comes as a bench of Justices Vikram Nath and Sandeep Mehta today issued notice on Karnataka government's challenge to an order...

2026 LiveLaw (SC) 3 | Adani Power Ltd v Union of India and others

Click the link below to read the judgment :Supreme Court Allows Customs Duty Exemption To Adani Power For Electricity Taken From Gujarat SEZLaw Cannot Change With Change Of Bench; Coordinate Bench's Decision Binding : Supreme Court ...

Delhi High Court Rejects Plea Challenging Patiala House Courts Bar Elections 2025

The Delhi High Court has rejected a plea seeking to declare the New Delhi Bar Association (NDBA) Elections, 2025, for Patiala House Courts as null and void and for conducting fresh polls. Justice Mini Pushkarna said that the election process of the NDBA cannot be said to have any public character, and cannot be decided in writ proceedings. The Court said that the election process of NDBA or...

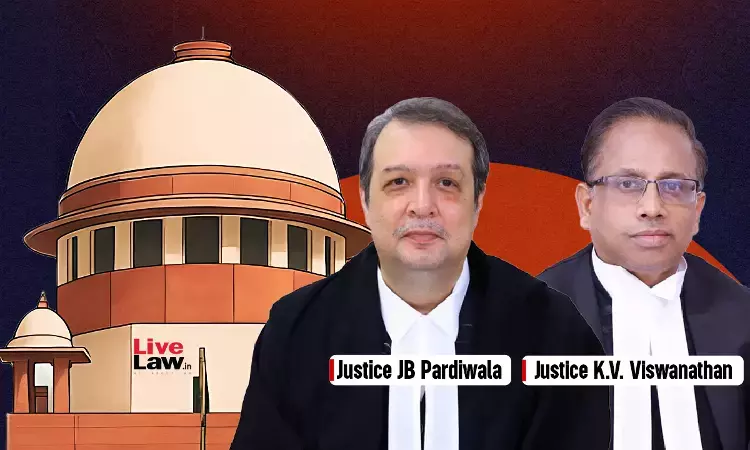

Supreme Court Issues Directions To Curb False And Frivolous Complaints Against Judicial Officers

The Supreme Court today issued directions on how High Courts should deal with complaints made against judicial officers of the district judiciary, drawing a distinction between false and frivolous complaints and those found to be prima facie true.A bench of Justice JB Pardiwala and Justice KV Vishwanathan held that strict action must be taken against persons found to be filing or...

2026 LiveLaw (SC) 2 | Nirbhay Singh Suliya v. State of Madhya Pradesh and Anr.

Click the links below to read the reports :'No Disciplinary Action Against Judge For Mere Error In Judgment' : Supreme Court Sets Aside Dismissal Of Judicial OfficerSupreme Court Flags Reluctance Of Trial Judges To Grant Bail Due To Fear Of Disciplinary ActionSupreme Court Issues Directions To Curb False And Frivolous Complaints Against Judicial...

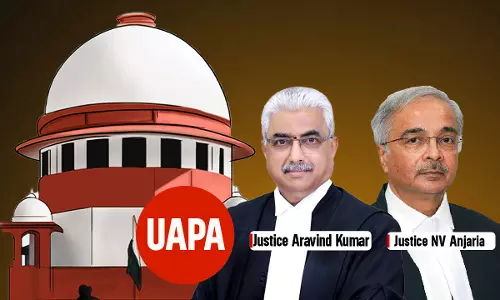

Delhi Riots UAPA Case : Supreme Court's Bail Conditions Bar Accused From Sharing Posts Digitally & Attending Gatherings

While granting bail to Gulfisha Fatima, Meeran Haider, Shifa ur Rehman, Shadab Ahmed and Mohd Saleem Khan in the Delhi riots “larger conspiracy” case, the Supreme Court on Monday imposed a stringent set of conditions, including prohibitions on attending rallies or public meetings and on circulating posters, banners or other campaign material in any form.The Bench comprising Justices...

Direct Tax Weekly Round-Up: December 29, 2025 - January 04, 2026

HIGH COURTSAndhra Pradesh HCIncome Tax | Delay in Filing Form 10-B Due To COVID Cannot Deny S.11 Exemption: Andhra Pradesh High CourtCase Title: M/s Amnos Evangelical v. The Centralized Processing Centre, BengaluruCase Number: WRIT PETITION NO: 8798 OF 2025The Andhra Pradesh High Court held that the exemption under Section 11 of the Income Tax Act cannot be denied merely on account of delay...

Madras High Court Sets Aside GST Demand For Not Considering CBIC Circulars Cited By Taxpayer

The Madras High Court has set aside a GST demand on a corporate guarantee after finding that the tax department failed to consider CBIC circulars relied upon by the taxpayer while raising the assessment.Allowing the writ petition, Justice G R Swaminathan held that an assessment order cannot survive if the tax department fails to consider the defence raised by the taxpayer. The court...

2026 LiveLaw (SC) 1 | Gulfisha Fatima v State (Govt of NCT of Delhi)

Click the links below to read the reports about the judgment :Supreme Court Denies Bail To Umar Khalid & Sharjeel Imam; Grants Bail To 5 Others In Delhi Riots Larger Conspiracy Case'Ideological Drivers Of Alleged Conspiracy' : Why Supreme Court Denied Bail To Umar Khalid & Sharjeel ImamDelay In Trial Not A 'Trump Card' For Automatic Grant Of Bail In UAPA Cases : Supreme Court Delhi...