Trending

Supreme Court Annual Digest 2025 - Advocates & Bar Councils

Advocate A right of an Advocate to appear for a party and to practice in the courts is coupled with the duty to remain present in the court at the time of hearing, and to participate and conduct the proceedings diligently, sincerely, honestly and to the best of his ability. Rights and duties are two sides of the same coin, and they are inherently connected with each other....

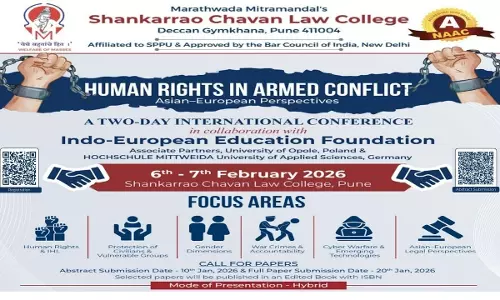

Shankarrao Chavan Law College, Pune To Host International Conference On “Human Rights In Armed Conflict: Asian-European Perspectives”

Marathwada Mitra Mandal's Shankarrao Chavan Law College, Pune, in collaboration with the Indo-European Education Foundation (Poland) and with academic support from the University of Opole, Poland and Hochschule Mittweida – University of Applied Sciences, Germany, is set to organise a Two-Day International Conference on the theme “Human Rights in Armed Conflict: Asian-European Perspectives” on 6th and 7th February, 2026.The conference seeks to bring together academicians, legal practitioners,...

NCLT Kolkata Approves Ambuja Housing's ₹34 Crore Plan to Revive Riverbank Developers

The National Company Law Tribunal (NCLT) at Kolkata has admitted and approved Ambuja Housing and Urban Infrastructure Company Ltd.'s resolution plea against Riverbank Developers, clearing a Rs 34 crore plan to revive the insolvent real estate firm. The decision provides a path forward for the "Usshar Project," a massive residential development involving more than 2,400 homebuyers who...

20% Pre-Deposit Not Mandatory For Stay Of Demand, AO Must Exercise Discretion U/S 220(6) Income Tax Act: Delhi High Court

The Delhi High Court has reiterated that deposit of 20% of the disputed tax demand is not mandatory for grant of stay, and that the Assessing Officer (AO) must independently exercise discretion under Section 220(6) of the Income Tax Act, 1961.A division bench of Justices V. Kameswar Rao and Vinod Kumar relied on National Association of Software and Services Companies (NASSCOM) v....

Interest Free Maintenance Security Collected From Homebuyers By Builder Not Financial Debt: NCLT Jaipur

The National Company Law Tribunal, Jaipur Bench has recently held that Interest Free Maintenance Security collected by a builder from flat buyers is not a financial debt under the Insolvency and Bankruptcy Code, 2016. Thus, it ruled that a residential welfare society cannot trigger insolvency proceedings on the basis of such maintenance-related claims.A coram of Judicial Member Reeta Kohli...

No Construction Or Residence Permissible On Yamuna Floodplains, Even Under Pretext Of Graveyard: Delhi High Court

The Delhi High Court has held that no construction or residential occupation is permissible on the Yamuna floodplains, even if such occupation is sought to be justified under the pretext of a graveyard or religious use.A Division Bench of Justices Prathiba M. Singh and Manmeet Pritam Singh Arora observed, “in the flood plains, people cannot be allowed to make their houses, tenements,...

Sole Arbitrator Returning Finding Based On Presumption, Modifying Agreement Vitiates Award: Allahabad High Court

The Allahabad High Court has held that finding returned by a Sole Arbitrator based on presumption and which has the effect of modifying the agreement, vitiates the arbitral award.The bench of Chief Justice Arun Bhansali and Justice Jaspreet Singh held “The Sole Arbitrator by returning a finding which is not based on any evidence and material on record and merely is based on presumption...

IBC Annual Digest 2025 Part 2

Supreme Court IBC Moratorium Doesn't Bar Voluntary Surrender Of Corporate Debtor's Leased Property To Lessor: Supreme Court Cause Title: Sincere Securities Private Limited & Ors. Versus Chandrakant Khemka & Ors. Citation : 2025 LiveLaw (SC) 774 The Supreme Court on Tuesday (August 5) held that the moratorium under the Insolvency and Bankruptcy Code, 2016 (IBC), does...

Centre Extends Anti-Dumping Duty On PET Resin Imports From China Till June 2026

The Ministry of Finance, Department of Revenue has extended imposition of Anti-Dumping Duty on imports of “imports of “Polyethylene Terephthalate” (PET) resin having an intrinsic viscosity of 0.72 decilitres per gram or higher” from China PR till June 26, 2026. The Anti-Dumping Duty Notification applies to PET resin having an intrinsic viscosity of 0.72 decilitres per gram...

Pendency Of Conciliation Proceedings Under MSME Act Does Not Bar Interim Relief U/S 9 Of A&C Act To Preserve Subject Matter: Calcutta HC

The Calcutta High Court has held that pendency of conciliation proceedings does not bar the grant of limited interim relief under section 9 of the Arbitration and Conciliation Act, 1996 ("Arbitration Act"), where such relief is essential to preserve the subject matter of the dispute. Justice Gaurang Kanth held while allowing a Section 9 application filed by Rishi Chemical Works...

GST | Failure To Prove Dispatch Of Hearing Notice Doesn't Automatically Mean No Personal Hearing Was Given: Delhi High Court

The Delhi High Court has held that merely because the tax department is unable to place on record proof of dispatch of a personal hearing notice such as entries in a dispatch register, speed post receipts, or email records— it does not automatically follow that no opportunity of personal hearing was granted.A division bench of Justices Prathiba M. Singh and Shail Jain refused to entertain...